Change you can believe in!

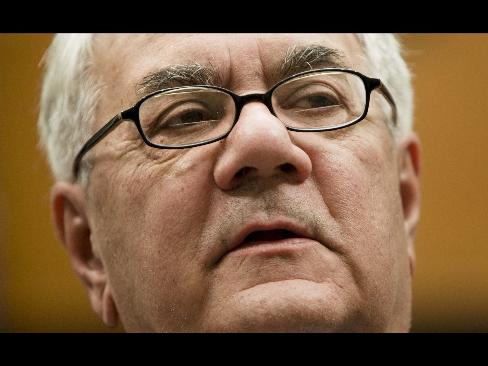

Representative Barney Frank, a Democrat from Massachusetts, speaks during a news conference on Capitol Hill in Washington (Getty Images)

Dec. 30 (Bloomberg) — To close out 2009, I decided to do something I bet no member of Congress has done — actually read from cover to cover one of the pieces of sweeping legislation bouncing around Capitol Hill.

Hunkering down by the fire, I snuggled up with H.R. 4173, the financial-reform legislation passed earlier this month by the House of Representatives. The Senate has yet to pass its own reform plan. The baby of Financial Services Committee Chairman Barney Frank, the House bill is meant to address everything from too-big-to-fail banks to asleep-at-the-switch credit-ratings companies to the protection of consumers from greedy lenders.

I quickly discovered why members of Congress rarely read legislation like this. At 1,279 pages, the “Wall Street Reform and Consumer Protection Act” is a real slog. And yes, I plowed through all those pages. (Memo to Chairman Frank: “ystem” at line 14, page 258 is missing the first “s”.)

The reading was especially painful since this reform sausage is stuffed with more gristle than meat. At least, that is, if you are a taxpayer hoping the bailout train is coming to a halt.

If you’re a banker, the bill is tastier. While banks opposed the legislation, they should cheer for its passage by the full Congress in the New Year: There are huge giveaways insuring the government will again rescue banks and Wall Street if the need arises.

Nuggets Gleaned

Here are some of the nuggets I gleaned from days spent reading Frank’s handiwork:

— For all its heft, the bill doesn’t once mention the words “too-big-to-fail,” the main issue confronting the financial system. Admitting you have a problem, as any 12- stepper knows, is the crucial first step toward recovery.

— Instead, it supports the biggest banks. It authorizes Federal Reserve banks to provide as much as $4 trillion in emergency funding the next time Wall Street crashes. So much for “no-more-bailouts” talk. That is more than twice what the Fed pumped into markets this time around. The size of the fund makes the bribes in the Senate’s health-care bill look minuscule.

— Oh, hold on, the Federal Reserve and Treasury Secretary can’t authorize these funds unless “there is at least a 99 percent likelihood that all funds and interest will be paid back.” Too bad the same models used to foresee the housing meltdown probably will be used to predict this likelihood as well.

More Bailouts

— The bill also allows the government, in a crisis, to back financial firms’ debts. Bondholders can sleep easy — there are more bailouts to come.

— The legislation does create a council of regulators to spot risks to the financial system and big financial firms. Unfortunately this group is made up of folks who missed the problems that led to the current crisis.

— Don’t worry, this time regulators will have better tools. Six months after being created, the council will report to Congress on “whether setting up an electronic database” would be a help. Maybe they’ll even get to use that Internet thingy.

— This group, among its many powers, can restrict the ability of a financial firm to trade for its own account. Perhaps this section should be entitled, “Yes, Goldman Sachs Group Inc., we’re looking at you.”

Managing Bonuses

— The bill also allows regulators to “prohibit any incentive-based payment arrangement.” In other words, banker bonuses are still in play. Maybe Bank of America Corp. and Citigroup Inc. shouldn’t have rushed to pay back Troubled Asset Relief Program funds.

— The bill kills the Office of Thrift Supervision, a toothless watchdog. Well, kill may be too strong a word. That agency and its employees will be folded into the Office of the Comptroller of the Currency. Further proof that government never really disappears.

