H/t reader squodgy:

“Seems mainstream media is being treated for what it is, lying, misleading false flag propagandists, and we’re not alone in dismissing them.”

And we’ve been here before.

What they are doing, by selling billions of dollars of paper gold in a second, is only done to keep the price of gold and silver artificially low.

– Gold, Precious Metals Flash Crash Following $2.7 Billion Notional Dump

– Silver Slammed As ‘Someone’ Dumps $1.4 Billion In ‘Paper’ Gold Futures

– Because Nothing Says “Best Execution” Like Dumping $1.5 BILLION In Gold Futures At 0030ET

– Gold Plunges Back Below $1300 As ‘Someone’ Dumps $2.3 BILLION In Futures

– Gold Slumps Most In 2014 As “Someone” Dumps $1.37 Billion In Futures At US Open

This is the new form of ‘gold confiscation’ by TPTB, trying to keep the people away from buying one of the save havens before the collapse happens and making it cheap for themselves.

Meanwhile China and Russia are buying.

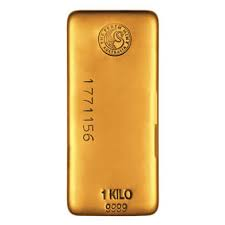

Perth Mint Gold Bar (1 kilo)

– Demand for Gold Bullion Surges – Perth Mint, and U.S. Mint Cannot Meet Demand (GoldCore, July 31, 2015):

– Perth Mint sees surge in demand and cannot keep up with demand

– “Our biggest restriction is the amount of unrefined gold we’re getting in from producers”

– Very high demand for Perth Mint coins, bars coming from Asia, U.S. and Europe

– U.S. Mint sees highest sales of gold coins in over 2 years

– U.S. Mint restrictions on silver coins due to very high demand

– Gold sentiment has moved from despondency to depression (see chart)

– Current negative sentiment despite strong demand is good contrarian indicatorDepressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

This is confirmed in conversations we have had with our refiner and mint partners in recent days. There are growing shortages of supply of small coins and bars. This is resulting in delays in receiving bullion and indeed to rising premiums.

Asian gold demand picked up this week keeping premiums robust and slightly higher in the world’s top gold buying regions.Read moreDemand for Gold Bullion Surges – Perth Mint, and U.S. Mint Cannot Meet Demand