– ATP Oil And Gas Files For Bankruptcy, CEO Blames Obama (ZeroHedge, Aug 18, 2012):

Now that the “alternative energy” industry is in shambles following one after another solar company bankruptcy, as the realization that at current prices, alternative energy business models are still just too unsustainable, no matter how much public equity is pumped into them, more “traditional” companies have resumed circling the drain. First, it was Patriot Coal, which finally succumbed to reality a month ago. Now it is the turn of ATP Oil and Gas, which filed Chapter 11 in Texas last night. And sure enough, in a world in which nobody is to blame, and everything is someone else’s fault, the CEO promptly made a case that he is blameless and it is all Obama’s fault. According to Forbes: “The founder and chairman of [ATP Paul Bulmahn] wants the world to know that the Obama Administration—and its illegal ban on deepwater drilling in the wake of the BP disaster—is to blame for the implosion of his company. Not him. “It is all directly attributable to what the government did to us,” he rails. “This Administration has gone out of its way to create problems for my company, the company that I formed from scratch.”

Forbes continues:

He’s more than angry. Bulmahn, 68, has already brought suit against the U.S. government seeking damages ($68 million to start with) for the 2010 moratorium that shut down deepwater operations in the Gulf of Mexico for the better part of a year. In an earlier case brought by ATP and rig company Ensco, Federal District Judge Martin Feldman ruled in May 2011 that the feds “acted unlawfully by unreasonably delaying action” on drilling permit applications. Still, ATP has a long, winding road to any hope of recovering damages from the government (which says it’s protected from claims by sovereign immunity).

There is truth to Bahlman’s allegations, although a lot of it may be attributable to sheer bad luck. After all it was just as the company had rolled out its massive expansion project: the $800 million Titan deepwater production platform, that disaster struck with the Deepwater Horizon leading to a drilling moratorium.

While hundreds of companies with operations in the gulf were affected by the government’s decision, perhaps no other was as hard hit as ATP—or as vulnerable. In 2010 the company had completed work on its $800 million deepwater production platform Titan and floated it out to the deepwater Telemark field 160 miles south of New Orleans. Bulmahn planned for Titan to complete drilling the final feet of four wells, hook them up, and let the oil—and the cash—start rolling in.

On April 19, 2010 ATP refinanced and rolled up $1.5 billion in debt into a new bond issue “and celebrated with champagne.” He says that at the time ATP stood a good chance of doubling its oil and gas volumes to 50,000 barrels per day within a year.

But the Deepwater Horizon exploded April 20. “We didn’t foresee an impact. The Titan is 80 miles farther south, and the spill is going to drift to the north,” says Bulmahn. Underwriter JPMorgan agreed, and it closed on the bond offering.

Soon ATP was informed by regulators that it would not be allowed to complete those Telemark wells, even though Titan was already outfitted with all the safety redun- dancies subsequently required for deepwater work. “They closed our spigot on revenues, but didn’t stop our expenses” for interest payments, rig contracts and the like. Bulmahn scrambled to spin off Titan as a subsidiary and borrowed $350 million more against it. ATP posted a net loss of $349 million in 2010.

And while the company’s demise was surely not ameliorated by this administration’s energy policies, there is a far more pragmatic reason why it had to file for bankruptcy: debt. $3.5 billion in debt to be precise, as that is how much it filed on its bankruptcy petition. Because had the company carried a clean balance sheet, it would have been able to mothball any temporarily non-viable project, cut costs to a minimum, and wait until the skies overhead shift. Instead, it was locked into a refinancing game to the bottom, with leverage into the stratosphere, that merely lay in wait for the spark to arrive, and set all that insurmountable debt on fire. And come it did.

Not only that, but despite the GOM setback, the company set off on an even more aggressive, and even more leveraged expansion scheme:

Instead of slashing costs and circling wagons, Bulmahn in late 2010 chose to take ATP on an international adventure. “I felt the need to find a way to keep our technically expert people occupied,” he says. That meant forging a deal with Isramco to drill an exploratory well offshore of Israel, near an area that has seen some massive natural gas discoveries. One well was finished in June; drilled to a depth of 14,000 feet it tapped as much as 800 billion cubic feet of gas. Sounds good, but it will be years before the infrastructure can be put in place to harvest it. Meanwhile ATP has $40 million in costs sunk off the coast of Israel.

