– Chicago Next? Windy City Cash Balance Plummets To Only $33 Million As Debt Triples (ZeroHedge, July 28, 2013):

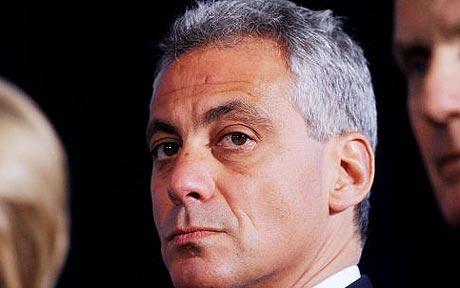

While everyone’s attention is focused on the Detroit bankruptcy, and just what assets the city will sell in lieu of raising a DIP loan, perhaps it is time to refocus attention to the city 300 miles west: Chicago. According to the Chicago Sun Times citing year-end audits, Obama’s former right hand man, Rahm Emanuel, closed the books on 2012 with $33.4 million in unallocated cash on hand — down from $167 million the year before — while adding to the mountain of debt piled on Chicago taxpayers. In addition to a liquidity problem, Chicago may also be quite insolvent as the city’s total long-term debt soared to nearly $29 billion. That’s $10,780 for every one of the city’s nearly 2.69 million residents. More than a decade ago, the debt load was $9.6 billion or $3,338 per resident. Of course, in a world in which debt is “wealth”, this is great news… at least until debt becomes “bankruptcy.”

Ironically last year, now-retiring City Comptroller Amer Ahmad argued that the city’s debt load was not “troubling” because, “We still have a very strong bond rating. Our fiscal position is getting better every year and we are aggressively managing our liabilities and obligations” (very much awhat the ECB’s Mario Draghi tells the world when he gives the periodic monthly update of European capital markets during the central bank’s press conference). It is ironic because last week, Moody’s downgraded Chicago from Aa3 to A3 in an unprecedented three notch cut in the city’s bond rating, citing Chicago’s “very large and growing” pension liabilities, “significant” debt service payments, “unrelenting public safety demands” and historic reluctance to raise local taxes that has continued under Emanuel.

Moody’s noted that the city’s total fund balance at the close of 2012 was $231.3 million and that Chicago has just $625 million in “leased asset reserves.” Had the city fully funded its $1.5 billion “actuarially required contribution” to its four under-funded city employee pension funds in 2012 alone, “these two reserves would have been entirely depleted,” Moody’s said.

The “unassigned” balance is $33.4 million. Experts recommend a cash cushion of at least $200 million for a budget the size of Chicago’s, according to the Civic Federation. The city ended 2009 with an unallocated checkbook balance of just $2.7 million.

According to the Sun Times, Chicago budget Director Alex Holt blamed the $133.6 million drop in cash on hand balances on “honest” budgeting and ending the long-standing practice of carrying “ghost” vacancies. “We’re trying to be more transparent about what we’re really spending and taking in — not just carrying a bunch of people who took up money in the budget and left money on the table at the end of the year,” Holt said. Well that’s a welcome development – unfortunately the inevitable outcome of honest in the New Normal is bankruptcy.

“Let’s be straightforward about what we’ve got to spend and not pretend we’re gonna hire for a position we haven’t hired for, who know how many years when those resources are need to provide other services. … This is about matching revenues with expenses. You don’t want to over-tax people.”

Wait, did someone from Chicago just say that?

As also disclosed by the Sun Times, audits by the accounting firm of Deloitte & Touche provide a treasure trove of information about city finances and operations.

Interesting nuggets include:

- Chicago’s principal private employers were: J.P. Morgan Chase (8,168 workers); United Airlines (7,521); Accenture LLP (5,590; Northern Trust (5,448); Jewel Foods (4,572) and Ford Motor Co. (4,187). The 2012 city payroll was 33,708 — down from 40,297 in 2006.

- The number of “physical arrests” by Chicago Police officers declined again — from 152,740 in 2011 to 145,390 in 2012. That continues a six-year trend that coincides with the hiring slowdown that caused a dramatic decline in the number of police officers. Police made 227,576 arrests in 2006. The number of arrests has been dropping like a rock ever since. The Chicago Police Department has long argued that it doesn’t measure the success of crime-fighting strategies simply by the number of arrests.

- Emergency responses continued their steady rise — to 472,752. That’s up from 300,971 in 2006.

