– Credit Suisse “Fear Barometer” Hits All Time High (ZeroHedge, June 24, 2014):

As we noted moments ago, the “old” VIX just hit record lows (and with the “new” one is just shy of single digits, it is hardly an indicator of imminent panic). Surely complacency rules, sentiment which is confirmed by looking at such indicators as intraday trading ranges and (even more) evaporating volumes, not to mention a Fed which explicitly is now involved in market “valuation” exercises following Yellen’s statement that the market appears fairly valued (she will surely advise when it is no longer fairly valued).

So is it smooth sailing ahead, with the market firmly under the control of the Fed?

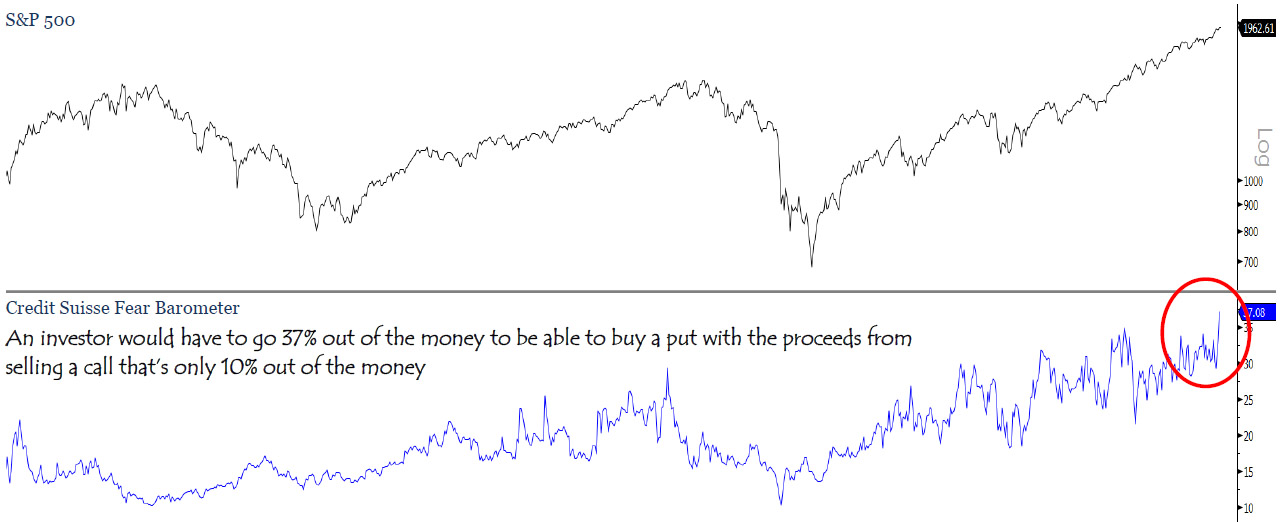

For one possible answer we refer to the latest note by FBN’s JC O’Hara who looks at a different “fear” index, namely the Credit Suisse Fear Barometer. He finds that, at 37%, it has never been higher.

For a succinct explanation of what this far less popular indicator captures we use a handy definition by SentimentTrader:

EXPLANATION:

The CSFB is an indicator specifically designed to measure investor sentiment, and the number represented by the index prices zero-premium collars that expire in three months.

The collar is implemented by the selling of a three-month, 10 percent out-of-the-money SPX call option and using the proceeds to buy a three-month out-of-the-money SPX put option. The premium on both sides will be equal, resulting in a term commonly known as a zero cost collar.

The CSFB level represents how far out-of-the-money that SPX put option is, or in insurance terms it represents the deductible one would have to pay before the put kicks in.

So, for example, if the CSFB is at 20, then that means an investor would have to go 20% out of the money to be able to buy a put with the proceeds from selling a call that’s only 10% out of the money. That means there is more demand for put protection – a sign of fear in the marketplace.

The index would rise when there is excess investor demand for portfolio insurance or lack of demand for call options.

It differs from the Chicago Board Options Exchange Volatility Index or VIX. The VIX, calculated from S&P 500 option prices, measures the market’s expectation of future volatility over the next 30-day period and often moves inversely to the S&P benchmark.

The VIX is a fear gauge by interpretation, not by definition. It was designed to quantify the expectations for market volatility — a property that is associated with, but not always correlated to fear.

GUIDELINES:

The Fear Barometer doesn’t work as most of us expect it to. It doesn’t necessarily rise as the market drops, or fall as the market rises. In fact, often it’s the exact opposite.

The reason is because traders in S&P 500 index options are mostly institutional, so the options activity is often a hedge against underlying portfolios. So when stocks rise, we often see more demand for put protection, not less.

It turns out that these traders can be pretty savvy short-term market timers. So when we see a sharp upward spike in the Fear Barometer, it means that traders are quickly bidding up put options, and the S&P 500 often sees a short-term decline soon afterward.

Conversely, when we see a sharp contraction in the Barometer (and the Rate Of Change drops to -10% or more), then we often see the S&P rebound shortly thereafter.

In brief: when it comes to the “here and now”, which in the Fed’s centrally-planned market is driven almost excusively by momentum ignition algos, complacency indeed rules. But even the nearest glimpse into the near future, or rather how the present environment may disconnect with what may happen tomorrow, or next week, or, as the case may be, in three months, institutional investors are more concerned than ever before. But is this a confirmation that the US stock market is about to have its own “Dubai” moment?

The answer is unclear. Recall that it is the same “institutional” smart money that has over the past 5 years been hedged by shorting a hedge fund hotel of most hated stocks: the same stocks which as we have shown time and again consistently outperform the market, due to one after another furious short squeeze. Perhaps hedge funds have gotten tired of “hedging” (and generating losses, with hedge fund alpha virtually zero since the Lehman collapse) using cash products, and are now simply rolling over collared protection with every passing month as the stock market rises to recorder highs, well above levels that in 2007 precipitated a crash that nearly wiped out the financial system?

As for whether they are right, well: the best person to ask is Janet Yellen of course. Because with the Fed now permanently broken the business cycle (as any prolonged downturn in the economy will merely bring the Fed back out of hiding and bidding up risk assets), virtually nobody knows just how to trade this centrally-planned construct that the Fed has unleashed on the world.

As for the retail investors, not only do they not know, but as it is quite clear by now, they don’t care either.