– US Companies Are Furiously Creating Jobs… Abroad (ZeroHedge, April 27, 2012):

Whatever one thinks of the practical implications of the Kalecki equation (and as we pointed out a month ago, GMO’s James Montier sure doesn’t think much particularly when one accounts for the ever critical issue of asset depreciation), it intuitively has one important implication: every incremental dollar of debt created at the public level during a time of stagnant growth (such as Q1 2012 as already shown earlier) should offset one dollar of deleveraging in the private sector. In turn, this should facilitate the growth of private America so it can eventually take back the reins of debt creation back from the public sector (and ostensibly help it delever, although that would mean running a surplus – something America has done only once in the post-war period). This growth would manifest itself directly by the hiring of Americans by US corporations, small, medium and large, who in turn, courtesy of their newly found job safety, would proceed to spend, and slowly but surely restart the frozen velocity of money which would then spur inflation, growth, public sector deleveraging, and all those other things we learn about in Econ 101. All of the above works… in theory. In practice, not so much. Because as the WSJ demonstrates, in the period 2009-2011, America’s largest multinational companies: those who benefit the most from the public sector increasing its debt/GDP to the most since WWII, or just over 100% and rapidly rising, and thus those who should return the favor by hiring American workers, have instead hired three times as many foreigners as they have hired US workers. Those among us cynically inclined could say, correctly, that the US is incurring record levels of leverage to fund foreign leverage, foreign employment, and, most importantly, foreign leverage.

Wonder why the BLS is forced to use such now pathetic trickery as collapsing the labor pool by double the natural rate of growth of the labor pool to make it seem that US unemployment is declining? Simple. The WSJ explains:

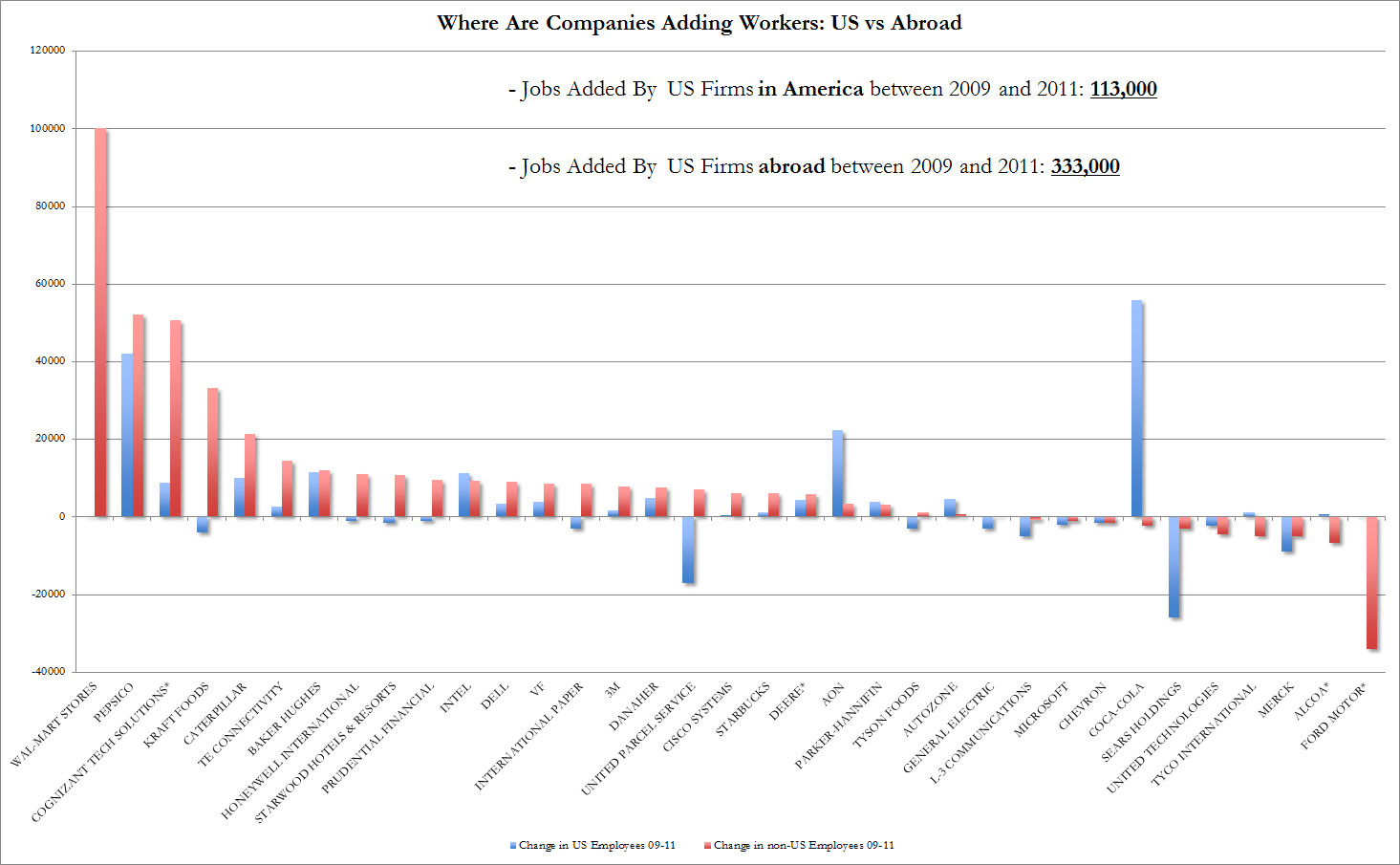

Thirty-five big U.S.-based multinational companies added jobs much faster than other U.S. employers in the past two years, but nearly three-fourths of those jobs were overseas, according to a Wall Street Journal analysis.