- O’Hare Airport operating revenues were up by $23.2 million, a 3.3 percent increase, thanks to rising terminal rental and use charges. Operating expenses rose $19.1 million because of rising personnel and contracting costs. Airline ticket taxes known as “passenger facility charges” generated $154.5 million in 2012.

- The number of passenger “enplanements” rose by a modest 37,000 — to 33.24 million. That’s despite a continued decline by O’Hare’s two largest carriers — from 8.7 million passenger boardings in 2011 to 7.4 million in 2012 at United Airlines and from 7.6 million to 7.2 million by American.

- In 2003, United and American together accounted for 67.7 percent of O’Hare enplanements. Now, it’s just 44 percent.

- Budget-oriented Midway Airport is thriving, spelling potentially good news if, as expected, Emanuel chooses to revive the $2.5 billion deal to privatize Midway that collapsed for lack of financing.

- Midway boardings rose from 9.45 million in 2011 to 9.78 million last year. Operating revenues were up just $462,000 because of decreased landing fees and terminal use charges. That’s even though concession revenues rose by $1.8 million due to an increase in parking, restaurant and auto rentals. Operating expenses rose by $4.2. Ticket taxes generated $43.9 million.

- The 55 percent subsidy to retiree health care that Emanuel wants to phase out and retirees are suing to maintain cost the city $97.5 million in 2012.

- Daily refuse collections declined from 3,983 tons in 2011 year ago to 3,763 in 2012. Last year’s 52-ton increase had reversed a five-year trend. The amount of garbage generated by the 600,000 Chicago households was 4,451 tons a day in 2006 to 4,240 in 2008.

- Thanks to last year’s record heat and drought conditions, average daily water consumption rose by 23 million gallons — to 793 million gallons — reversing a steady decline. In 2006, Chicago’s 1.04 million households were guzzling 884.9 million gallons-a-day. Operating revenues in the city’s water fund were up by $122.1 million or 29.6 percent, thanks to Emanuel’s 25 percent increase in water rates.

- Chicago’s 165 tax-increment-financing districts had a collective balance of $1.5 billion. Most of that money is uncommitted, fueling an aldermanic demand Emanuel has rejected: to declare a TIF surplus and use the money to reduce some of the 3,000 layoffs at Chicago Public Schools.

- The condition of Chicago’s four city employee pension funds is growing ever more precarious. The firefighters pension fund has assets to cover just 25 percent of liabilities, followed by: Police (31 percent); Municipal Employees (38 percent) and Laborers (56 percent).

- Chicago’s historical collections and works of art are valued at $13.2 million.

There’s all that, and then there is the now traditional weekend slaughter of countless people as irrefutable proof that guns laws work, although maybe not in the city they were implemented.

By July 31, Emanuel must release a preliminary city budget. It’s almost certain to include another massive deficit — strengthening the city’s case in contract talks with city unions — that will have to be closed with more layoffs, service cuts and new revenues.

Since Emanuel’s 2013 budget held the line on taxes, fines and fees — beyond those set in motion the year before and annual increases in parking meter rates locked into the 75-year lease – what appears inevitable is another rise in the cost of Chicago living. The mayor also eliminated 275, mostly-vacant jobs while making strategic investments in tree-trimming, rodent control and children’s health and after-school programs.

But, aldermen warned that it was the calm before the storm: a painful solution to the city’s pension crisis that will require both new revenues and concessions from city employees.

Of course, now that Detroit has shown the way, and since he who defaults first, defaults best (and the second best and so on), there is a far more realistic outcome…

It is part of the corporate takeover of America. 23 cities have gone bankrupt in the last 3 years, one third of all municipal bankruptcies in the last 63 years.

When a city goes bankrupt, corporate bean counters (stooges) move in, kick out all the elected leaders, and take over. They sell off any treasures the city may have at pennies on the dollar to their greedy gut friends, grab anything else of value, and leave the city broken with no assets or any way of rebuilding. It is like a Mafia bust out.

All the pensions vanish, all of that is grabbed by the greedy bankers, the only ones to profit.

They say reorganization will help the cities recover. It is the opposite. They leave them nothing to rebuild with, they are like a bunch of locusts….they descent and eat everything of value, leaving nothing in their path.

This needs to be stopped. They need to put regulations on municipal bankruptcies, and cut out the profiteering.

Will they do it? Not likely until enough people wake up and face the Orwellian nightmare this nation now lives in.