– “Hello Scotia Mocatta, This Is JPMorgan – We Urgently Need Some Of Your Gold” (ZeroHedge, Aug 8, 2013):

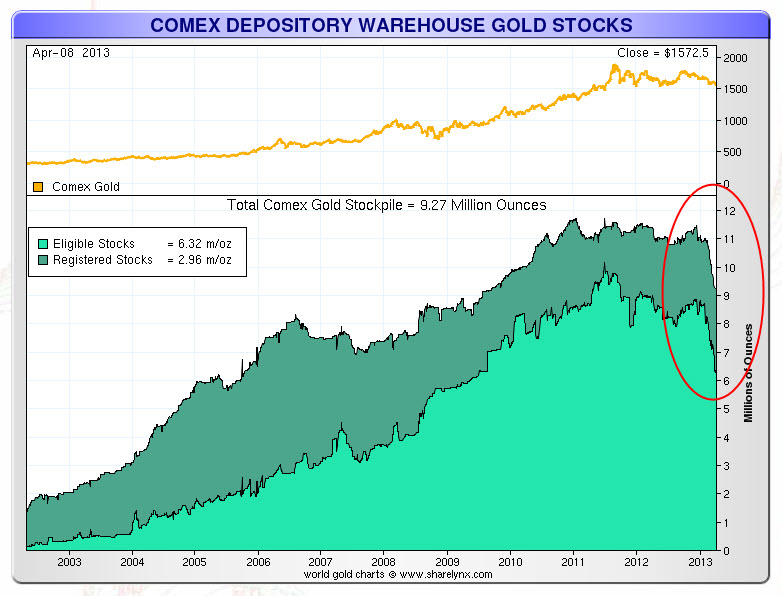

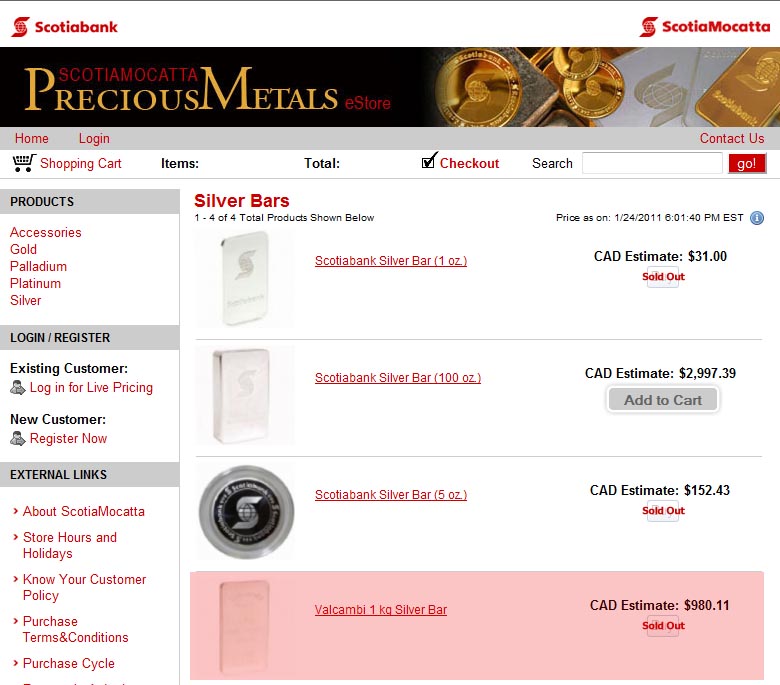

Yesterday, it was HSBC. Today, the lucky respondent to JPM’s polite gold ‘procurement‘ request, is the second “fullest” New York commercial gold vault: Scotia Mocatta. As ZH reported previously, following the announcement of an imminent withdrawal of 63.5k ounces of its gold (16% of the total), JPM’s vault operations team promptly called around and to its disappointment was only able to procure a tiny 6.4k ounces: not nearly enough to preserve the impression that it is well-stocked. We then said, “None of which changes the fact that in a few days, the inventory in JPM’s gold vault will drop to another record low of only 380K ounces and the JPM “rescue” pleas from HSBC and other Comex members will become ever louder and more desperate until one day they may just go straight to voicemail.”

Today, as we predicted, the calls into HSBC indeed appear to have gone straight to voicemail (perhaps HSBC did not have any more unencumbered gold to share, perhaps it just didn’t want to) which left JPM with just one option: go down the list.

Read more‘Hello Scotia Mocatta, This Is JPMorgan – We Urgently Need Some Of Your Gold’