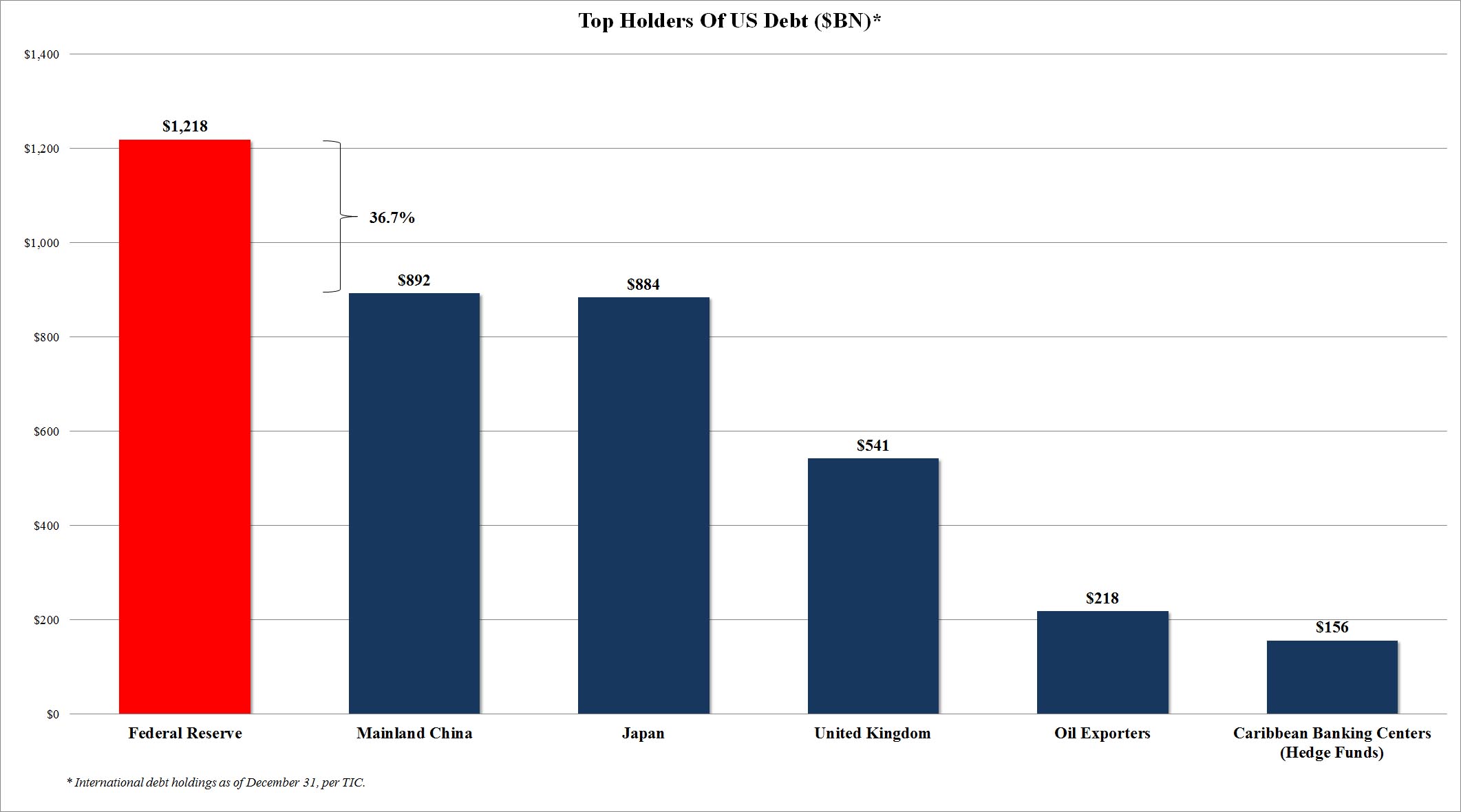

The old faithful chart comparing Fed holdings with those of formerly major foreign holders. The Fed now surpasses China in its Treasury holdings by 37%!

