– Greece Gambles On “Catastrophic Armageddon” For Europe, Warns It “Only Has Weeks Of Cash Left” (ZeroHedge, Feb 7, 2015):

One of the bigger problems facing the new, upstart Greek government, which has set before itself the lofty goal of overturning 6 years of oppressive European policies and countless generations of Greek cronyism, corruption and tax-evasion is not so much the concern about deposit outflows and bank runs – even though it most certainly will be in the next few days unless the Tsipras government finds some resolution to the dramatic standoff with Merkel and the ECB – but something far more trivial: running out of money.

Recall that two weeks into the Greek elections, Greece was rocked by a dire, if entirely underappreciated development, when its already “tax-paying challenged” population decided to completely hold off paying any taxes in advance hopes that the Tsipras government will “overturn” austerity. We wrote:

… while there will be no official confirmation whether Greece did or did not have a bank run for months, unless of course some bank keels over and dies in the interim, one thing is certain: with an increasing probability they may not have a “continuity-promoting” government in less than two weeks, Greeks tax remittances to the government, which were almost non-existent to begin with, have ground to a halt!

According to a second Kathimerini report, budget revenues have slumped over the last few days as a result of the upcoming elections and taxpayers’ uncertainty about the future: “Most taxpayers have chosen to delay their payments, given that the positions of the two main parties leading the election polls are diametrically opposite: Poll leader SYRIZA promises to cancel the ENFIA and even write off bad loans, while ruling New Democracy acknowledges the difficulties but is avoiding raising issues that would generate problems and fiscal consequences.

The dwindling state revenues will not only hamper the next government’s fiscal moves, but, given that the fiscal gap will expand, also negotiations with the country’s creditors.

The tax collection mechanism appears to be largely out of action while expired debts are swelling due to taxpayers’ wait-and-see tactics and the reduction in inspections.

So for battered, depressed Europe “austerity” really meant “taxation” – it is no surprise then why so many in peripheral Europe, who for the past 7 years have not seen any benefits from Germany’s delay in reintroducing the Deutsche Mark (and keeping its export industry humming, and Deutsche Bank solvent, courtesy of the much lower Euro), hate “austerity” so much: after all there really should be no “austerity” without representation and most European voices hardly matter in a monetary “Union” where only bankers and unelected eurocrats are heard.

But going back to the main topic, namely the Greek liquidity situation, it was none other than the Eurogroup which late on Friday gave Greece a 10 day ultimatum to cede all demands and resume work under the Bailout program, or face a liquidity collapse and effective expulsion from the Eurozone. Which means suddenly Europe is engaged in the biggest bluff since 2012, as Greece and Europe both desperately try to outbluff each other that the “adversary” need it more than vice versa.

The problem is that Greece may not even have 10 days. As the WSJ reports, “Greece warned it was on course to run out of money within weeks if it doesn’t gain access to additional funds, effectively daring Germany and its other European creditors to let it fail and stumble out of the euro.”

Greek Economy Minister George Stathakis said in an interview with The Wall Street Journal that a recent drop in tax revenue and other government income had pushed the country’s finances to the brink of collapse.

“We will have liquidity problems in March if taxes don’t improve,” Mr. Stathakis said. “Then we’ll see how harsh Europe is.”

As we reported last month, “Government revenue has declined sharply in recent weeks, as Greeks with unpaid tax bills hold back from settling arrears, hoping the new leftist government will cut them a better deal. Many also aren’t paying an unpopular property tax that their new leaders campaigned against. Tax revenue dropped 7%, or about €1.5 billion ($1.7 billion), in December from November and likely fell by a similar percentage in January, the minister said. Other senior Greek officials said the country would have trouble paying pensions and other charges beyond February.”

Said otherwise, when Yanis Varoufakis responded to Europe that “Greece already is bankrupt” he knew exactly what he was talking about.

And as the WSJ further details, this means that the infamous ultimatum on Greece may have been set by none other than Greece itself!

Greece has made no secret of its precarious financial position, but the minister’s comments suggest the country has even less time than many policy makers thought to resolve its standoff with Europe.

Eurozone officials have asked Greece to come up with a specific funding plan by Wednesday, when finance ministers have called a special meeting to discuss the country’s financial situation.

The country needs €4 billion to €5 billion to tide it over until June, by which time it hopes to negotiate a broader deal with creditors, Mr. Stathakis said, adding that he believes “logic will prevail.” If it doesn’t, he warned, Greece “will be the first country to go bankrupt over €5 billion.”

What happens then: “If the Greek government runs out of cash, the country would be forced to default on its debts and reintroduce its own currency, thus abandoning the euro. Most of the €240 billion in aid that Europe and the International Monetary Fund have pumped into the country would be lost.”

Of course, Greece knows all this. The bigger question is what does a Grexit mean for Europe. Recall it was in May 2012, just around the time of the second Greek bailout, that Charles Dallara, who as head of the International Institute of Finance (IIF) spent months in Athens negotiating the largest ever sovereign debt restructuring, said that “the damage to the rest of Europe from Greece leaving the euro would be “somewhere between catastrophic and Armageddon.”

“I think that it (a Greek exit) is possible, but I wouldn’t call it inevitable and I wouldn’t even call it likely because the costs for Greece, for Europe and for the global economy are likely each in their own way to be immense.”

“The pressures on Spain, Portugal, even Italy and conceivably Ireland could be immense and the need for Europe to step up with much greater support for the banking systems would be substantial.”

If that isn’t enough here is what Willem Buiter predicted:

As soon as Greece has exited, we expect the markets will focus on the country or countries most likely to exit next from the euro area. Any non-captive/financially sophisticated owner of a deposit account in that country (or in those countries) will withdraw his deposits from banks in countries deemed at risk – even a small risk – of exit. Any non-captive depositor who fears a non-zero risk of the future introduction of a New Escudo, a New Punt, a New Peseta or a New Lira (to name but the most obvious candidates) would withdraw his deposits from the countries involved at the drop of a hat and deposit them in the handful of countries likely to remain in the euro area no matter what – Germany, Luxembourg, the Netherlands, Austria and Finland.

The funding strike and deposit run out of the periphery euro area member states (defined very broadly), would create financial havoc and mostly like cause a financial crisis followed by a deep recession in the euro area broad periphery.

…

A banking crisis in the euro area and in the EU would most likely result from an exit by Greece from the euro area. The fundamental financial and real economy linkages from the rest of the world to the euro area and the rest of the EU are strong enough to make this a global concern.

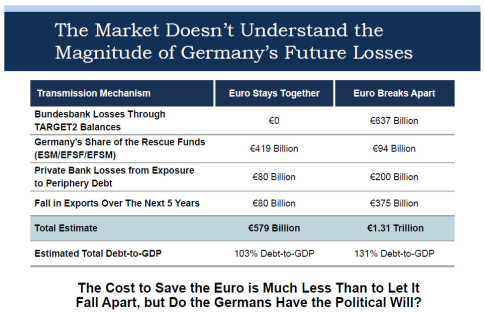

And of course, there was Carmel’s presentation from the summer of 2012, comparing the costs to Germany from a Euro staying together versus falling apart:

That is precisely the gambit the Greece is playing right now: in fact, that is the only gambit it has left – one final gamble that kicking Greece out of the Eurozone will have far more devastating consequences on the Eurozone, where not only is the ever-persistent threat of deposit bank run from the periphery one flashing red headline away, but where one after another anti-European party, from Spain’s Podemos to Marine Le Pen’s surge in France, are ascendent and may seek to recreate the Greek example unless Germany steps in in the last minute and concedes the Greek demands.

The problem is that as Merkel understands very well, should she concede to Greece, then she would be expected to concede to Italy, and Spain, and Portugal, and Ireland, and anyone else who came knocking at her door with a loaded gun and threatening to commit suicide. The WSJ picks up on this as well:

Europe wants Athens to commit to further labor-market and other reforms as a precondition for more money. The new government is refusing, arguing that it was elected to turn back many of the painful measures Europe and other creditors have demanded of it.

Berlin worries that the eurozone would lose leverage over Athens if it gives into its request for an interim loan. Without a binding agreement from Greece to continue its reform program, officials say Germany is unlikely to back down.

Berlin, which is counting on financial pressures to force the Greek government’s hand, believes time is on Germany’s side.

