– This Is The End: Venezuela Runs Out Of Money To Print New Money:

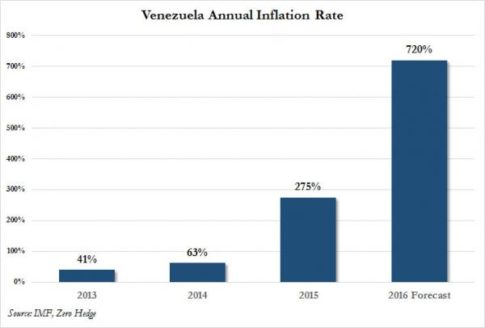

Back in February, when we commented on the unprecedented hyperinflation about the be unleashed in the Latin American country whose president just announced that he would expand the “weekend” for public workers to 5 days…

… we joked that it is unclear just where the country will find all the paper banknotes it needs for all its new physical currency. After all, central-bank data shows Venezuela more than doubled the supply of 100-, 50- and 2-bolivar notes in 2015 as it doubled monetary liquidity including bank deposits. Supply has grown even as Venezuela has fewer U.S. dollars to support new bolivars, a result of falling oil prices.

This question, as morbidly amusing as it may have been to us if not the local population, became particularly poignant recently when for the first time, one US Dollar could purchase more than 1000 Venezuela Bolivars on the black market (to be exact, it buys 1,127 as of today).

And then, as if on cue the WSJ responded: “millions of pounds of provisions, stuffed into three-dozen 747 cargo planes, arrived here from countries around the world in recent months to service Venezuela’s crippled economy. But instead of food and medicine, the planes carried another resource that often runs scarce here: bills of Venezuela’s currency, the bolivar.

The shipments were part of the import of at least five billion bank notes that President Nicolás Maduro’s administration authorized over the latter half of 2015 as the government boosts the supply of the country’s increasingly worthless currency, according to seven people familiar with the deals.

More planes were coming: in December, the central bank began secret negotiations to order 10 billion more bills which would effectively double the amount of cash in circulation. That order alone is well above the eight billion notes the U.S. Federal Reserve and the European Central Bank each print annually—dollars and euros that unlike bolivars are used world-wide.

Where things got even more ridiculous for the government where the largest bill in denomination is 100 Bolivars, is how much physical currency it needed, and the cost to print it:

The high cost of the printing binge is an especially heavy burden as Venezuela reels from the oil-price collapse and 17 years of free-spending socialist rule that have left state finances in shambles.

Most countries around the world have outsourced bank-note printing to private companies that can provide sophisticated anticounterfeiting technologies like watermarks and security strips. What drives Venezuela’s orders is the sheer volume and urgency of its currency needs.

The central bank’s own printing presses in the industrial city of Maracay don’t have enough security paper and metal to print more than a small portion of the country’s bills, the people familiar with the matter said. Their difficulties stem from the same dollar shortages that have plagued Venezuela’s centralized economy, as the Maduro administration struggles to pay for imports of everything, including cancer medication, toilet paper and insect repellent to battle the mosquito-borne Zika virus.

Wait a minute, why not just print a single 100,000,000 Bolivar note instead of one million 100 bolivar bills? After all the savings on the printing, let along the air freight, to the already insolvent country will be tremendous and allow it to pretend it is not a failed nation for at least a few more days? It is here that the sheer brilliance of the rulers of this socialist paradise shines through:

Currency experts say the logistical challenges of importing and storing massive quantities of bank notes underscore an undeniable truth: Venezuela is spending a lot more than it needs because the government hasn’t printed a higher-denomination bank note—revealing a misplaced fear, analysts say, that doing so would implicitly acknowledge high inflation the government publicly denies.

“Big bills do not cause inflation. Big bills are the result of inflation,” said Owen W. Linzmayer, a San Francisco-based bank-note expert and author who catalogs world currencies. “Larger bills can actually save money for the central bank because instead of having to replace 10 deteriorated notes, you only need five or one,” he said.

The Venezuelan central bank’s latest orders have been exclusively only for 100- and 50-bolivar notes, according to the seven people familiar with the deals, because 20s, 10s, 5s and 2s are worth less than the production cost.

Mr. Maduro and his allies say galloping consumer prices reflect a capitalist conspiracy to destabilize the government.

Well, no, but at this point one may as well sit back and laugh at the idiocy of it all. But at least we will give Maduro one thing: he has done away with the pretense that when push comes to shove, the state and the central bank (and thus commercial banks) are two different things: “the president in late December changed a law to give himself full control over the central bank, stripping congressional oversight just as his political opponents took control of the National Assembly for the first time in 17 years.”

