– China Increases Gold Holdings By 57% “In One Month” In First Official Update Since 2009 (ZeroHedge, July 17, 2015):

Back in April we wrote that “The Mystery Of China’s Gold Holdings Is Coming To An End” as a result of China willingness to add the Yuan to the IMF’s SDR currency basket which would require the disclosure of China’s gold holding ahead of an IMF meeting on SDR composition which may be held in October.

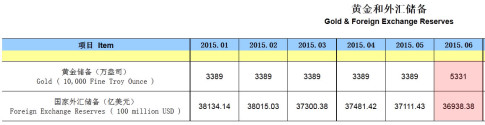

By way of background, the reason why everyone has been so focused on Chinese official gold holdings is that there has been no official update to the gold inventory of the world’s biggest nation, which have been fixed at 33.89 million oz since April 2009, a little over 1000 tons. In other words, the PBOC’s gold inventory has been “unchanged” for over 6 years which is in stark contrast to the ravenous buying of physical gold China has been engaging in for the past 5 years.

As we further noted in April, “with China disclosing so little about its hoard, finding out how much the central bank has in its vaults is of increasing interest to traders. Confirmation of bigger holdings would signal the importance of the metal as a reserve asset and boost market sentiment, TD Securities’ Melek said. At a time when prices are languishing, the buying could give support, said Suki Cooper, director of commodities at Barclays Plc in New York.”

In a rare comment on gold, Yi Gang, the central bank’s deputy governor, said in March 2013 that the country could only invest as much as 2 percent of its foreign-exchange holdings in gold because the market was too small. The press office of the People’s Bank of China in Beijing didn’t respond to a fax seeking comment sent on April 14.

Well, the long awaited moment has finally arrived and this morning, after a 6 year delay when, China finally admitted that it had been misrepresenting its gold holdings for a very long time, when it announced that its gold holdings had increased from 38.89 million to 53.31 million troy ounces, a 57% increase “in one month.”

The amounts to a new grand total of 1658 metric tons, an increase of 604 tons from the 1054 reported last in 2009 and which according to the PBOC was also the May 2015 total.

What is surprising about this release are three things:

First, while we welcome some long overdue “transparency”, the number is well below official expectations. This is what Bloomberg said previously: “The People’s Bank of China may have tripled holdings of bullion since it last updated them in April 2009, to 3,510 metric tons, says Bloomberg Intelligence, based on trade data, domestic output and China Gold Association figures. A stockpile that big would be second only to the 8,133.5 tons in the U.S.”

Second, China has finally admitted that its official gold numbers were fabricated (alongside all other official data released from the communist country) as it is impossible the PBOC could have bought 600 tons of gold in the open market in June when the price of the yellow metal actually dropped by 2%.

Third, and perhaps most important, is the reasoning behind the increase. While in April it was expected that China will be focused on SDR acceptance of the Yuan, that was subsequently refuted when it became clear that the IMF has no intention of making such a decision any time soon. So why make the disclosure?

- PBOC SAYS GOLD RESERVE INCREASE AIMS TO ENSURE SECURITY

And from the PBOC:

Gold as a special asset, with multiple attributes financial and commodities, together with other assets to help regulate and optimize the overall risk-return characteristics of international reserves portfolio. From the perspective of long-term and strategic perspective, if necessary, dynamically adjusted international reserves portfolio allocation, safety, liquidity and increasing the value of international reserve assets.

In other words, China had to wait until its stock market was crashing to present the “systemic stability” bazooka: gold.

Because in revealing a surge in its gold holdings, the PBOC is hoping to finally provide that final missing link that will boost investor sentiment, and get people buying stocks all over again.

And now that the seal has been finally broken after so many years, and since today’s update indicates that Chinese gold numbers are clearly goal-seeked with a specific policy purpose – to boost confidence – we await for the PBOC to start leaking incremental gold holding data every month (and especially in months when the market crashes) which will bring us ever closer to what China’s true gold holdings are.

* * *

The SAFE’s full accompanying Q&A statement with reporters on its latest reserves is below (google translated):

People’s Bank of China, the State Administration of Foreign Exchange, the official answered reporters’ questions on China’s total foreign debts, foreign exchange reserves, gold reserves, etc.

To further enhance the quality and transparency of foreign data, fully reflects the outcome of the internationalization of RMB recently, People’s Bank of China, the State Administration of Foreign Exchange SDDS according to IMF data (SDDS) announced the country’s foreign exchange reserves, gold reserves, and other data, corresponding adjustment of the caliber of external debt data, published a full-bore renminbi debt, including the debt included. People’s Bank of China, the State Administration of Foreign Exchange person in charge of related issues answered reporters’ questions.

First, what SDDS is?

A: SDDS namely IMF (IMF) Special Data Dissemination Standard of, is an international standard on countries’ economic and financial statistics published by IMF enacted in 1996, the English name Special Data Dissemination Standard, referred to as the SDDS.