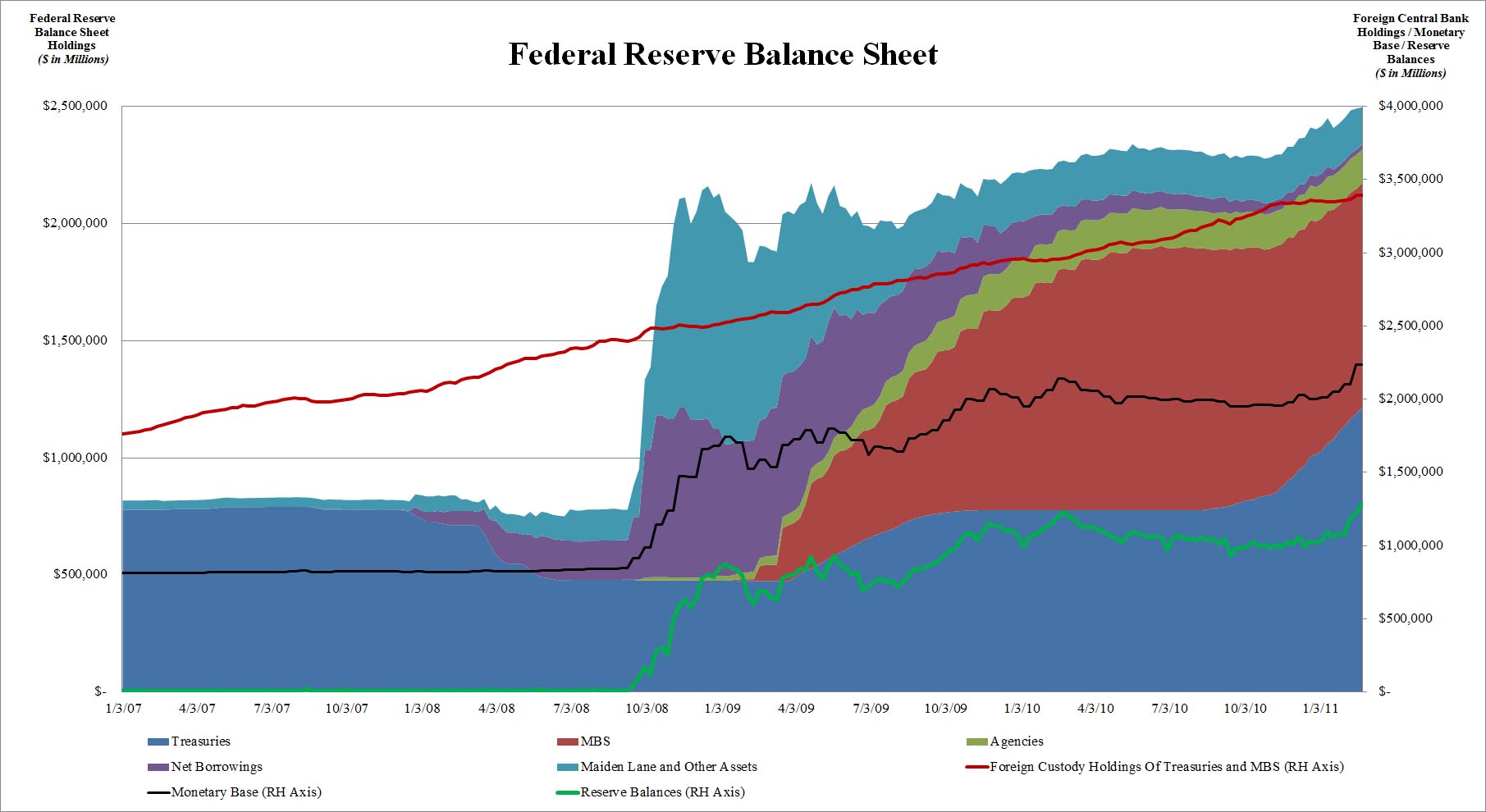

There are two key datapoints to present in this week’s Fed balance sheet update: the surge in excess reserves, and the comparative Treasury holdings between the Fed and other foreign countries. But first the basics: the total Fed balance sheet hit a new all time record of $2.5 trillion. The increase was primarily driven by a $23 billion increase in Treasury holdings as of the week ended February 23 (so add another $5 billion for yesterday’s POMO) to $1.214 trillion.

With rates surging, QE Lite has been put on hibernation and there were no mortgage buybacks by the Fed in the past week: total MBS were $958 billion and Agency debt was also unchanged at $144 billion. The higher rates go, the less the QE Lite mandate of monetization meaning that the Fed will be continuously behind schedule in its combined QE2 expectation to buy up to $900 billion by the end of June.

Yet most notably, as we touched upon yesterday, the Fed’s reserves with banks surged by $73 billion in the past week, as more capital was reallocated from the unwinding SFP program. As noted previously, we expect the total bank reserves held with the Fed to jump from the current record $1.29 trillion to at least $1.7 trillion by June.

Full Fed Balance Sheet:

(Click on images to enlarge.)

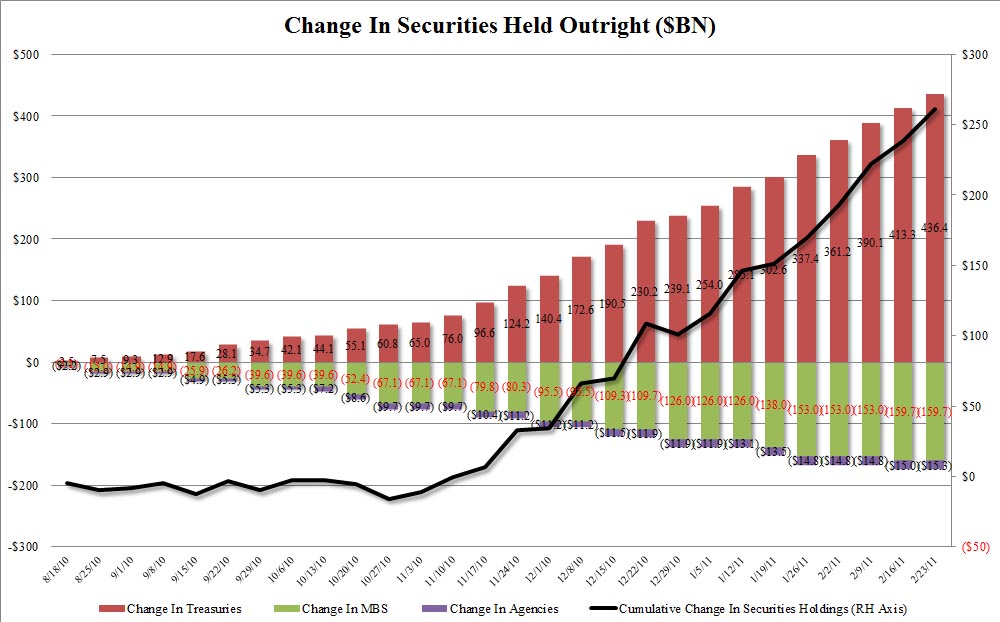

Tracking purchases of USTs coupled with dispositions of Agency debt, shows that while the first is accelerating, the second is slowing down dramatically:

Most notably is the dramatic and sudden surge in excess reserves:

Submitted by Tyler Durden on 02/25/2011 09:23 -0500

Source: ZeroHedge