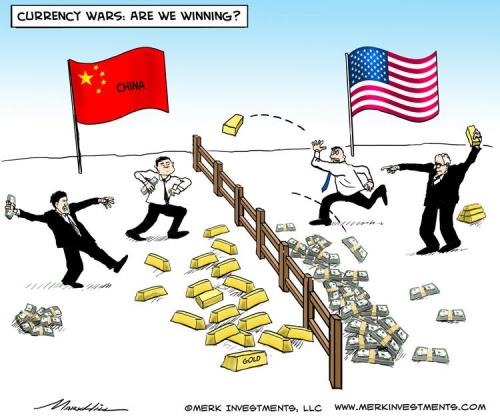

– China chooses her weapons (Gold Money Aug 20, 2015):

China’s recent mini-devaluations had less to do with her mounting economic challenges, and more to do with a statement from the IMF on 4 August, that it was proposing to defer the decision to include the yuan in the SDR until next October

The IMF’s excuse was to avoid changes at the calendar year-end and to allow users of the SDR time to “adjust to a potential changed basket composition”. It was a poor explanation that was hardly credible, given that SDR users have already had five years to prepare; but the decision confirming the delay was finally released by the IMF in a statement on Wednesday 19th.

One cannot blame China for taking the view that these are delaying tactics designed to keep the yuan out, and if so suspicion falls squarely on the US as instigators. America has most to lose, because if the yuan is accepted in the SDR the dollar’s future hegemony will be compromised, and everyone knows it. The final decision as to whether the yuan will be included is not due to be taken until later this year, so China still has time to persuade, by any means at her disposal, all the IMF members to agree to include the yuan in the SDR as originally proposed, even if its inclusion is temporarily deferred.

China was first rejected in this quest in 2010 and since then has worked hard to address the deficiencies raised at that time by the IMF’s executive board. That is the background to China’s new currency policy and what also looks like becoming frequent updates on her gold reserves. It bears repeating that these moves had little to do with her domestic economic conditions, for the following reasons:

- To have an economic effect a substantial devaluation would be required. That is not what is happening. Furthermore devaluation as an economic solution is essentially a Keynesian proposal and it is far from clear China’s leadership embraces Keynesian economics.

- Together with Russia through the Shanghai Cooperation Organisation, China is planning an infrastructure revolution encompassing the whole of Asia, which will replicate China’s economic development post-1980, but on a grander scale. This is why “those in the know” jumped at the chance of participating in the financing opportunities through the Asian Infrastructure Investment Bank, which will be the principal financing channel.

- China’s strategy in the decades to come is to be the provider of high-end products and services to the whole of the Eurasian continent, evolving from her current status as a low-cost manufacturer for the rest of the world.

China’s leaders have a vision, and it is a mistake to think of China solely in the context of a country whose economy is on the wrong end of a credit cycle. This is of course true and is creating enormous problems, but the government plans to reallocate capital resources from legacy industries to future projects. Rightly or wrongly and unlike any western government at this point in a credit cycle, China accepts that a deflating credit bubble is a necessary consequence of a deliberate policy that supports her future plans. She is prepared to live with and manage the fall-out from declining asset valuations and business failures, facilitated by state ownership of the banks.

Instead, to understand why she is changing the yuan-dollar rate we must look at currencies from China’s perspective. China is the world’s largest manufacturing power by far, and can be said to control global trade pricing as a result. It then becomes obvious that China is not so much devaluing the yuan, but causing a dollar revaluation upwards relative to international trade prices. She is aware that the US economy is in difficulties and that the Fed is worried about the prospect of price deflation, so lower import prices are the last thing the Fed needs. Now China’s currency move begins to make sense.

The mini-devaluations were a signal to Washington and the rest of the world that if she so wishes China can dictate the global economic outlook through the foreign exchange markets. China believes, with good reason, that she is more politically and economically robust, and has a better grasp over the actions of her own citizens, than the welfare economies of the west in the event of an economic downturn. Therefore, she is pursuing her foreign exchange policy from a position of strength. And the increments that will now be added to gold reserves month by month are a signal that China believes she can destabilise the dollar through her control of the physical gold market, because it gently reminds us of an unanswered question always ducked by the US Treasury: what evidence is there of the state of the US’s gold reserves?

China would probably live with a deferral of her SDR membership for another year, if there is a definite decision in October to include her currency in the SDR basket. That being the case, China must be tempted to increase pressure on all IMF members ahead of the October meeting. The strategy therefore changes from less passivity to more aggression over both foreign exchange rates and gold ownership over the next eight weeks. We can expect China to tighten the screw if necessary.

The stakes are high, and China’s devaluation of only a few per cent has caused enough chaos in capital markets for now. But if the eventual answer is that the yuan will not be allowed to join the SDR basket, it will be in China’s interest to increase the pace of development of the new BRICS bank instead with its own version of an SDR, selling dollar reserves and underlying Treasuries to fund it. The threat that China will turn her back on the post-war financial system and the IMF would also undermine the credibility of that institution more rapidly perhaps than the dollar’s hegemony if the yuan was accepted. And if a US-controlled IMF loses its credibility, even America’s allies will desert her, just as they did to join the Asian Infrastructure Investment Bank a few months ago.

It was always going to be the US that faced a predicament from China’s growing economic power. She has chosen to bluff it out instead of gracefully accepting the winds of change, as Britain did over her empire sixty years ago. Change in the economic pecking-order is happening again whether we like it or not and China will have her way.

* * *

And, as a reminder from 2013, here again is the “US vs China Currency War For Dummies”