In order to improve the transparency of the Member States of macroeconomic statistics, IMF has developed GDDS (GDDS) and Special Data Dissemination Standard (SDDS) two sets of data dissemination standards. Both the overall framework basically the same, but in actuality, SDDS for data coverage, publication frequency, timeliness released, data quality, and other aspects of the public can get more demanding. SDDS the countries need to adopt in accordance with the requirements of the standard, published data of the real economy, fiscal, monetary, foreign and socio-demographic and other five sectors.

Currently, there are 73 economies adopted SDDS, including all developed economies, as well as Russia, India, Brazil, South Africa and other major emerging market countries. GDDS country had been announced by macroeconomic data.

Second, why should the adoption of SDDS?

A: With the deepening of economic globalization, improve data quality, make up the data gaps and enhance data comparability and enhance data transparency become a consensus. China’s proactive response and internationally accepted data standards initiative, in November 2014, the Chairman Xi Jinping at the G20 summit in Brisbane officially announced that China will adopt the IMF Special Data Dissemination Standard (SDDS). After a series of technical preparations, the current standard conditions according to SDDS data published ripe.

Adopted SDDS, in line with our needs further reform and expand opening-up, help to improve the transparency of macroeconomic statistics, reliability and international comparability, promote the improvement of statistical methods; to further find out the macroeconomic real situation, as the country’s macroeconomic provide the basis for decision-making to prevent and defuse financial risks; conducive to China’s active participation in global economic cooperation, enhance the international community and public confidence in the domestic economy.

Three , according to the SDDS reserves data released specifically what?

A: The foreign exchange reserves, according to data released SDDS carried out, including the “official reserve assets” and “International Reserves and Foreign Currency Liquidity Data Template” in two parts. “Official Reserve Assets” includes the foreign exchange reserves, IMF reserve positions and special drawing rights (SDR), gold, other reserve assets of five projects, including “reserves” This project corresponds to the size of our country’s foreign exchange reserves in the past announced ; “International Reserves and Foreign Currency Liquidity Data Template” includes four tables of official reserve assets and other foreign currency assets, the predetermined short-term net outflow of foreign currency assets and foreign currency assets or net outflow of short-term, memos.

On the publishing frequency, two pieces of data are released monthly, including “official reserve assets” not later than the seventh day of general release of the data at the beginning of each month on month, “International Reserves and Foreign Currency Liquidity Data Template” general release in the end of each month data. Since this is the first release, we have also released two pieces of data, to facilitate your control, according to the corresponding time in the future will be published separately requirements.

On statistical methods, in full accordance with IMF to carry out uniform standards relevant statistics.

Fourth, the comparative size of foreign exchange reserves in the past released the recently released data which points?

A: There are three main aspects:

- (1) This announcement is fully consistent with the country’s reserves of foreign exchange reserves in the past announced the size of caliber. The size of our country’s foreign exchange reserves in the past has been published in accordance with the relevant methods and standards of statistics in SDDS. As of the end of June 2015, China’s foreign exchange reserves of $ 3.69 trillion.

- (2) new released other foreign currency assets. As of the end of June 2015, the Bank of other foreign currency assets of $ 232.9 billion.

- (3) adjusted by the size of its gold reserves. As of the end of June 2015, the scale of China’s gold reserves to 53.32 million ounces (equivalent to 1,658 tons).

Five , gold reserves according to data released this time, compared with the scale of China’s gold reserves since the end of April 2009 increased by 604 tons. Why should our holdings of gold reserves?

A: The gold reserve has been an important element of international reserve diversification countries constituted the majority of the central bank’s international reserves have gold, country as well. Gold as a special asset, with multiple attributes financial and commodities, together with other assets to help regulate and optimize the overall risk-return characteristics of international reserves portfolio. From the perspective of long-term and strategic perspective, if necessary, dynamically adjusted international reserves portfolio allocation, safety, liquidity and increasing the value of international reserve assets.

Six , in recent years, international gold prices volatile, the current round of holdings of gold reserves is at what time what channel from holdings? Whether the future will continue to overweight?

A: With the prices of other commodities and financial assets, the international gold prices also ebb. Over the past few years, gold prices continued to rise to a record high, the gradual decline. Our asset-based valuation and price changes for gold analysis, under the premise of impact and influence in the right markets, at home and abroad through a variety of channels, this part of the gradual accumulation of gold reserves. Overweight channels including domestic miscellaneous gold purification, production Shouzhu, domestic and foreign market transactions and other means.

Gold has a special risk-return characteristics, at a particular time is a good investment products. But the capacity of the gold market is small compared with the scale of China’s foreign exchange reserves, if a large number of short-term foreign exchange reserves to buy gold, easily affect the market. At present, China has become the world’s largest gold producer, is also a big consumer of gold, “hidden gold to the people,” the situation has been happening. The need to continue and consider the future of private investment demand and international reserve asset allocation, flexible operation.