– Forget China’s Goal-Seeked GDP Tonight; This Is The Chart That Keeps The PBOC Up At Night (ZeroHedge, July 12, 2012):

As we wait anxiously for the not-too-hot and not-too-cold but just right GDP data from China this evening, we thought it instructive to get some sense of the reality in China. From both the property bubble perspective (as Stratfor’s analysis of the record high prices paid just this week for Beijing property – by an SOE no less – and its massive ‘microcosm’ insight into the bubbliciousness of the PBOC’s attempts to stave off the inevitable ‘landing’); to the rather shocking insight that Diapason Commodities’ Sean Corrigan offers that ‘Hot Money Flows’ have left China at a rates exceeding that during the worst of the Lehman crisis; take a range of key indicators – from electricity usage, to Shanghai container throughput, to nationwide rail freight ton-miles, to steel output – and you will notice that none of these shows a rate of growth during the second quarter of more than 4% from 2011, and some are as low as 1%. Whatever fictive GDP number we are presented with this week, the message is clear: “Brace! Brace! Brace!”

Via Sean Corrigan of Diapason Commodities,

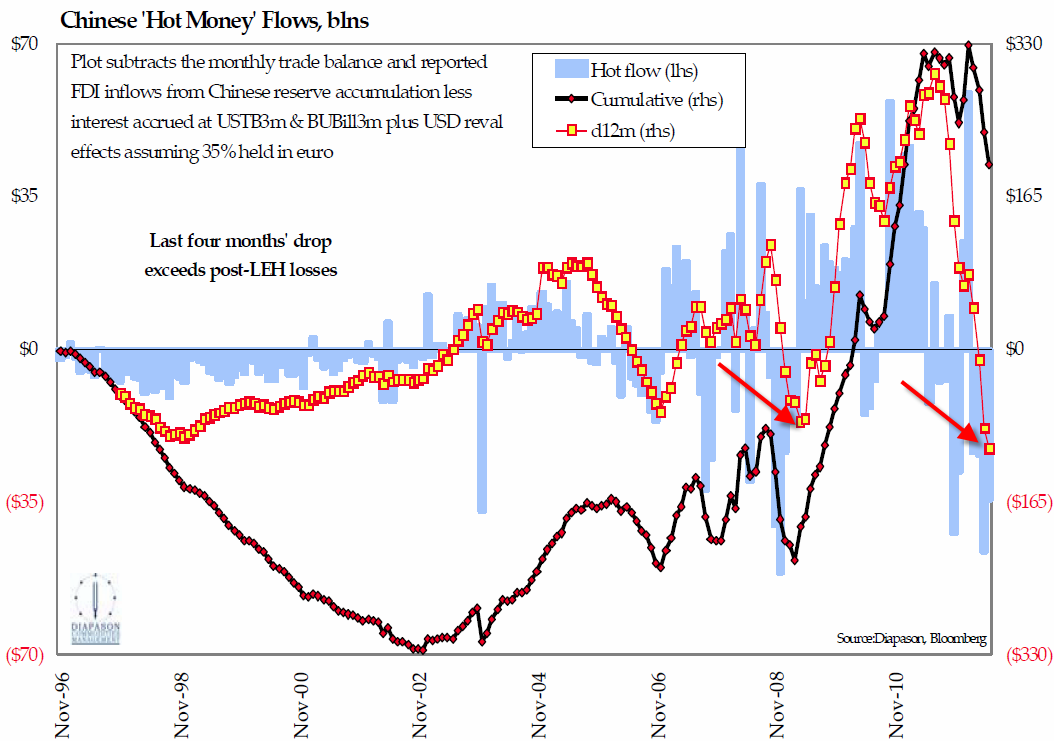

Indeed, there are clear signs that some of these dangers are beginning to be realised. Taking the difference between the reported size of China’s forex reserves and the sum of trade and FDI inflows (and making some best-guess reckoning of the effects of reval changes and interest gains), one gets an estimate of hot money movements being diffused across the porous barrier of capital controls – most famously via the metals L/C rehypothecation scam. Between March’09 and February of this year, such ‘unexplained’ flows amounted to no less than $560 billion – roughly two-fifths of China’s total reserve accumulation and a third of its coincident increase in M1.

The last four months of increasing angst about the state of the ‘landing’ have seen a dramatic reversal of these flows, to the point that the discrepancy in the books suggests that China may have lost no less than $128 billion – a flight which exceeds that suffered during the worst of the Lehman crisis.

Taken at face value, this implies further, self-reinforcing pressure for the renminbi to weaken, for the Dim Sum bond bubble to deflate, and for commodity loans to be unwound, either suddenly – by means of re?exporting some of the swelling inventories of copper, et al – or gradually – by cutting back on new imports until the excess has worn off and the bills settled.

Either way, a chilling prospect, even if this does not trigger a new financial crisis among China’s complex and shadowy interweaving of ‘loan guarantee’ companies and off?balance sheet ‘wealth management products’.

China has now begun to react, of course, cutting the effective bellwether, one-year lending rate from 5.9% (6.55% official less the permitted discount of 10%) to 4.2% (6.0% less the widened 30% rebate) in the space of a month. As Wang Shuo, Managing Editor of the influential and highly-regarded Caixin Magazine blogged at once on his Weibo page: “This is an admission that the hard landing is already here.” In this, he only anticipated his sovereign overlord, President Hu, by a few hours, for this latter worthy soon thereafter started bleating that the economy faces – severe downwards pressure?.

You bet it does! Take a range of key indicators – from electricity usage, to Shanghai container throughput, to nationwide rail freight ton-miles, to steel output – and you will notice that none of these shows a rate of growth during the second quarter of more than 4% from 2011, and some are as low as 1%. Whatever fictive GDP number we are presented with this week, the message is clear: “Brace! Brace! Brace!”

The trick will now be to avoid re-inflating the property bubble – and information suggesting 125% of June’s overall loan total was comprised of household credit offers little reassurance on that score. It is also imperative that the regime acts to assuage the fears of a populace who were already, in the aftermath of the first rate reduction, responding to official survey questions in a high and increasing proportion that they feared an imminent ?surge? in consumer goods prices. Good luck with that, Comrades!

and just for good measure – here is Stratfor on that very same property bubble reinflating as record prices were paid (by an SOE no less) for property in Beijing this week – as she reminds us that property is more than a sector (accounting for 25% of GDP including its knock-on effects) it is a microcosm of China’s model for growth:

Source: Diapason Commodities, Stratfor