Finally, the fact that ATP was just very badly run was hardly among the pressing issues the CEO felt like blaming his bankruptcy on:

Ravi Kamath, high-yield analyst with Global Hunter Securities, has been bearish on ATP for years and had a sell rating on ATP debt since early 2011, when it was trading at 104 cents on the dollar. It’s fallen to 29 cents now. Kamath says ATP’s problems reach far beyond the moratorium. He keeps a spreadsheet with 105 instances from the past decade where he says ATP has overpromised and then underdelivered. “Bulmahn has said lots of stuff that never happened,” says Kamath. “They have 11 years of bad forecasts.”

The irony is that in the end, it is the administration’s fault, but not for the reason noted.

What Obama, in conjunction with Wall Street, and the Fed are guilty of, is encouraging people like Bulmahn, and everyone else, to lever up to the hilt on cheap, cheap debt. The more debt the better: just ask America’s student and the record $1 trillion in debt they currently hold, more than all credit card debt combined, and the next credit bubble to pop. Just ask the second coming of the housing bubble as Wall Street investors, eager to build out rental empires are engaging in a wild borrowing spree to be among those participating in the REO-to-rental program, which too will soon implode. Also, blame the administration for allowing companies with atrocious balance sheets (if quality assets) such as Chesapeake to remain in existence, as despite an untenable leverage profile, ZIRP forces investors to plough ever more money into unsustainable businesses such as CHK. Why? It provides just a few more bps of yield, which in the past three years has become the mantra among the fixed income community.

ATP is just the first: massively levered company, with a balance sheet priced to perfection, ignorant of the risk borne by a massive debt load. Yes: interest rates may be at record lows, but soaring debt still has to be serviced. When the money inflows end, for one reason or another, and the debt interest can no longer be paid, it is game over.

This is what Obama is guilty of: forcing everyone in America to increasingly rely on debt as the only source of capital, leading to a world where even the tiniest gust of wind in an unexpected direction, or any other unpredictable development, can lead to immediate insolvency. Unless one is Too Big To Fail of course, and can afford to hold the world, and the US economy hostage.

And finally, since there is no such thing as a free lunch, as that the current administration is doing in allowing record low interest rates, is onboard the balance sheet risk to the tune of $1+ trillion in sovereign US debt added to the tally of current and future generations of Americans. Why not: after all rates are low, and the USD is the reserve currency. What can possibly go wrong.

In a word everything: as the last 3 weeks showed, a year’s worth of gains in the bond market can go poof in the span of days, if not hours.

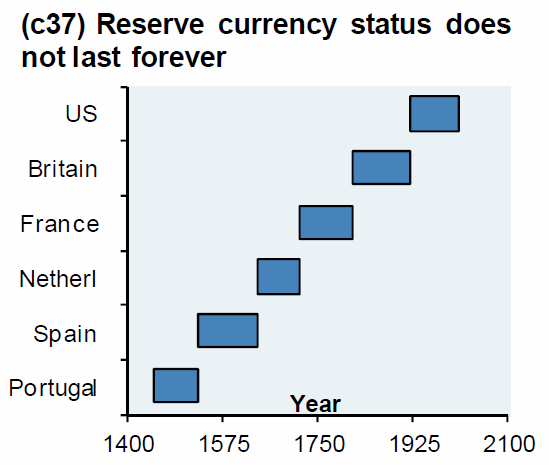

As for the reserve currency argument, well, there is always our favorite graphic.

Finally, as to what lies in store for ATP next, simple: the carcass will be picked clean as more debt is added, however this time to a fresh start company. In the process all the existing debt and quity will be wiped out. Just like what should have happened with America’s just as insolvent financial system in the fall of 2008.

So what happens to ATP from here? They have already secured $600 million in debtor-in-possession financing, but after first-lien holders like Michael Dell’s MSD Capital are paid off, that won’t get it very far. Analysts say investors holding common shares, preferreds, convertible bonds and unsecured debt will get wiped out. Buyout bids are welcome.

In a few years time, the US itself, leveraged far, far more than ATP ever possibly could, may be seeking buyout bids for itself. And China will be delighted to oblige. At pennies on the then devalued dollar of course.