– Who Left the Crash Window Open? (OfTwoMinds, March 22, 2015):

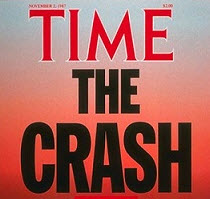

Can stocks keep hitting new highs even as sales and profits fall?

Given that we live in a world where a modest 3% decline in the stock market triggers panicky demands for more quantitative easing (QE 4), few observers expect much a correction, regardless of the souring fundamentals such as sales and profits.

A correspondent notified me of a Puetz “crash” window (based on the analysis of Stephen J. Puetz) opening in late March-early April. (Since I am not a subscriber to Puetz’s work, I can’t confirm this.) As I understand it, while these windows do not predict a crash/sharp correction, such moves tend to occur in these windows, which are based on cycles and events such as eclipses.So I decided to look for any evidence that a sharp correction might be in the offing.One classic precursor of corrections is weakening market leaders and narrowing of breadth/liquidity/volume. When leaders who pulled the index higher roll over, the index is usually not far behind.Consider the chart of Apple, (AAPL), long the engine that has been pulling the indices higher for years. Apple’s chart is looking weak:

Another classic precursor of a decline is high levels of complacency, which is reflected in a low VIX or volatility index. When fear has been vanquished, the VIX declines to the 10-12 range. These levels reliably indicate market tops.Interestingly, the VIX has been tracing out a descending wedge, a pattern that is usually bullish. (The VIX soars when stocks fall sharply and fear comes alive.)

The signs of a global slowdown are so plentiful that even the most ardent bulls should start feeling caution. Yet the central-bank-driven stock markets in the UK and Germany are hitting new highs, and the S&P 500 (SPX) in the US is within a few points of its all-time high.But the S&P 500 is acting rather tired. Despite the declining VIX, the SPX has only managed a tepid 30-point gain in the past three months–months that are typically among the best in the calendar year for strong equity gains. This is characteristic not of a robust Bull trend but of a topping process–a process that typically takes several months to manifest.

Can stocks keep hitting new highs even as sales and profits fall? History suggests we’ve reached Peak Central Banking–the faith that central bank easing can push markets higher forever, regardless of fundamentals, has reached near-euphoric levels. Few fear a decline or an increase in volatility.So it’s all smooth sailing even as the global economy slides into recession? That is a disconnect from reality that beggars belief.Perhaps the VIX will soon awaken from its slumbers, reflecting a “surprise” plummet in stocks.

Apple is a stock that ought to concern every investor. Cities, counties and states have altered their own rules to allow them to buy Apple stock in the hopes its return on investment will help them meet their obligations to pension retirees. Such strategies are flawed, and the financial weakness in their pension funds will come out………

A couple of months ago, I read an article on the number of corporate CEOs who were buying back their own stock using borrowed money. Apple topped the list with over $17 billion……….a final kick in the teeth to all those people who invested using their own money, the shareholders who will be left holding the bag when the stock does finally crash to its real value, a far cry from the pumped numbers pushed at us each day.

People ought to be asking the questions…..why are they doing it? Instead, nobody seems to know or care……..

The US stock market no longer reflects real value; HFTs have allowed a few individuals controlling huge funds to buy and sell large numbers of securities in less time than it takes to blink an eye. The key is sell……….they always take, and never give. This constant skimming warps the daily readings of the market, and these few people change the daily outcome and make millions while they do.

The US stock market is rigged to the hilt with these warped readings, and HFTs need to be made illegal before it can ever begin to be trusted again. It will take a radical shift, a huge crash, before the problem can be addressed and repaired.

Apple is now viewed by many as a stable investment rather than a stock with risks……much as we grew to trust real estate investments to always go up in value, never down…..at least, not for long. Millions of us have painfully learned that isn’t always the case, and a similar fate is in store for Apple investors.

For a long time, the market reflected the real economy……….but no longer. The side bets, derivatives markets, HFTs, and all the other games now played have twisted it into a world of its own.

Banks used to be part of the real economy, loaning money on autos, houses, and business………no longer. Every loan they make is being sold on Wall Street, so the banks are now part of the stock market’s warped reality…….banks have little to do with small business (which has been essentially wiped out by the corporate oligarchy) or the daily lives of working people.

A disconnect from reality that beggars belief? You bet.

Marilyn,

It’s Ostrich time yet again. What I find most disconcerting is that whilst we all know middle America suffer the disease more than anyone, here in UK the people I know still think I’m nuts & laugh at everything I tell them.

Yet they seemingly appreciate the dam is cracking and we are being told lies by those whose wages we pay to look after us.

Either way we’re all screwed and there are so many triggers waiting in the wings the PTB will have a field day, so best hunker down! Dig this

http://www.naturalnews.com/049094_Greece_European_Union_economic_collapse.html

Stanley, a great article that our friend at IU was kind enough to post this afternoon. At some point, even ostriches run out of sand to bury their heads in………

The markets in the US are so disconnected from the real economy as to be laughable…….nothing works anymore. I really think the writer at Natural News is spot on……at some point, other peoples money will dry up and vanish, as it already has in Greece. When that happens, all the denial in the world will not change the outcome.