Federal Reserve Chairman Ben Bernanke has reduced the key federal funds rate six times in as many months — reducing the cost for major borrowers significantly. This combines with providing $270 million in funding, plus $30 billion in additional guarantees, for JP Morgan Chase to buy Bear Stearns Cos.

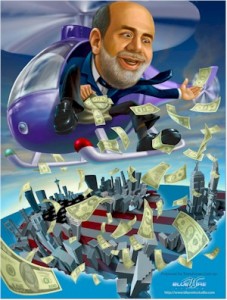

“Helicopter Ben” is living up to the nickname he earned after he remarked in a 2002 speech that he would stave off a recession even if he had to drop money from helicopters to do it.

The results of these policies have been destructive. The dollar is collapsing not only against foreign currencies — we’re now at par with the Canadian dollar and rocketing toward a 2-1 deficit against the Euro — but also against commodities. Gold was passing the $1,000-an-ounce landmark, silver $20. Even industrial metals like copper and zinc are fetching record prices.

Now, a spike in a particular commodity — say, for instance, $100-per-barrel oil — can be attributed to a shortage. But when they all move dramatically and simultaneously, it’s the purchasing power of our money that has gone down.

In fact, the increasing cost of even the base metals recently prompted Edmund Moy, director of the United States Mint, to propose further debasing the copper and nickel-plated, zinc slugs we call coins by substituting color-coated steel.