H/t reader squodgy:

“Interesting that the actual paper Gold &Silver is being suppressed while it looks like hard metal prices are hardened slightly higher.

This renders the mining industry as marginal at best and a total rock bottom liability at worst, pointing to cheap sell offs for the benefit of the moneyed few who can then mothball them causing the price hike they can benefit from.”

With the price for an ounce of silver being below the cost of production, how can silver not be called a bargain?

– Gold & Silver Smashdown – Mining Industry Collapse (Level9News, April 29, 2015):

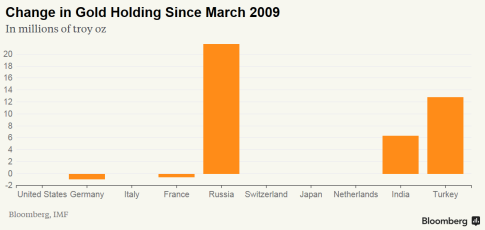

As we’ve seen the price of gold and silver smashed down in order to drive people out of their physical and paper holdings, we are seeing a buying frenzy towards the acquisitions of physical gold and silver, not only by private investors and individuals, but a massive push towards acquisition by leading BRICS nations while simultaneously dumping US Treasuries. This is creating, or at least we are being told, a physical shortage of these metals in the market.

There appears to be an orchestrated attempt to relieve private holders of their gold and silver physical and paper assets at the focal point of the power centralization structure to consolidate these holdings in the hands of the few elite who are manipulating the markets.

We saw in April/May of 2011 Gold and Silver soar to all time highs of $1800.00+ and $49.00+ per oz respectively. This, looking back on what we know now, was an attempt to get private holders to sell, grab a quick profit and therefor consolidate the holdings in the coffers of the few. This plan did not work. As a matter of fact, physical gold and silver purchases by private investors like you and me, increased having the opposite effect desired by the elites. This is the old reliable, Problem Reaction, Solution with a twist:

The Problem being that the masses are waking up to the fact that currency isn’t money and have slowly but surely been trying to preserve their wealth by converting currency to physical gold and silver.

The Reaction, at least the one they’d hoped for, was that if they could lift the lid on prices temporarily, so to speak this would cause a selling frenzy whereby the elite could then pick up the excess supply from a sell off as prices slid back down.

The Solution, they were counting on, was to reduce the holdings of precious metals in the hands of the public and concentrate or centralize those quantities in the hands of the elite.

Just recently we saw a smash down in precious metals, their goal was the same. As fear is a greater motivator than greed, the powers that be attempted to orchestrate a panic which would result in a fear driven rush of people selling their physical metals by creating an illusion or fear that your gold and silver would continue to lose value. This attempt back fired as well as many of us took this as an opportunity to buy – not GLD or SLV, but physical gold and silver. In addition, many people holding paper metal assets, attempted to convert their paper holdings to physical gold and silver unsuccessfully. Instead they were given one option upon redemption, to redeem their GLD and SLV certificates for dollars. This I believe was to reduce their own third party counter risk stemming from the fact that the actual physical metal backing the contracts sold into circulation was running upward of 1:100. A run on these ETFs for redemption of the physical metals they represent would have would have wiped out the vaults at JP Morgan and other US repositories.

They have one more card that they’ve been holding and it may be only a matter of time before they play it. That card is to collapse and bankrupt the precious metals mining industry. If they play that card, they will own the extraction, production and distribution of precious metals and distribution won’t be available to you or me.

What do we know:

#1. A manufacturing company, whether they’re producing widgets or precious metals, can not continue to produce and sell in the market, while having the price they can sell their product for suppressed by the markets or exchanges they’re trading on without incurring significant profit losses.

#2. The mining industry in general, is one of the most costly endeavors with respect to cost vs. units produced.

#3. Gold and Silver prices in particular have been being suppressed for quite some time. “Gold prices have been artificially held down for the past few years by the banking cartel, desperate to keep confidence in the false stock market and the debt-based Ponzi-fiat-money scheme. Yet mining companies are starting to go out of business, as it cost more to mine an ounce of gold, than what is the selling price per ounce. And keep prices down, they have. But demand is way up. How long can they defy the forces of economics? How long can demand for precious metals be high, the supply low, and prices low? What happens when there is no supply to meet that demand?” ~ GramsGold.com (BIN)

#4. This is being further compounded by the endless printing of money by the Fed which is causing rising inflation in the cost of everything including costs of operations. But unlike other industries that are free to increase the cost of goods being sold in the market to maintain a reasonable profit margin, the precious metals markets are not. Therefor while other manufacturing industries are able to maintain a reasonable profit margin, Gold and Silver mining industries are incurring shrinking profit margins and mounting losses.

#5. The BRICS nations are aggressively acquiring massive amounts of physical Gold and Silver, while other European nations are demanding their US holdings back to no avail with delays and outright refusals coming from the US government.

#6. The COMEX has openly discussed a near term default or collapse due to physical demand that cannot be met along with the lesser discussed issue of the naked short sales of SLV and GLD that cannot be covered with physical inventories. Even if they were to extract ALL of the Gold and Silver that’s in the ground! In November of 2010 it was reported that there were 56,048 silver contracts that were sold short, or 280.2 million ounces of SLV paper sold with no backing and even if you calculate in the 116.1 million ounces available to be mined out of the ground, that leaves a total shortfall of 164.1 million ounces of silver sold that simply does not exist according to the CFTC. These discrepancies have been increasing over the past 2 ½ years.

