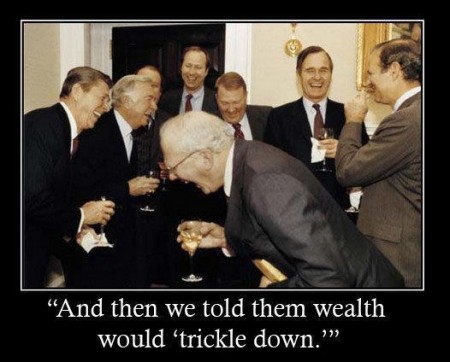

– “Trickle Down” Has Failed; Wealth and Income Have “Trickled Up” to the Top .5%:

Central bank policies have generated a truly unprecedented “trickle-up” of wealth and income to the top .5%.

Over the past 20 years, central banks have run a gigantic real-world experiment called “trickle-down.” The basic idea is Keynesian (i.e. the mystical and comically wrong-headed cargo-cult that has entranced the economics profession for decades): monetary stimulus (lowering interest rates to zero, juicing liquidity, quantitative easing, buying bonds and other assets– otherwise known as free money for financiers) will “trickle down” from banks, financiers and corporations who are getting the nearly free money in whatever quantities they desire to wage earners and the bottom 90% of households.

The results of the experiment are now conclusive: “trickle-down” has failed, miserably, totally, completely.

It turns out (duh!) that corporations didn’t use the central bank’s free money for financiers to increase wages; they used it to fund stock buy-backs that enriched corporate managers and major shareholders.

The central bank’s primary assumption was that inflating asset bubbles in stocks, bonds and housing would “lift all boats”–but this assumption was faulty. It turns out most of the financial wealth of the nation is held by the top 5%.

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP