Well, it’s Not the biggest problem.

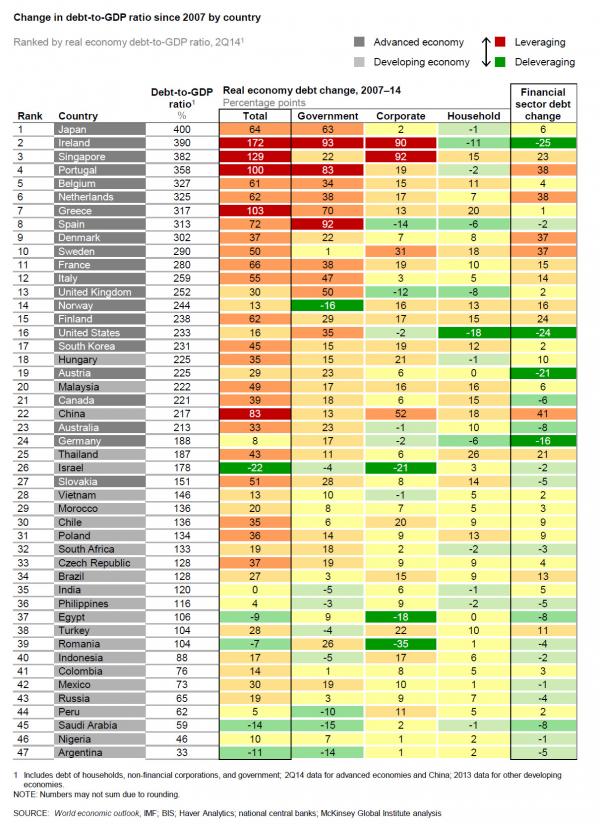

– This Is The Biggest Problem Facing The World Today: 9 Countries Have Debt-To-GDP Over 300% (ZeroHedge, Feb 23, 2015):

If anyone has stopped to ask just why global central banks are in such a rush to create inflation (but only controlled inflation, not runaway hyperinflation… of course when they fail with the “controlled” part the money paradrop is only a matter of time) over the past 5 years, and have printed over $12 trillion in credit-money since Lehman, the bulk of which has ended up in the stock market, and which for the first time ever are about to monetize all global sovereign debt issuance in 2015, the answer is simple, and can be seen on the chart below.

It also shows the biggest problem facing the world today, namely that at least 9 countries have debt/GDP above 300%, and that a whopping 39% countries have debt-to-GDP of over 100%!

We have written on this topic on countless occasions in the past, so we will be brief: either the Fed inflates this debt away, or one can kiss any hope of economic growth goodbye, even if that means even more central bank rate cuts, more QEs everywhere, and stock markets trading at +? while the middle class around the globe disappears and only the 0.001% is left standing.

Finally, those curious just how the world got to this unprecedented and sorry state, this full breakdown courtesy of McKinsey should answer all questions.

Note the countires not on the list, Brazil, Russia, India, China and South Africa, the top players in BRICS.

That is the real story. The west, and other fool nations like Vietnam and Japan who followed their lead are finished.

Once you get over 100% of debt to GDP, every cent that comes in is already spent, and the only way to continue is to build debt.

These numbers are quite different than the ones I found on http://www.usdebtclock.org, but the story is the same…………….all of the EU, Japan and the US are mired in debt.

I am again reminded what FDR’s Federal Reserve Chairman, M. Eckles said in 1952 when asked what caused the great crash of 1929:

“As in a poker game, as the chips get concentrated in fewer and fewer hands, the other fellows can only stay in the game by borrowing. When their credit ran out, the game stopped.”

I just keep wondering how long they can keep the balls they juggle each day in the air………..they will fight to the death to keep Greece because when one ball falls, all the others follow.

Excuse me, I now see on the more detailed list that it does include the weak link in BRICS, China. China lies about everything, they have been hurting badly since the west is no longer gobbling up Chinese junk exports. China relied far too much on the consumption level of the west. Now, that much of the fool consumption is over, they resort to lying about their export level. Even when the countries to which they claim to have exported deny their numbers, the Chinese continue to lie……….