The banksters looting the American taxpayer again.

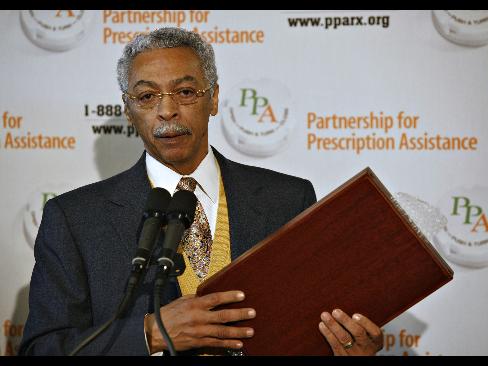

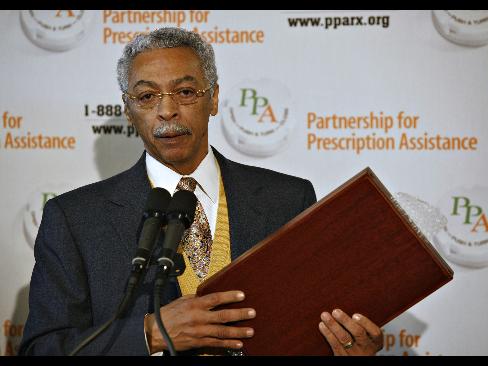

Larry Langford, then Jefferson County commissioner, speaks at a Partnership for Prescription Assistance event in Birmingham, Alabama, in this file photo taken Feb. 2, 2007. Photographer: Gary Tramontina/Bloomberg

Oct. 19 (Bloomberg) — In its 190-year history, Jefferson County, Alabama, has endured a cholera epidemic, a pounding in the Civil War, gunslingers, labor riots and terrorism by the Ku Klux Klan. Now this namesake of Thomas Jefferson, anchored by Birmingham, is staring at what one local politician calls financial “Armageddon.”

The spectacle — a tax struck down, about 1,000 county employees furloughed, a politician indicted over $3 billion in sewer debt that may lead to the largest municipal bankruptcy in history — has elbowed its way up the ladder of county lore.

“People want to kill somebody, but they don’t know who to shoot at,” says Russell Cunningham, past president of the Birmingham Regional Chamber of Commerce.

One target of their anger is Larry P. Langford, who was the county commission’s president in 2003 and 2004 and is now mayor of Birmingham. The 61-year-old Democrat goes on trial today, charged in a November 2008 federal indictment with taking cash, Rolex watches and designer clothes in exchange for helping to steer $7.1 million in fees to an Alabama investment banker as the county refinanced its sewer debt.

Jefferson County’s debacle is a parable for billions of dollars lost by state and local governments from Florida to California in transactions done behind closed doors. Selling debt without requiring competition made public officials vulnerable to bankers’ sales pitches, leaving taxpayers to foot the bill for borrowing gone awry.

Swaps Blew Up

Under Langford’s stewardship, the county bet on interest- rate swaps, agreements that a representative of New York-based JPMorgan Chase & Co. told commissioners could reduce their interest costs. Instead, the swaps — covering more than $5 billion in all — blew up during the credit crisis after ratings for the county’s bond insurers fell.

JPMorgan, through spokeswoman Christine Holevas, declined to comment for this story.

Thousands of public borrowers across the U.S. chose a similar strategy, and many are now paying billions of dollars to escape the contracts, said Peter Shapiro, managing director at Swap Financial Group in South Orange, New Jersey. Even Harvard University, the world’s richest academic institution with an endowment of $26 billion, fell for Wall Street’s financing in the dark: It paid $497.6 million to investment banks during the fiscal year ended June 30 because it chose to cancel $1.1 billion of interest-rate swaps.

Read moreFinancial ‘Armageddon’ in Alabama Proves Parable for Local US Governments