Sadly, that did nothing for the imploding economy and country, whose morgues are now overflowing due to rampant social violence.

Of course, the punchline of all the above means that Venezuela has to buy bolivars from abroad at any cost. “It’s easy money for a lot of these companies,” one of the people with details on the negotiations said.

The problem is that it is “very difficult money” for Venezuela which needs to pay in hard dollars to print its rapidly devaluing domestic currency. In fact, among the sources of funds to purchase its own money was the liquidation of its gold reserves, which as we reported recently, Venezuela has been quietly selling to willing offshore buyers.

* * *

All of this brings us to today’s latest update in the sad story of Venezuela’s terminal collapse: today Bloomberg wrote a story that basically covers everything said above, noting that “Venezuela’s epic shortages are nothing new at this point. No diapers or car parts or aspirin — it’s all been well documented. But now the country is at risk of running out of money itself.”

Indeed, as we hinted three months ago, “Venezuela, in other words, is now so broke that it may not have enough money to pay for its money.”

Among the new information revealed by Bloomberg is that last month, De La Rue, the world’s largest currency maker, sent a letter to the central bank complaining that it was owed $71 million and would inform its shareholders if the money were not forthcoming. The letter was leaked to a Venezuelan news website and confirmed by Bloomberg News.

“It’s an unprecedented case in history that a country with such high inflation cannot get new bills,” said Jose Guerra, an opposition law maker and former director of economic research at the central bank. Late last year, the central bank ordered more than 10 billion bank notes, surpassing the 7.6 billion the U.S. Federal Reserve requested this year for an economy many times the size of Venezuela’s.

Venezuela had prudently diversified its money printing relationships, and ahead of the 2015 congressional elections, the central bank tapped the U.K.’s De La Rue, France’s Oberthur Fiduciaire and Germany’s Giesecke & Devrient to bring in some 2.6 billion notes, Bloomberg adds. Before the delivery was completed, the bank approached the companies directly for more. De La Rue took the lion’s share of the 3-billion-note order and enlisted the Ottawa-based Canadian Bank Note Company to ensure it could meet a tight end-of-year deadline.

As we reported four months ago, the cash arrived in dozens of 747 jets and chartered planes. Under cover of security forces and snipers, it was transferred to armored caravans where it was spirited to the central bank in dead of night.

But while Venezuela was already planning its future cash orders, the cash vendors were starting to get worried. According to company documents, De La Rue began experiencing delays in payment as early as June. Similarly, the bank was slow to pay Giesecke & Devrient and Oberthur Fiduciaire. So when the tender was offered, the government only received about 3.3 billion in bids, bank documents show.

Which led to an interesting phenomenon: when it comes to counterparty risk, one usually has in mind digital funds or electronic securities. In this case, however, the counterparty risk involved cold, hard cash: “Initially, your eyes grow as big as dish plates,” said one person familiar with matter. “An order big enough to fill your factory for a year, but do you want to completely expose yourself to a country as risky as Venezuela?”

As Venezuela’s full implosion emerges, the answer has now become obvious, and companies are backing away. With its traditional partners now unenthusiastic about taking on new business, the central bank is in negotiations with others, including Russia’s Goznack, and has a contract with Boston-based Crane Currency, according to documents and industry sources.

We expect these last ditch efforts to obtain much needed paper currency for the hyperinflating nation will break down shortly, forcing Venezuela into one of two choices: do away with cash entirely and resort to barter, or begin printing high-denomination bills which in turn will only facilitate even faster hyperinflation as there will be no actual physical limit on how much something can cost; as of right now the very physical limit is how many 100 bolivar bills one can put on a wheelbarrow.

Steve Hanke, a professor of applied economics at Johns Hopkins University, who has studied hyperinflation for decades, says that to maintain faith in the currency when prices spiral, governments often add zeros to bank notes rather than flood the market.

“It’s a very bad sign to see people running around with wheelbarrows full of money to buy a hot dog,” he said. “Even the cash economy starts breaking down.”

In Venezuela’s case it is sadly too late.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

It is so easy to criticise Socialism and justify undermining it if it interferes with global Capitalism and the raping of nations on behalf of the Global Corporations.

The principle of Socialism is that the countr’s assets are for the benefit of the people, to be generated at a pace dictated by the people.

This flies in the face of the greed based global corporate profit machine which we can all see destroying society through minimum wages and lousy employment terms.

A mixed economy has always worked. Milton Friedman’s principles are destructive for society and mankind. Richard Dowthwaite’s principles calling for no need for the Bankster illusion of growth, is THE way forward.

http://www.paulcraigroberts.org/2016/05/02/washington-brings-regime-change-to-venezuela-paul-craig-roberts/