Economy

Americans Pour Into Pawnshops, Selling Gold Jewelry As Price Surges

– Americans Pour Into Pawnshops, Selling Gold Jewelry As Price Surges:

With gold trading at record highs, cash-strapped Americans are heading to pawnshops to sell their jewelry.

“People are using gold as an ATM they never had,” King Gold & Pawn and Empire Gold Buyers owner Gene Furman tells Bloomberg. He says gold-selling traffic at his 5th Avenue location in New York City has more than tripled as gold has surged 17% off its 2024 low in February to now trade near $2,400 an ounce.

While some just want to take advantage of the price surge, others are compelled by price inflation that’s put them in a financial bind. “Prices are high, and I need cash,” 30-year-old IT specialist Branden Sabino tells Bloomberg, citing the burden of higher prices for food, rent and car insurance. A 55-year-old woman said she needed the money to pay for gas.

Read moreAmericans Pour Into Pawnshops, Selling Gold Jewelry As Price Surges

Silver Exchanges Could Fail; Physical Pressure Mounts | John Rubino (Liberty and Finance Video)

Planned financial/economic collapse is coming, as predicted.

***

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Gold’s Historic Run Is Unsettling, Here’s Why | Doomberg (Liberty and Finance Video)

Planned WW3 is coming, as predicted.

***

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Two Senior Tesla Executives Leave Amid Global Layoffs

– Two Senior Tesla Executives Leave Amid Global Layoffs:

Update (1025ET):

The Wall Street Journal reports Tesla plans to reduce 10% of its global workforce, approximately 14,000 employees, confirming an earlier report by the EV blog Electrek.

Tesla Chief Executive Elon Musk sent a letter to employees detailing how the company needed to reduce costs and increase productivity. WSJ obtained a copy of the email.

“As part of the effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally,” Musk wrote in the letter, adding, “There is nothing I hate more, but it must be done. This will enable us to be lean, innovative, and hungry for the next growth phase cycle.”

Separately, Bloomberg journalists on X reported that Tesla Senior Vice President Drew Baglino and Tesla Vice President of Public Policy and Business Development Rohan Patel are leaving the company.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Mike Shedlock: Daytime Solar Power Glut In California, Rooftop Sales Plunge 90%

– Daytime Solar Power Glut In California, Rooftop Sales Plunge 90%:

Demand for rooftop solar systems dries up in California after subsidies drop. 100 contractors go out of business. Fancy that…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

It’s 100% Certain! Gold Is Next to Go Completely Crazy in Next Few Months – Alasdair Macleod (Video)

H/t reader Squodgy:

“Alasdair McCleod explains why. He, Lynette Zang & Bill Holter have consistently emphasised that rises in the market values of Gold & Silver are merely reflections of the declines in the value of the currencies being used to purchase everything.

This is clear in looking at the value of any item in terms of how much physical gold is needed to buy that item. It simply stays constant because the worth of the FIAT currency drops with inflation and the market price of G&S increase accordingly to reflect the incompetent creation of Government spending to fulfil election promises and war funding which is totally beyond the World’s capacity to pay off, and as economic activity deteriorates even the interest due on the debts becomes beyond the possibilities of repayment. Historically, paper currencies depreciate through engineered inflation at 2% per year, which computes to a 50 year lifespan, coincidentally the age of the petrodollar. The only way out of this is default, debt jubilee & write off, a debt forgiveness which the Banksters call aJubilee or Shemitah. Sadly they single these deals out between themselves and it is not for the plebs or their Governments, who are in fact the Banksters’ cash cows. Therefore for the likes of us the only way out is for our Governments to declare Bankruptcy, but that will be an admission of failure by the Governments to the voters (plebs) and obfuscated by the Banksters who obviously would lose their income, so they’ll then try to drag it out keeping the debt alive as long as possible as it is their main source of income until, as hyperinflation ensues, the repeat of the Weimar/Zimbabwe circus collapse ensues and the paper currency becomes a totally worthless relic. All eyes on how they try to wriggle round this mess so they camouflage the game they play at our expense, with some false flag event and War circus.”

