– The Greek Bluff In All Its Glory: Presenting The Grexit “Falling Dominoes” (ZeroHedge, July 4, 2015):

Earlier today, Yanis Varoufakis reiterated his core thesis driving the entire Greek approach from day 1 of its negotiations with the Eurogroup: “Europe [stands] to lose as much as Athens if the country is forced from the euro after a referendum on Sunday on bailout terms.”

This is merely a recap of what we said 4 years ago when in July of 2011 we explained “How Euro Bailout #2 Could Cost Up To 56% Of German GDP“, recall:

the bottom line is that for an enlarged EFSF (which is what its blank check expansion today provided) to be effective, it will need to cover Italy and Belgium. As AB says, “its firepower would have to rise to €1.45trn backed by a total of €1.7trn guarantees.” And here is where the whole premise breaks down, if not from a financial standpoint, then certainly from a political one: “As the guarantees of the periphery including Italy are worthless, the Guarantee Germany would have to provide rises to €790bn or 32% of GDP.” That’s right: by not monetizing European debt on its books, the ECB has effectively left Germany holding the bag to the entire European bailout via the blank check SPV. The cost if things go wrong: a third of the country economic output, and the worst case scenario: a depression the likes of which Germany has not seen since the 1920-30s. Oh, and if France gets downgraded, Germany’s pro rata share of funding the EFSF jumps to a mindboggling €1.385 trillion, or 56% of German GDP!

Several years later, in anticipation of precisely the predicament Europe finds itself today, the ECB did begin to monetize European debt, which has since become the biggest European risk-shock absorber of all, and the one which the ECB is literally betting the bank on: just count the number of times the ECB has sworn it has the tools and can offset any Greek risk contagion simply by buying bonds.

Unfortunately, it is not that simple.

The reason is precisely in the contagion threat inherent in Europe’s alphabet soup of bailout mechanism as we explained four years ago in the post above, and as Carl Weinberg of High-Frequency Economics did hours ago in today’s edition of Barrons. Here is how the Greek contagion would spread, laid out in all its simplicity, should there be a Grexit, an outcome which the ECB could catalyze as soon as Monday in case of a “No” vote by raising ELA collateral haircuts:

The [Greek] government appears ready to renege on its debt obligations. So Greece’s creditors are going to lose money—a lot of money. Since these creditors are public entities, the losses will be borne, initially, by the public.

This crisis is about managing the resolution of bad Greek assets in a way that inconveniences creditor governments the least, forcing the least net new public borrowing, and minimizing financial system risks. The best way to do that is to avert a hard default, even if it means kicking the can down the road.

That, once again, is the Varoufakis all-in gamble, a gamble which assumes the ECB will be rational enough (in a game theory context) to appreciate the fallout of a Grexit on Europe’s creditors. Here is a qualitative determination:

Consider the ESM, Greece’s biggest creditor. Under its previous name, the European Financial Stability Facility, it loaned Greece €145 billion. If Greece defaults, the ESM, a Luxembourg corporation owned by the 19 European Monetary Union governments, will have to declare loans to Greece as nonperforming within 120 days. Accounting rules and regulators insist that financial institutions write off nonperforming assets in full, charging losses against reserves and hitting capital.

Here’s the rub: The ESM has no loan-loss contingency reserves. Its only assets—other than loans to Greece—are loans to Ireland and Portugal. Its liabilities are triple A-rated bonds sold to the public. How do you get a triple-A rating on a bond backed entirely by loans to junk-rated sovereign borrowers? Well, the governments guarantee the bonds, and because they are unfunded off-balance-sheet liabilities, they aren’t counted in their debt burdens—unless borrowers default.

If Greece defaults hard, governments will be on the hook for €145 billion in guarantees on those loans to the ESM. We expect credit-rating agencies to insist that these unfunded guarantees be funded. After all, unfunded guarantees are worthless guarantees.

