– A Furious Italian Prime Minister Slams Deutsche Bank As Europe’s Most Insolvent Bank:

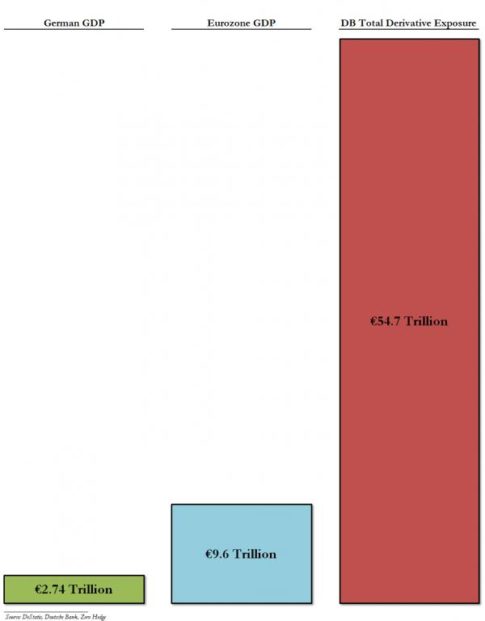

Several years ago, we were the first to point out the true “elephant in the room”, namely Deutsche Bank’s $75 trillion in derivatives which as we said at the time was about 20 times bigger than Germany’s GDP, and 5 times bigger than the entire economic output of the Eurozone.”

This was largely ignored by the “experts” because why bring attention to something which is fundamentally a devastating break in the narrative that “Europe is fine” and the financial crisis is now contained.

Fast forward to today when Europe is once again not fine, only this time one can’t blame Europe’s problems on Greece (instead the same “experts” are trying to blame everything in Brexit), when in a surprising admission of reality, none other than Italy’s prime minister Matteo Renzi, “went there” and slammed Deutsche Bank as the true “derivative problem” facing Europe.

To be sure, Renzi has his own problems, chief among which is how to pass a banking bail out of his insolvent banks without implementing the dreaded bail in mechanism unveiled in 2016 as the only permitted European bank resolution mechanism. Alas, in his push to bail out rather than bail in Italian banks, Renzi has faced stiff resistance from the Germans, namely Angela Merkel and Wolfgang Schauble who have both strongly opined against this kind of backtracking. Just today, Wolfgang Schaeuble, speaking at a news conference in Berlin (just hours after Italy hinted once again at an imminent bailout of Monte Paschi), said his Italian counterpart Pier Carlo Padoan told him that Italy intends to stick to the banking-union rules. Perhaps not.

So it is not surprising that when faced with stiff resistance from the Germans, Renzi decided to call a spade a spade when, as Reuters reports, he said that the difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives.

One look at the chart above and it becomes clear just who he was referring to.

As Reuters adds, speaking at a joint news conference with Swedish Prime Minister Stefan Lofven, Renzi said other European banks had much bigger problems than their Italian counterparts.

“If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred,” Renzi said

So just like that the Mutually Assured Destruction doctrine is activated, because now that Deutsche Bank’s dirty laundry has been exposed for all to see, Renzi’s gambit is clear: if Merkel does not relent on bailing out Italian banks, the collapse of Italian banks will assure the failure of Deutsche Bank in kind. And since in a fallout scenario of that magnitude DB’s derivative would not net out, there will be no chance to save the German banking giant, bail out, in, or sideways.

And now the ball is in Germany’s court: to be sure, traders everywhere will be curious to see just how this diplomatic escalation in which the fingerpointing at insolvent banks is only just beginning concludes, and most of all, they will follow every word out of Merkel’s mouth to see if the Chancellor will relent and give in to what is the first tacit case of financial – and factual – blackmail.

Ironically, even the best possible outcome, namely another bailout of every insolvent European bank, will merely accelerate the same populist anger that catalyzed the Brexit-driven schism in the first place, and lead to even more anger at what will, inevitably, be yet another banker bailout until ultimately the war of words between the classes becomes all too literal.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Renzi is right saying that. It is Italy together with Deutsche bank at the moment. Maybe cracking down the EU will start in Germany which is not expected