#7. JP Morgan’s reported a staggering drop of 1.2 million ounces or $1.8 billion in the physical gold stockpiles in their vaults over the past 120 days with JP Morgan stating, “The how and why these stockpiles are being removed at such a rapid rate…is a mystery.” I find the term “being removed” in this context instead of say….being converted or being depleted, rather odd as the term “being removed” denotes something being “taken” vs. being traded or converted. That statement by JP Morgan should send up a red flag that something big is on the horizon regarding physical gold and silver.

#8. The COMEX, is openly contemplating default due to what they claim is a surmounting inability to cover outstanding orders and now is refusing to convert contracts to physical Gold and Silver and offering cash only settlements on larger contracts, rather than making physical deliveries.

#9. A physical shortage in gold and silver continues to rise, yet prices of these precious metals continue to fall and they are still well below the 2011 highs. This makes absolutely no sense as in a properly functioning capitalist based economy, the price of a commodity in high demand and short supply rises.

In conclusion:

#1. The market manipulation in precious metals and massive currency devaluation is putting excessive pressure on the gold and silver mining industry.

#2. Past efforts by the power elites to remove our physical holdings or personal possession of gold and silver and centralize possession into their hands were an epic fail.

#3. We’ve been seeing the shutdown of precious metals mining operations in the US in places like Utah, Idaho, Montana as well as shutdowns is Africa, Chile and Australia to name a few, and this short list doesn’t cover production slowdowns globally, which with currency devaluation and rising inflation combined with precious metals price suppression will only result in inevitable shutdowns as well.

#4. A looming COMEX default or collapse could result in the suspension of trading in precious metals for a period to be determined by the global power elite which would equate to sudden death for the gold and silver mining industry, forcing them into bankruptcy.

#5. A continuation of the trends outlined in this presentation will inevitably lead to a collapse, leaving these private and state owned mining operations ripe for takeover by the power elites. In India billionaire elites like Rajesh Mehta are buying fledgling gold and silver mining operations. Would it be a stretch to presume that the wealthiest 1% of the 1% of the global power elites will not seize the opportunity to acquire private and state owned mining operations at pennies on the dollar to gain control of the production, distribution and availability of gold and silver?

#6. People are waking up to the fact that the markets are manipulated. They are coming to the realization that the COMEX is a fraudulent, criminal operation and are scurrying to remove their assets from the custodianship of the COMEX to safer havens. The power elite are running out of options. The collapse of the precious metals mining industry and subsequent takeover would ultimately render total control of the extraction, production and distribution, in particular gold and silver in their hands.

Think about this. When, not if, but when the currency collapses and the power elite control all availability aspects of precious metals, the extraction, production and distribution, they can set the price at whatever they want. And what if the global elites decide the new currency system will be based in total or in part, on gold and silver? What if they set that price not at $3,000.00 an ounce, but at $300.00 an ounce, or $30.00 an ounce? Remember, at that point you and I won’t be able to acquire any more than we already have. If a play like this were to be put into action, you and I would find ourselves waking up one day in abject poverty overnight.

The collapse and takeover of the PM mining industry is a very real possibility given he conditions and trends laid out here.

Reference Links:

2011 Gold Silver hit all time highs

https://www.kitcomm.com/showthread.php?t=78107

2011 Silver gold hit new records:

COMEX inventories collapse by largest amount ever recorded

http://news.goldseek.com/GoldSeek/1365538557.php

Gold miners hit by rising costs

Gold buying frenzy continues – BRICS + Australia

Gold miners need $3000/oz in 5 years to be profitable

http://silverdoctors.com/gold-miners-will-need-3000-in-five-years-to-be-profitable/

War officially declared on gold and silver

http://etfdailynews.com/2013/04/29/gold-silver-war-unofficially-declared-on-12-april-2013/.

Silver shortage at COMEX

http://www.silverbearcafe.com/private/12.10/silvershortage.html

Are the banks significantly short of PM’s supply

http://lakshmi-capital.com/2010/11/a-twist-on-the-silver-market-are-banks-short/

16% of US silver supply just vaporized

Silver mine shutdown in Idaho

http://www.silverseek.com/article/mine-shutdown-mean-lost-jobs-economic-uncertainty

Montana gold and silver mine shutdown

http://www.manufacturing.net/news/2013/04/historic-mine-shutting-down-after-gold-price-drop

South African strike shuts down 39% of gold production

Kinross to shut down Chilean gold mine

www.juniorminingnews.com/?p=1533

Australian silver mines shut down/abandoned

‘H/t reader squodgy’ writes:

“With the price for an ounce of silver being below the cost of production, how can silver not be called a bargain?”

This kind of info can be detrimental to would-be silver investors.

I think the trend for gold and silver is still down.

Costs of production are down in 2015:

http://seekingalpha.com/article/2882886-gold-and-silver-headwinds-lower-mining-costs

To Lana,

This line …

… is not from squodgy, but from me.

For example:

Well, we will see. So far …

So the price investors pay is lower/has been lower than the cost of production.

I know that a lot will happen in the not too distant future and I consider silver to be one of the best protection for your financial assets out there.

The last thing I want is to mislead people.