And the punchline:

The strength of these guarantees is untested. Would the German Bundestag vote tomorrow to raise €35 billion by selling Bunds, the government debt, to cover Germany’s share of ESM losses on Greek bonds? That seems improbable. Bund sales of that scale, if they did occur, would flood the market, raising yields and depressing prices. If, instead, the Bundestag refused to cover its guarantees, then we would see a legal dust-up on a grand scale. With the presumption of valid guarantees, credit raters would have no choice but to downgrade ESM paper. Then losses would be borne by bondholders, and the ESM—the euro zone’s safety net and backstop—couldn’t raise money in the capital markets.

In other words, Grexit would usher in a pandemonium of unheard proportions because when the ESM, EFSF and countless other bailout mechanism were postulated, none even for a minute evaluated the scenario that is being flouted with ease, and, paradoxically, by the ECB itself most of all: an ECB which stands to lose the most…

A hard default would produce other losses to be covered. The ECB would have to be recapitalized after it writes off the €89 billion it has loaned the Greek banks to keep them liquid. The ECB would need to call for a capital contribution from its shareholders—the governments.

… not to mention any last shred of confidence it may have had.

But wait, there’s more:

And don’t forget that Greek banks owe the Target2 bank clearinghouse, a key link in the interbank payment system, an estimated €100 billion. The governments are on the hook to make good that shortfall, too. The cash required to cover these contingencies would have to be funded with new bond sales.

The conclusion is incidentally, identical to what Zero Hedge said back in the summer of 2011: “the ultimate loser in a Greek default would be the euro-zone sovereign-bond market, which is already vulnerable. ” The only difference is that this time, yields are near all-time lows, and durations are high. Ironically, even the smallest fluctuations in yield mean a volatile response in prices, and an immediate crippling of the bond market. Perhaps most ironic is that Europe’s bond market is far less prepared to deal with Greek contagion now than when Italian bonds were blowing out and trading at 7%, just because everyone has double down and gone all-in that the ECB can contain the contagion. If it can’t, it’s very much game over.

This is what Varoufakis’ likewise all-in gamble on the future of Greece boils down to.

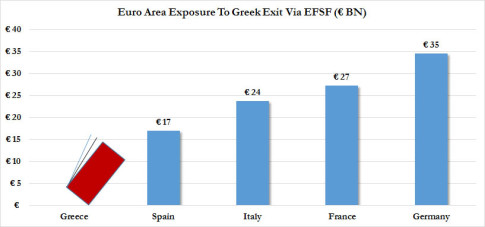

And just so we have numbers to work with, here courtesy of Bawerk’s fantastic summary, is a way to quantify what a Grexit and the resultant falling dominoes would look like for Europe:

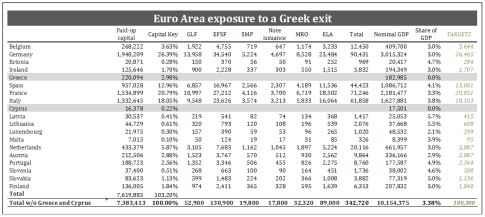

Simplistic representation of falling dominos not enough? Then here is the full breakdown of implicit exposure every Euro Area country has toward a Greek exit, because it is not just the EFSF dominoes, it is also SMP, MRO, ELA, Target2, and oh my…

And tying it all together, here is some more from “Eugen von Böhm-Bawerk“:

The Germans, French and IMF alike reluctantly admit so much, but they cannot give the Greeks any debt relief because as soon as Greece starts to default on their obligations on the off-balance sheet guarantees extended by the euro countries the whole system could fall like dominoes.

The paradox, however, is that the IMF already did admit that Greece does not a haircut, implying that at least one member of the grand status quo, under pressure form the US, has already gotten the tap on the shoulder and has been told to prepare for the falling dominoes. Which leads to even more question:

What would happen if Italy suddenly got an extra funding requirement of more than €60bn? Every euro apologist point to Italy’s primary surplus, but what good does that do when your debt is over 130 per cent of GDP and rising? The interest payment on that gargantuan debt load means Italy must cough up more than €75bn a year just to service liabilities already incurred. A primary surplus is a useless concept in a situation like the one Italy finds itself in. Adding another €60bn to Italy’s balance sheet could very well be the straw that breaks the Italian camel.