— Since Congress isn’t cutting jobs, why not add a few more. The bill calls for more than a dozen agencies to create a position called “Director of Minority and Women Inclusion.” People in these new posts will be presidential appointees. I thought too-big-to-fail banks were the pressing issue. Turns out it’s diversity, and patronage.

— Not that the House is entirely sure of what the issues are, at least judging by the two dozen or so studies the bill authorizes. About a quarter of them relate to credit-rating companies, an area in which the legislation falls short of meaningful change. Sadly, these studies don’t tackle tough questions like whether we should just do away with ratings altogether. Here’s a tip: Do the studies, then write the legislation.

Consumer Protection

— The bill isn’t all bad, though. It creates a new Consumer Financial Protection Agency, the brainchild of Elizabeth Warren, currently head of a panel overseeing TARP. And the first director gets the cool job of designing a seal for the new agency. My suggestion: Warren riding a fiery chariot while hurling lightning bolts at Federal Reserve Chairman Ben Bernanke.

— Best of all, the bill contains a provision that, in the event of another government request for emergency aid to prop up the financial system, debate in Congress be limited to just 10 hours. Anything that can get Congress to shut up can’t be all bad.

Even better would be if legislators actually tackle the real issues stemming from the financial crisis, end bailouts and, for the sake of my eyes, write far, far shorter bills.

(David Reilly is a Bloomberg News columnist. The opinions expressed are his own.)

Click on “Send Comment” in the sidebar display to send a letter to the editor.

To contact the writer of this column: David Reilly at [email protected]

Last Updated: December 29, 2009 21:00 EST

Commentary by David Reilly

Source: Bloomberg

More for ‘Obama administration’ fans:

– Treason: Obama gives INTERPOL immunity from the Constitution (Amending Executive Order 12425)

– Peter Schiff on Obamacare, Freddie Mac & Fannie Mae: The Nightmare Before Christmas

– Obama administration backs Fannie Mae and Freddie Mac no matter how big their losses may be

– Rep. Dennis Kucinich: US War Presidents ignore Congress and Constitution

– Obamacare: Big payoffs to senators on health bill stoke public anger

– US: Trillions Of Troubles Ahead

– Chinese central banker Zhu Min: ‘The world does not have so much money to buy more US Treasuries.’

– Obamacare: Change Nobody Believes In

– Obama’s surge comes at a cost: At least $57,077.60 per minute

– US National Debt Tops Debt Limit

Hypocrite in Chief (Funny):

– President Obama: Another Busy Day in The Oval Office!

– Fascism in America: By Political Definition The US Is Now Fascist, Not A Constitutional Republic

– John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

Liar in Chief (NOT funny!!!):

– Barack Obama Lies 7 Times In Under 2 Minutes!!!!!

– Rep. Dennis Kucinich: ‘These Wars Are Corrupting The Heart Of Our Nation!’

– Famous Investor Jim Rogers: Incompetence In Washington, Abolish The Fed And The Treasury

– Rep. Dennis Kucinich: The Truth About Afghanistan

– Obama’s Big Sellout (Rolling Stone Magazine)

– Obama administration to lift debt ceiling by $1.8 trillion

– Climategate: President Obama’s rule by EPA decree is a coup d’etat against Congress, made in Britain

– Obama administration tells Pakistan: Tackle Taliban or we will

– MSNBC Rachel Maddow: War President Obama

– Ron Paul: ‘Obama is Actually Preparing Us For Perpetual War’

– Afghanistan Surge to Cost At Least $40 Billion, That Is $1.333.333 For One US Soldier Per Year

Liar in Chief (Over 300 soldiers died in 2009 because of this lie!!!):

– Obama: ‘I will promise you this, that if we have not gotten our troops out by the time I am President, it is the first thing I will do. I will get our troops home. We will bring an end to this war. You can take that to the bank.’