Those companies, which include Wal-Mart Stores Inc., International Paper Co., Honeywell International Inc. and United Parcel Service Inc., boosted their employment at home by 3.1%, or 113,000 jobs, between 2009 and 2011, the same rate of increase as the nation’s other employers. But they also added more than 333,000 jobs in their far-flung—and faster-growing— foreign operations.

The companies included in the analysis were the largest of those that disclose their U.S. and non-U.S. employment in annual securities filings. All of them have at least 50,000 employees. Collectively, they employed roughly 6.4 million workers world-wide last year, up 7.7% from two years earlier. Over the same period, the total number of U.S. jobs increased 3.1%, according to the Labor Department.

Spin on:

The data show that global companies, aided by overseas revenue, are faring better than purely domestic companies during the economic recovery. Nearly 60% of the revenue growth between 2009 and 2011 at the companies in the Journal’s analysis came from outside the U.S.

Partly as a result, these companies are more likely to focus their resources and people outside the U.S. The nation’s largest private-sector employer, Wal-Mart, added 100,000 jobs outside the U.S. last year; its head count in the U.S. has been flat at 1.4 million since 2007.

Spin off: these companies, benefiting from ZIRP in the US, and exporting of inflation, and thus rising prices, and wages in the rest of the world, can fund their foreign operations domestically at virtually no cost, courtesy of the US taxpayers and savers, who are getting the short end of the stick day after day with a savings rate of 0.001%. And, naturally, these companies which only focus on their return on equity and return to shareholders, will in turn take advantage of this arb, and hire cheap labor globally, there where US debt issuance has the most marginal, yet indirect, impact.

In other words, in an ideal world, the offset to soaring US leverage would be that US corporates, with balance sheets sparkling clean, would return the favor for the public sector burden, and hire US citizens who have no interest (i.e., fixed) income, and certainly no dividend income. Instead, the corporates defect most blatantly, an act nobody can blame them for as they do merely what is efficient, and hire foreigners, or those who do not have to suffer the consequences of ZIRP.

Alas, one will read none of this in the WSJ piece which continues as follows:

Economists who study global labor patterns say companies are creating jobs outside the U.S. mostly to pursue sales there, and not to cut costs by shifting work previously performed in the U.S., as has sometimes been the case.

“If you want to capture market share in China, you’re going to have to hire lots of locals,” says Arie Lewin, a professor at Duke University’s Fuqua School of Business who has studied outsourcing and offshoring. “You just can’t export that stuff.”

Jobs added overseas “are not necessarily at the expense of U.S. workers,” adds Martin Baily, of the Brookings Institution, a former economic adviser to President Bill Clinton. Mr. Baily says it is “almost inevitable” that the biggest and most successful U.S. companies would look beyond the nation’s borders.

One can be sure however, that the topic of job creation geography will be a very tangible one in the upcoming presidential debates:

Where American companies are creating jobs is a hot political issue. President Barack Obama has proposed tax benefits for companies to create jobs in the U.S., and tax penalties for those with large operations in other countries. His tax-overhaul plan—which has no real chance of passing Congress this year—would require, for the first time, that U.S. companies operating overseas pay a minimum tax on their foreign earnings.

Republicans, including presumptive presidential nominee Mitt Romney, say excessive taxes and regulations are driving jobs overseas. Mr. Romney has suggested cutting the nation’s 35% corporate tax, which he calls, “among the highest in the industrial world,” to 25%, lower than the 28% Mr. Obama has proposed.

Of the 35 companies in the analysis, 16 added jobs both in the U.S. and abroad, while six of them cut both domestic and international jobs.

Seven companies reduced their workforces in the U.S., while expanding them elsewhere. They include International Paper, which has restructured as Americans use less office paper and demand rises overseas.

At the end of 2008, more than two-thirds of its 61,700 employees at the 114-year-old industrial stalwart were in the U.S. Since then, International Paper has closed U.S. mills and bolstered its packaging division through acquisitions in the U.S. and Asia.

Its total workforce—61,500 at the end of last year—hardly changed. But the location of those employees changed a lot, with 8,000 fewer in the U.S. and 8,000 more in other countries. So did International Paper’s revenue.

Sales in the U.S. and Europe in 2011 were nearly unchanged from 2008. But revenue from Asia more than doubled over the period to $1.8 billion.

And so forth. While hardly news to most, the reality is that anyone who thinks in economic terms from a practical standpoint (which automatically excludes 100% of Ph.D. economists and 99% of bloggers and armchair econ experts on twitter), the reality is that soaring US public leverage has virtually no incremental return to the US public sector. In fact, as the above chart shows, the returns from additional US debt are roughly 3 to 1 in the benefit of foreign countries compared to the US. But no matter: the Krugmans of the world will keep on prodding anyone who still cares to listen to their ramblings to spend, spend, spend and raise, raise, raise debt as the IRR will ultimately catch up. Well, he is right: for a very specific subset of Americans – those who are shareholders of big multinationals. Unfortunately, the money, once it trickles down to the bottom line, ends up being deposited… just not in the US, but far, far away, preferably in Taiwan, Singapore and HK banks (now that Obama made any American non-grata in Zurich and Geneva) as those same corporate types know very well that the same government which is so generous in giving, will be just as greedy when the time comes to taketh away.

That time is rapidly coming.