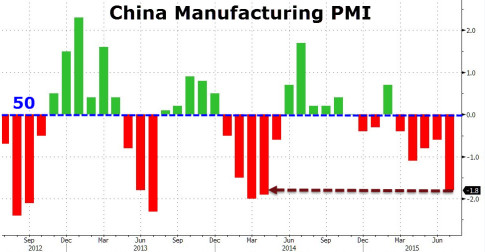

– Gold “Flash-Crashes” Again Amid Continued Commodity Liquidation As China Manufacturing Slumps To 15-Month Lows (ZeroHedge, July 23, 2015):

As Bridgewater talks back its now widely discussed bearish position on fallout from China’s equity market collapse, Chinese stocks rose at the open (before fading after ugly manufacturing data). However, liquidations continue across the commodity complex in copper, gold, and silver. Though not on the scale to Sunday night’s collapse, the China open brought another ‘flash-crash’ in precious metals. All signs point to CCFD unwinds, and forced liquidations as under the surface something smells rotten in China, which has just been confirmed by the lowest Manufacturing PMI print in 15 months.

Gold flash crashed…

As we noted previously, while the actual selling reason was irrelevant, the target was clear: to breach the $1080 gold price which also happens to be the multi-decade channel support level.

As liquidations across the metals complex continue..

Scotiabank’s Guy Haselmann noted earlier…the plunging of the commodity complex is telling us that the China economy could be imploding.

Problems stemming from China are spreading further into more sectors and markets (various high yield sectors, emerging markets, EM and commodity currencies).

As I wrote in my note Tuesday (Too Much of Everything), Zero interest rates have contributed to over-production, pressuring consumer prices lower. Certainly, borrowing in the energy sector contributed to the over-supply of oil and look what has happened in that sector. Now, weakening demand from China is accelerating the decent in most commodities. Budgets of EM supplier-countries and commodity exporters are being materially impacted.

As commodities fall, the FOMC says that inflation targets are harder to obtain, leading to a self-perpetuating belief that continued cheap money is needed.

Yet, claims fell to the lowest level since 1973, housing is strong, and auto sales are back to almost 17mm units (etc). Clearly, the Fed has gotten itself into a difficult position. By not lifting-off and taking their medicine in 2014 – market imbalances today are now bigger and the consequences greater.

China is unfolding as the most important story of 2015 for markets. Stay alert. Long-dated US Treasuries remain attractive and good place to hid.

* * *

It seems Guy may be on to something as Manufacturing just collapsed in China…

All that stimulus, all those “measures” and Chinese manufacturing collapses at the fastest rate in 15 months; and it appears bad news is bad news still in China…

Charts: Bloomberg

Of course China’s mfg is slumping…………..their economy is nearly 100% export based. The US, Euro, Japanese and other economies are all in a long term depression, regardless of the lies of US media. The world economy never recovered from the Crash of 2008 caused by Wall Street greedy guts and an amoral legal system that replaced the once sterling US markets.

It has cost the US greatly, it has lost all respect, prestige and positive world opinion. The world has since moved away from the US, even going with an electronic currency that replaces the world reserve currency status…….started by Hugo Chavez in 2005, with his introduction of the Sucre, it quickly spread throughout Russia, China, India, Brazil, much of South and Central America, now it is even used in Canada……Loss of world reserve status has cost the US much economic clout.

Europeans know how to cut back in hard times, and they stopped shopping. The US consumer, though less desirous of doing so is now being forced by economic necessity. Japan stopped after Fukushima ground their economy to a halt in 2011. What isn’t widely publicized about Japan is the fact many of their MFG goods have been rejected and returned by other nations due to high radioactive content. Their economy has gone from the largest saving and lending nation in the world to one that now has debt to GDP approaching 60%…..in 4 1/2 years from zero, that is a huge hike.

The US is in trouble. Job losses continue at hundreds of thousands a month. Right now 93.6 million working age Americans suffer with long term unemployment. Last month, I went to the census website and figured out the total number of working age Americans…..it is a bit over 200 million.

93.6 million out of 200 million tells me the real unemployment is closer to 50% than the 5.3% lauded by this mendacious government. Do the fools truly believe their lies will defeat the truth? One thing I have learned about reality….it is implacable, and nothing can hold it at bay for long…..even US government statistical lies.

So, no surprise the Chinese economy is grinding to a halt, regardless of all the government arm twisting and absurd laws outlawing a market crash……Their market base has declined, and continues to fall……