– If Everything Is Fine, Why Are 20% Of All Chinese Shares Still Halted? (ZeroHedge, July 20, 2015):

On Monday, Beijing gave the unofficial all clear for Chinese stocks, when the following headline crossed the wires just prior to the open in Shanghai:

- CHINA’S ZHU SAYS STK MKT ROUT CEASED BY TIMELY MEASURES: DAILY

Yes, “timely measures” or, as the emergency plunge protection deployed by the PBoC is called outside of China: “unprecedented government intervention,” or perhaps more appropriately “outright manipulation.”

But however one wants to characterize the bevy of pronouncements, central bank backstops, and short seller witch hunts, one thing seems clear to us and to quite a few other observers: Beijing’s extraordinary efforts to perpetuate the equity rally underscore the degree to which the stock market mania serves as a critical distraction for a nation that might otherwise be focused on decelerating economic growth and a collapsing property bubble.

Meanwhile, China is now in damage control mode when it comes to explaining why the 30% decline in mainland shares isn’t likely to spillover into the real economy or put too much of a strain on household balance sheets. Consider the following excerpts from Xinhua:

The ramifications of China’s stock market volatility on household balance sheets are manageable given the size of families’ massive deposits and property valuations, a leading investment firm said Monday.

After the recent market slide, “the overall household balance sheet has only incurred limited damage,” China International Capital Corporation (CICC) said in its latest research report.

The wealth destruction is “well-cushioned” by 53 trillion yuan of household deposits and another 40 trillion of non-equity and non-property assets, said the CICC.

“Furthermore, the equity holding of Chinese households is only a small fraction of their real estate assets, and the balance sheet impact of a 30-percent loss in equity investment is equivalent to damage caused by a meager 3-percent swing in property prices,” even using the conservative estimate of total household real estate assets by China Southwestern University of Finance and Economics, it added.

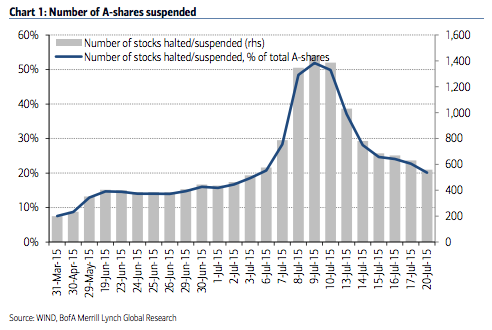

So our question is this: if the danger has passed and if households are so “well-cushioned” that the sell-off was entirely “manageable”, then why is it that more than 20% of mainland shares are still halted?

Fine…..Stands for:

Fouled up

Impaired

Negative

Empty:

Held together with a mass of lies.