***

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

“Food PRICES have sky rocketed” (Video)

…”Food PRICES have sky rocketed”

“I just went into this McDonald’s here. A Big Mac meal costs $11.79 before taxes”

“It’s now at a price where people simply CAN’T AFFORD to come to McDonald’s anymore. McDonald’s CEO now reporting that those making less than $45,000 a year… pic.twitter.com/kX7qH8gsOy

— Wall Street Silver (@WallStreetSilv) April 14, 2024

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Buying Votes: Biden Cancels Student Debt For 277,000 Borrowers Ahead Of Presidential Elections

– Buying Votes: Biden Cancels Student Debt For 277,000 Borrowers Ahead Of Presidential Elections:

https://archive.is/h8vTD

On Friday, President Joe Biden announced that he would cancel the federal student debt of more than 277,000 Americans, equating to about $7.4 billion. This would bring the total of what is considered classical vote buying ahead of the November presidential elections to more than $153 billion, or forgiving the debt of 4.3 million people.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

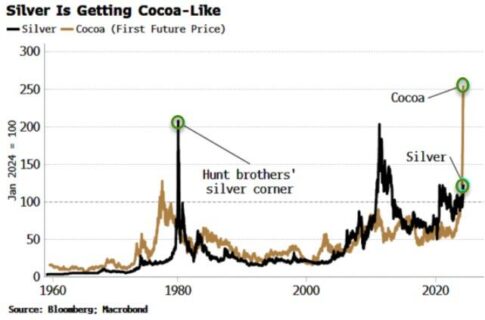

Is Silver About To Do A Cocoa?

– Is Silver About To Do A Cocoa?:

Authored by Simon White, Bloomberg macro strategist,

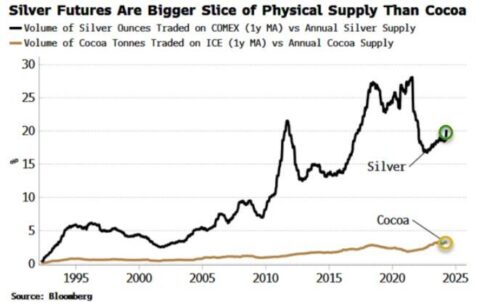

Silver prices have rocketed higher in recent days, and they have been surging today (with great volatility). As a futures market, more of it trades on exchange relative to its annual physical supply compared to cocoa. Therefore it’s not inconceivable silver could deliver a similar sort of move to cocoa’s recent mega-rally.

Silver is notoriously volatile and is considerably smaller than the gold market. It has experienced the sort of rallies cocoa recently experienced before: the Hunt brothers’ infamous corner in 1980, and in 2011.

With the futures market being bigger relative to annual supply compared to cocoa, that further increases the chance surging demand could cause prices to spike even more.

In a further demonstration of the small size of the silver market, the rally in 2011 did not really have a single factor.

Instead, loose monetary policy, the US’s debt downgrade and other factors conspired to drive demand that the market simply could not handle.

China and inflation are probably driving silver demand.

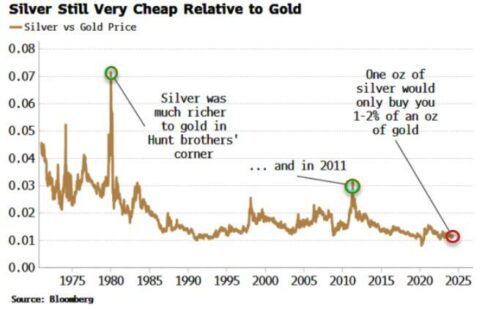

On the latter front, silver positioning has risen sharply in recent weeks, perhaps as latecomers looking for an inflation hedge feel they have missed the boat on gold (discussed here at the beginning of the month).

Either way, silver is still very cheap relative to gold, another factor that could help drive its price to cocoa-like extremes.

Of course, given its extreme volatility, prices could fall as quickly as they have risen.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP