– Moody’s “Junks” Russia, Expects Deep Recession In 2015 (ZeroHedge, Feb 20, 2015):

Having put Russia on review in mid-January, Moody’s has decided (somewhat unsurprisingly) to downgrade Russia’s sovereign debt rating to Ba1 (from Baa3) with continuing negative outlook. The reasons:

- *MOODY’S SAYS RUSSIA EXPECTED TO HAVE DEEP RECESSION IN ’15, CONTINUED CONTRACTION IN ’16

- *MOODY’S SEE RUSSIA DEBT METRICS LIKELY DETERIORATING COMING YRS

We assume the low external debt, considerable reserves, lack of exposure to US Treasuries, and major gold backing were not considered useful? Moody’s concludes the full statement (below) by noting that they are unlikely to raise Russian sovereign debt rating in the near-term.

* * *

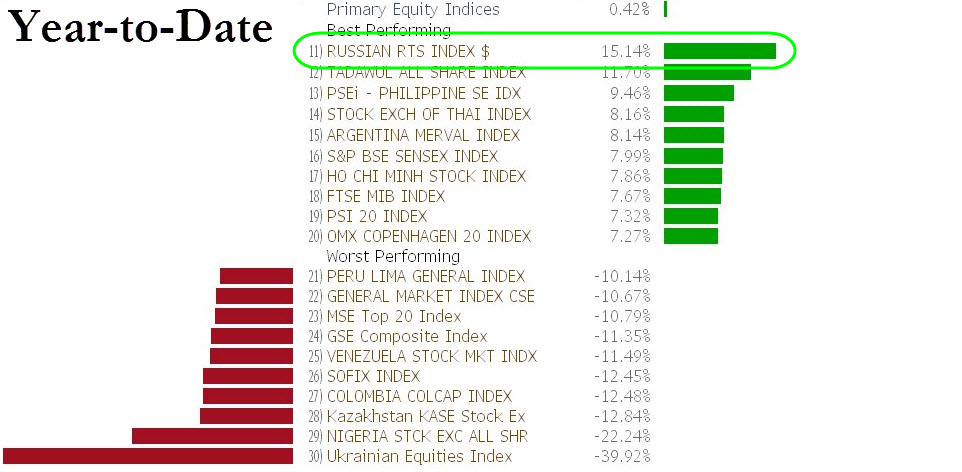

Kind of ironic then that Russia is the best performing stock market in the world this year!!

* * *

Full Moody’s Statement:

Moody’s Investors Service has today downgraded the government of Russia’s sovereign debt rating to Ba1/Not Prime (NP) from Baa3/Prime-3 (P-3). The rating outlook is negative. This rating action concludes the review for downgrade that commenced on January 16, 2015.

Moody’s downgrade of Russia’s government bond rating to Ba1 is driven by the following factors:

(1) The continuing crisis in Ukraine and the recent oil price and exchange rate shocks will further undermine Russia’s economic strength and medium-term growth prospects, despite the fiscal and monetary policy responses;

(2) The government’s financial strength will diminish materially as a result of fiscal pressures and the continued erosion of Russia’s foreign exchange (FX) reserves in light of ongoing capital outflows and restricted access to international capital markets;

(3) The risk is rising, although still very low, that the international response to the military conflict in Ukraine triggers a decision by the Russian authorities that directly or indirectly undermines timely payments on external debt service.

The assignment of the negative outlook reflects the potential for more severe political or economic shocks to emerge, related either to the military conflict in Ukraine or a renewed decline in oil prices, which would further impair Russia’s public and external finances.

In a related decision, Moody’s has lowered Russia’s country ceilings for foreign currency debt to Ba1/NP from Baa3/P-3; its country ceilings for local currency debt and deposits to Baa3 from Baa2; and its country ceiling for foreign currency bank deposits to Ba2/NP from Ba1/NP. A country ceiling generally indicates the highest rating level that any issuer domiciled in that country can attain for instruments of that type and currency denomination.

RATINGS RATIONALE

RATIONALE FOR THE DOWNGRADE TO Ba1

FIRST DRIVER — IMPAIRED PROSPECTS FOR RUSSIA’S ECONOMY

The first driver for the downgrade of Russia’s government bond rating to Ba1 relates to the effects of the ongoing crisis in Ukraine, as well as the fall in oil prices and of the ruble exchange rate on the country’s economic strength and financial stability.

In Moody’s view, the existing and potential future international sanctions, the erosion of the country’s foreign exchange buffers and persistently lower oil prices plus high and rising inflation will take a negative toll on incomes as well as business and consumer confidence. As a result, Russia is expected to experience a deep recession in 2015 and a continued contraction in 2016. The decline in confidence is likely to constrain domestic demand and exacerbate the Russian economy’s already chronic underinvestment.

It is unlikely that the impact of recent events will be transitory. The crisis in Ukraine continues. While the fall in the oil price and the exchange rate have reversed somewhat since the start of the year, the impact on inflation, confidence and growth is likely to be sustained.

The authorities’ policy response is gradually coalescing. However, policymakers confront a multi-faceted dilemma characterized by a falling exchange rate, sizeable capital outflows, declining economic activity and rising inflation. In Moody’s view policymakers are unlikely to be able to resolve these policy tensions in order to reverse the economic decline.

The monetary authorities face the conflicting objectives of keeping interest rates high enough to restrain the exchange rate and bring down inflation and keeping rates low enough to reinvigorate economic growth and bank solvency. While the interest rate cut in January coincided with a rise in oil prices that cushioned the otherwise negative initial reaction of the exchange rate, a too-rapid reduction in interest rates risks further currency depreciation and higher inflation, which would further compress domestic purchasing power and extend and/or deepen the economic downturn.

Meanwhile, the authorities’ revamped fiscal strategy will attempt to consolidate the budget to achieve balanced budgets at the lower oil prices and devalued exchange rates that now prevail. Details of this strategy will be made public in coming months. However, Moody’s believes that financial conditions in Russia are inherently vulnerable to renewed volatility, which would in turn trigger fresh capital flight and further downward pressure on the exchange rate and the balance of payments.

As a consequence, Moody’s believes that the government will face substantial difficulty in dealing with the wide range of economic, fiscal and monetary challenges that the country is facing.

SECOND DRIVER — FURTHER EROSION OF FISCAL STRENGTH AND FX RESERVES

The second driver for the downgrade of Russia’s government bond rating to Ba1 is the expected further erosion of Russia’s fiscal strength and foreign exchange buffers. As the rating agency noted in January when initiating its review for downgrade, the government’s ability to sustain its fiscal and financial strength was the main factor supporting Russia’s investment grade rating. Following the review, Moody’s expects further deterioration in the government’s financial strength despite the authorities’ fiscal policy responses.

Taking at face value the government’s plans to proceed with its planned fiscal consolidation for 2015, Moody’s expects a consolidated government deficit of approximately RUB1.6 trillion (2% of GDP) as well as a widening of the non-oil deficit. The deficit would likely be financed by drawing on the Reserve Fund, which is specifically designed for circumstances when oil prices fall below budgeted levels. Moody’s also expects that widespread demands for fiscal easing are likely to emerge if, as the rating agency projects, the recession persists into 2016. In a scenario in which the government would turn to borrowing in the domestic market to finance at least a share of these deficits, higher spending could result in an increase of the debt-to-GDP ratio to 20% or more.

In the rating agency’s view, therefore, the government’s debt metrics are likely to deteriorate over the coming years, albeit from low levels. Low debt and robust external buffers have been the key factors sustaining the rating in investment grade until now, given the country’s relatively lower economic and institutional strength and higher exposure to event risk than Baa-rated sovereigns.

Moreover, under the stress exerted by a shrinking economy, wider budget deficits and continued capital flight — in part reflecting the impact of the Ukraine crisis on investor and depositor confidence — and restricted access to international capital markets, Moody’s expects that the central bank’s and government’s FX assets will likely decrease significantly again this year, cutting the sovereign’s reserves by more than half compared to their year-end 2014 level of approximately USD330 billion.

In a more adverse but not unimaginable scenario, which assumes smaller current account surpluses and substantially larger capital outflows than in Moody’s baseline forecast, FX reserves including both government savings funds would be further depleted. While the government might choose to mobilise some form of capital controls to impede the outflow of capital and reserves, such tools are not without consequences. Capital controls, which might include a rationing of retail deposit withdrawals and/or prohibition upon repatriation of foreign investment capital, would weaken the investment climate further and undermine confidence in the banking system.

THIRD DRIVER — UNPREDICTABLE POLITICAL DYNAMICS

The third driver for the downgrade of Russia’s government bond rating to Ba1 relates to the very low but rising risk that the international response to the conflict in Ukraine triggers a decision by the Russian authorities that directly or indirectly undermines timely payments on external debt service.

Moody’s acknowledges the current and prospective efforts by the country’s policymakers to contain the economic and financial consequences of the many challenges they face: the Ukraine crisis as well as the collapse in global oil prices and the ruble exchange rate. However, the sovereign faces predicaments that few would have predicted six months to a year ago, and the government’s reaction to a possible escalation of these challenges is difficult to foresee. In Moody’s view, the risk of policy decisions being taken that pose a threat to the repayment of Russian debt obligations remains very low, but that risk is rising.

RATIONALE FOR THE NEGATIVE OUTLOOK

The negative outlook on the Ba1 rating reflects Moody’s view that the balance of economic, financial and political risks in Russia is slanted to the downside, with scenarios incorporating either an escalation of the Ukraine crisis and/or damage caused by recent shocks being greater than in Moody’s baseline scenario. Essentially, the probabilities associated with the downside scenarios are higher than those associated with an upside scenario in which the recession is shorter and shallower than Moody’s baseline.

For example, it seems more likely that Russia will face additional sanctions than that current sanctions are lifted in the coming months. The associated economic risks are also biased to the downside. Similarly, the likelihood of a further shock to confidence, with associated capital outflows and damage to investment and consumption intentions, seems greater than that of a return of confidence and a cessation of capital outflows or a material resumption of inflows.

WHAT COULD CHANGE THE RATING UP/DOWN

Moody’s is unlikely to upgrade Russia’s sovereign debt rating in the near term given the negative outlook. However, Moody’s would consider stabilizing the outlook on the Russian government rating if the macro-economic and financial market conditions were to stabilize, if the risks of financial market volatility were to subside, and/or if there was a serious prospect of the Ukraine crisis being resolved in such a way that the risk of ongoing or escalating military hostilities and further sanctions were to dissipate.

Moody’s would consider downgrading Russia’s government bond rating if the macroeconomic and financial market conditions were to deteriorate substantially below the rating agency’s base case, or were the government to water down or abandon its fiscal and structural reform plans. The rating agency might also downgrade if the military conflict were to escalate and result in the introduction of additional sanctions that further undermine the country’s economic strength. Finally, actions that create greater uncertainty around the government’s capacity or willingness to continue to service its debt would also likely result in a downgrade.

GDP per capita (PPP basis, US$): 24,298 (2013 Actual) (also known as Per Capita Income)

Real GDP growth (% change): 1.3% (2013 Actual) (also known as GDP Growth)

Inflation Rate (CPI, % change Dec/Dec): 6.5% (2013 Actual)

Gen. Gov. Financial Balance/GDP: -1.3% (2013 Actual) (also known as Fiscal Balance)

Current Account Balance/GDP: 1.6% (2013 Actual) (also known as External Balance)

External debt/GDP: 35.1% (2013 Actual)

Level of economic development: Moderate level of economic resilience

Default history: At least one default event (on bonds and/or loans) has been recorded since 1983.

On 17 February 2015, a rating committee was called to discuss the rating of the Russia, Government of. The main points raised during the discussion were: The issuer’s economic fundamentals, including its economic strength, have materially decreased. The issuer’s fiscal or financial strength, including its debt profile, has materially decreased. The issuer has become increasingly susceptible to event risks.

They are lying, as usual. They wish Russia were in the same position the US is in….but they are not. Go to USdebtclock.org, and click on World. Look at US debt to GDP to Russia’s.

US debt is now 100% of GDP

Russia: 33% debt to GDP.

Where would you put your money?

Even if they are lying, it won’t matter as nobody pays any notice, nor gives it any credence.

Furthermore, a quick glance at their reasoning shows it is based more on jew propaganda and politics than anything else, yet ignores the fact that all bullish garbage about western prospects are based on the same crap…..doh!