– Greek PM Calls Emergency Meeting For Bank Liquidity: MNI (ZeroHedge, July 5, 2015):

Congratulations Greece: for the first time you had the chance to tell the Troika, the unelected eurocrats, and the entire status quo establishment, not to mention all the banks, how you really felt and based on the most recent results, some 61% of you told it to go fuck itself.

Now comes the hard part.

Because at this point, with Greek banks all of them effectively insolvent, it is all up to the ECB: should Mario Draghi now announce an increase in the ELA haircut or pull it altogether as the ECB did with Cyprus, then a Greek deposit haircut bloodbath ensues. And judging by the latest news out of Market News, this is precisely what Tsipras is focusing on.

According to MNI, Greece’s Prime Minister, Alexis Tsipras has called an emergency meeting for Sunday evening, after the referendum vote result will be announced, to assess the situation in the banking sector and the liquidity shortage, a senior Greek official told MNI Sunday.

The source said that so far Tsipras has not had any communication with other EU leaders “but that could change in the coming hours.” Finance Minister Yiannis Varoufakis is currently meeting with the representatives of the Greek banking union to mull whether the banking holiday ,which expires Monday evening, should be prolonged and until when.

Greece’s government spokesman, Gavriel Sakellarides told Antenna TV that the Central Bank of Greece will submit Sunday evening a request to the European Central Bank for further Emergency Liquidity Assistance saying “there is no reason why we cannot get ELA” adding that “negotiations should start as soon as today with reasonable demands.”

The Greek source who spoke with MNI said that, according to his estimations, the No vote would be even higher than what the preliminary polls showed earlier.

The source also said that the EuroWorking Group, the aides of the Eurozone Finance Ministers, are expected to convene Monday and that the Eurogroup might also convene via teleconference to assess the situation.

A Banking source has told MNI that even when banks reopen capital controls are expected to be readjusted and imposed for a long period of time, until trust is restored and a deal with the creditors is being reached.

The ball is now in the ECB’s court: will it let Greece keep the Greek ELA (or perhaps even raise it) to prevent an all out banking panic and allow Greek bank to reopen as Varoufakis promised, or will it cut the haircut or yank it altogether, starting the Greek depositor haircut as well as the falling dominoes we described yesterday…

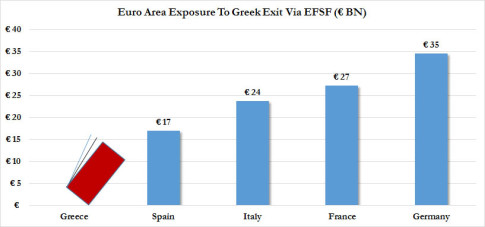

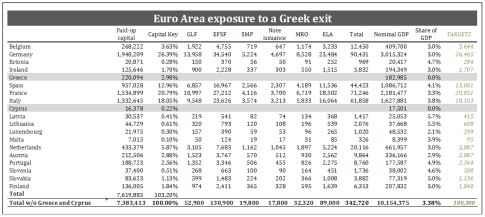

… Because as much as the ECB wants to deny it, the Euroarea is on the hook for more than 3% of its gross GDP, and perhaps far more once all the off balance sheet liabilities emerge…

In other words, an uncontrolled Grexit at this point would surely lead to a Eurozone depression, one that not even an increase in the ECB’s massive bond (and perhaps stocks) buying would stem. Which, of course, was Varoufakis’ gamble all along.

Greece has a payment coming due to the ECB in the next two or three weeks……and if the ECB does not help them, Greece will default on the payment they owe them.

On the other hand, who is to say Greece won’t default anyway? Where will they get the money to make the interest payment they owe the ECB in the next couple of weeks?

Greece may have to dump the Euro and issue it’s own currency once again. They can tie in with an electronic currency system, such as much of the world (except the Euro, Japan and the US) now use. Based on the Sucre, the first electronic currency introduced to the world by Hugo Chavez in 2010, this system allows all participating nations to trade directly with each other using their own currencies. The Sucre (or equivalent) translates the value of each nation’s currency at the time of transaction, making the need to convert to any world reserve currency obsolete.

This would be a cost effective and quick way to establish their own currency without waiting for months to print……it can all be done electronically, printing can still be done without panic in the meantime.