Related info:

– China Increases Gold Holdings By 57% ‘In One Month’ In First Official Update Since 2009

– Gold, Precious Metals Flash Crash Following $2.7 Billion Notional Dump (ZeroHedge, July 19, 2015):

The last time gold plummeted by just over $30 per ounce (dragging down silver and bitcoin with it) and resulted in a crash so furious it led to a “Velocity Logic” market halt for 10 seconds, was on January 6, 2014. Many said this was just perfectly normal selling, although we explicitly said (and showed) that it was a clear case of an HFT algo gone wild (following an order to do just that and slam all sell stops) when someone manipulated the market and repriced gold substantially lower.

Precisely one month ago, some 18 months after the incident, the Comex admitted as much, when it blamed the collapse on “unusually large and atypical trading activity by several of the Firm’s customers and caused the mass entry of order messages by Zenfire, which resulted in a disruptive and rapid price movement in the February 2014 Gold Futures market and prompted a Velocity Logic event.” Curiously despite the “errant” order, gold did not rebound because the entire purpose of the selling slam was to reset the prevailing price far lower. This is what the Comex said in Disciplinary action 14-9807-BC:

Pursuant to an offer of settlement Mirus Futures LLC (“Mirus” or the “Firm”) presented at a hearing on June 16, 2015, in which Mirus neither admitted nor denied the rule violations upon which the penalty is based, a Panel of the COMEX Business Conduct Committee (“BCC”) found that it had jurisdiction over Mirus pursuant to Exchange Rule 418 and that on January 6, 2014, Mirus failed to adequately monitor the operation of its trading platform (Zenfire), and connectivity of its trading system (Zenfire) with Globex. This failure resulted in unusually large and atypical trading activity by several of the Firm’s customers and caused the mass entry of order messages by Zenfire, which resulted in a disruptive and rapid price movement in the February 2014 Gold Futures market and prompted a Velocity Logic event.

The Panel found that as a result, Mirus violated Rules 432.Q. (Conduct Detrimental to the Exchange) and 432.W.

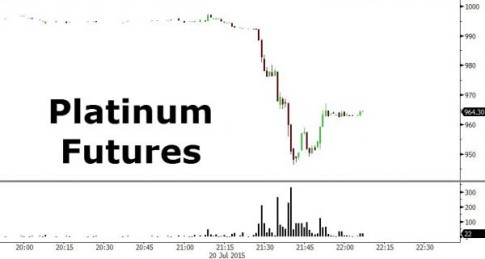

We bring this up because moments ago, just before 9:30pm Eastern time or right as China opened for trading, gold (as well as platinum, silver, and virtually all precious metals) flashed crashed when “someone” sold $2.7 billion notional in gold, resulting in a 4.2% or about $50 to just over $1,086/oz, the lowest level since March 2010.

Gold:

Silver:

Platinum:

Once again, as in February 2014 and on various prior cases, the fact that someone meant to take out the entire bid stack reveals that this was not a normal order and price discovery was the last thing on the seller’s mind, but an intentional HFT-induced slam with one purpose: force the sell stops.

So what caused it?

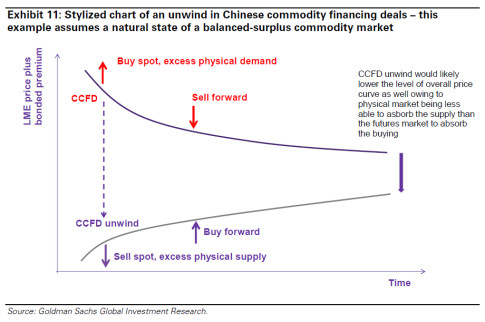

The answer is probably irrelevant: it could be another HFT-orchestrated smash a la February 2014, or it could be the BIS’ gold and FX trading desk under Benoit Gilson, or it could be just a massive Chinese commodity financing deal unwind as we schematically showed last March…

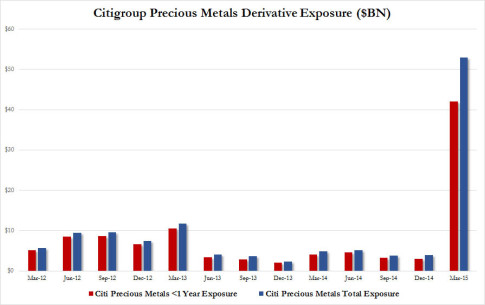

… or it could be simply Citigroup, which as we showed earlier this month has now captured the precious metals market via derivatives.

Whatever the reason, gold just had its biggest flash crash in nearly two years, as a targeted stop hunt launched by the dumping of $2.7 billion notional in product, accelerates the capitulation of the momentum buyers (and in this case sellers) pushing gold to a level not seen almost since 2009.

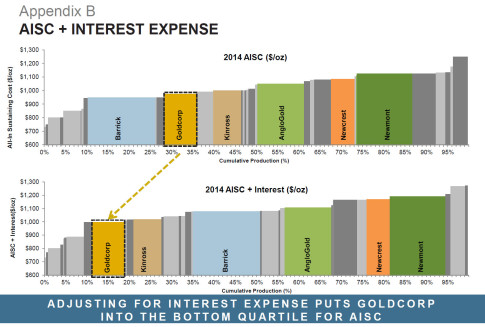

The price appears to have rebounded after the initial shock, up about $20 from the intraday low of $1,086 but we expect that to be retested shortly, and for gold to plunge further into triple digits, at which point gold miners will simply cease to produce the metal whose all-in production cost is in the $1100 and higher range, when it will also become clear that only derivatives and “paper” are the marginal “price” setters.

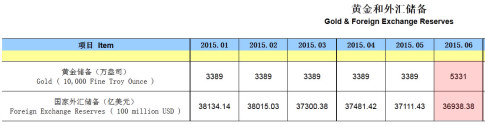

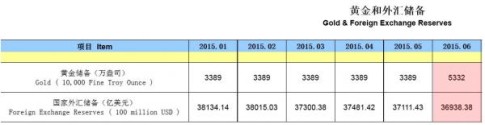

But perhaps the biggest irony of the night is that moments before the flash crash, the PBOC revised its shocking Friday announcement revealing its gold holdings had increased by 57%. As Bloomberg said:

- CHINA PBOC REVISES GOLD RESERVES TO 53.32M FINE TROY OUNCES

Previously, this was said to be 53.31 million ounces or 10,000 ounces lower, confirming China is literally just making up gold inventory “numbers” as it goes along, and clearly buying ever more physical while the price of paper precious metals conveniently plunges ever lower.

One thing is certain: the PBOC will be quite grateful to whoever (or whatever) was the catalyst for the latest and greatest gold flash crash as well.