And for now, it is correct: “Those pressures are being felt across Greece’s economy. Its banks lost €8 billion to €10 billion in deposits in January alone, government officials say. The banking system’s woes were exacerbated by the ECB’s decision earlier in the week to no longer accept Greek government bonds as collateral from banks seeking funds.”

As Zero Hedge pointed out several times last week, both the ECB, the Eurogroup and even S&P, are no longer concerned about starting a bank run in Greece, as this would be the surest way to crush support for the new Greek government and force it to the negotiating table with its tale between its legs. Furthermore, in order to avoid giving the Greeks the satisfaction that their strong-arm policy is working, the central banks have done everything in their power to keep stock markets afloat and levitating this week, to avoid giving the impression that anyone in the world is concerned about contagion side-effects should Greece in fact exit the Eurozone. Or as we put it:

ECB leverage measured in Greek ATM lines; Greek leverage measured inversely in the level of the Stoxx 50

— zerohedge (@zerohedge) February 5, 2015

This strategy may, however, backfire and result in even more support for the government which unlike its predecessors who were perceived merely as Europe’s lackey muppets, refuses to concede to Merkel, which is a distinct risk for the German chancellor:

Germany’s strong-arm strategy carries substantial risk. In addition to possibly triggering Greece’s exit from the euro, it carries political overtones.

Many Europeans already view Germany as the continent’s unyielding paymaster. Refusing to compromise with Greece’s new government over a few billion euros would further cement that image and open Berlin to accusations that it is ignoring Greece’s plight and riding roughshod over the democratic process.

Such resentments could fuel Europe’s other ascendant anti-austerity movements, particularly in Spain, where the Podemos party, modeled on Greece’s governing leftists, has recently surged in the polls.

And that’s the gamble in a nutshell: Greece has already bluffed with everything it has (even raising the specter that it will cooperate with Russia if Europe kicks it out, giving Putin a foothold on the continent) while Europe desperately pretends that Charles Dallara’s warning from less than three years ago is no longer relevant and that a Grexit is not only neither “catastrophic” nor “Armageddon“, but instead is welcome and perfectly normal.

We should know who will crack first as soon as this week, just before or during the Eurogroup emergency meeting on February 11, although Greece already appears to be regretting its liquidity shortfall threat, as Reuters reported earlier today it “will not face any cash crunch while negotiations with its euro zone partners on a new programme to roll back austerity take place, its deputy finance minister said on Saturday. “During the time span of the negotiations there is no problem (of liquidity). This does not mean that there will be a problem afterwards,” Deputy Finance Minister Dimitris Mardas said on Mega TV. “Asked whether state coffers may encounter a cash crunch if talks drag on until May, the minister said he did not expect the negotiations over a new deal to last that long.”

Indeed, if Greek negotiations fail, read if the bluff does not succeed, by May Greek state coffers will likely be getting funding from Beijing and or Moscow. Which then begs the question: has Greece indeed lost everything, allowing it to be finally free to do anything?

Additional reading: Game theory and euro breakup risk premium

Greece will have to regard itself as much like France after the Revolution. Leaders will have to work for very little, people will have to kick in what they can to keep things going, but only after the Euro is officially out. Staying in the Euro zone only sets them, their children and grandchildren in unrealistic debt forever. They need to leave, follow the lead of Iceland, and throw the damn bankers out.

BRICS and Russia have offered them food and financial assistance once they leave the Euro. If they don’t leave the Euro, poverty and debt will destroy them.

If they are smart, they will do it officially, and stop playing two sides against the middle. If they are that greedy and stupid, they deserve whatever happens to them. If they meant what they said, the people and the leaders have a chance to regain a place as a nation among nations, nothing more. They entered the Euro using Enron accounting and lies about their true finances, and borrowed a lot of money from Germany to stay in the Euro.

I would venture they need to repay Germany, but tell the greedy bankers and those who would steal their islands and treasures to get lost.

They need to review other nations who have revolted and won the first steps in a new nation………and understand what the role for all will be.

Oh, I forgot to write the last sentence. Since they borrowed from Germany after entering the Euro zone, they owe them because they borrowed under false pretenses. For the rest of the greedy gut debts piled on the entire EU, to hell with the bankers.

By the way, Spain is next, than Portugal, Italy……this is just the beginning.