The French would be on the hook for around €70bn just when they have agreed with the European Commission to “slash” spending to get within the Maastricht goal of 3 per cent, in 2017!

Imagine the German peoples wrath when they learn that Merkel defied their sacrosanct constitution; a constitution that clearly state that the German people, through its Bundestag, is the sole arbiter of any act that have fiscal implications regarding the German people. The Bundestag did not approve the €42bn of ECB programs that have funded the Greek states excessive consumption.

All this is purely theoretical. For the practical implications of the above “falling domino” chain, we go back to Carl Weinberg:

What if a downgrade of ESM paper causes a hedge fund to fail, which triggers the demise of the bank that handles its trades? The costs of fixing failed institutions will also, of course, fall on governments. The ultimate cost of Greece’s default is yet to be seen, but it is surely larger than it seems.

Contained? We think not. And neither does Varoufakis, which is why he is willing to bet the fate of the Greek people on that most critical of assumptions. The only outstanding question is what does Mario Draghi, and thus Goldman Sachs, believe, and even more importantly, whether the Greek people have enough faith in Varoufakis to pull it off…

The IMF, Germany, France, Italy and Spain are the four major debt holders of Greek debt. These four nations hold/guarantee 98% of it. All have debt to GDP in triple digits, every cent that comes in already owed elsewhere. Spain and Italy nearly collapsed a while back…..the idea of any of them underwriting the majority of Greek debt is financial suicide. The leaders of all these countries, and of the IMF all ought to be canned.

None of them have the money. As Greek defaults on the IMF, it exposes the fact the IMF is an empty shell, along with Germany and the other nations. If the other nations run into trouble, German citizens get saddled with all their debt…..any and everyone but the greedy guts who promoted this financial madness. All over the Euro, the people are being set up….it is criminal.

The only product sold on Wall Street, the Euro Stock market and obviously China……is debt. They package and promote debt that promises a rate of return, and they insist they are assets. In fact, they are debt.They sell mortgages, auto loans, credit card debt, business loans, everything but anything of substance. Stock in any company (even ones like Tesla) are debt….and greedy guts have taken it to new highs.

Greece’s default has finally shined a light on the truth, and now the cats are out of the bag. There is no way to turn it off now, investors all over the world are now paying close attention.

It affects Germany, France, Italy, Spain, the IMF, the US, and the rest of the Euro…..We are on the precipice of another real estate contraction. Mortgage rates are going up ruthlessly, thousands of homeowners are dealing with rising monthly payments they can no longer afford. This is reflected in the record rate of margin calls that are being ignored, a record high number letting their debt ridden stock go rather than miss a house payment……

Millions were urged to go for ARMs, the interest rates were amazingly low since the turn of the century. Greenspan said consumers could save thousands by the difference in payments between 1% and 4% required by fixed rate loans. Many fell for it, he was considered a financial genius instead of a crook.

Now, no ARM mortgage holder can get a conversion to a fixed rate loan. Jumbo ARMs are approaching 7%, others are heading for 6%. Fixed rate for perfect credit approaching 5%. The FED rate for greedy gut banks remain incredibly low, while the rest of us are being hit from all sides.

Our dollar is dramatically falling in value every week. Food, drinking water, supplies, insurance, housing, vehicles…..everything is going up sharply. Drinking water has gone from $1 a gallon to $1.50 in the last week. I could go on with an endless list of examples.

Regardless of the “strong dollar” as defined by the moneychangers, our currency is deflating in value; the ensuing inflation one result of it.

We are on the precipice of a sharp slide, and Greece has given us a small push, enough to start us, and now, there is nothing that can stop us.