– Mario Draghi: Charlatan Of The Apparatchiks (David Stockman’s Contra Corner, Jan 22, 2015):

Well, he finally launched “whatever it takes” and that marks an inflection point. Mario Draghi has just proved that the servile apparatchiks who run the world’s major central banks will stop at nothing to appease the truculent gamblers they have unleashed in the casino. And that means there will eventually be a monumental crash landing because the bubble beneficiaries are now commanding the bubble makers.

There is not one rational reason why the ECB should be purchasing $1.24 trillion of existing sovereign bonds and other debt securities during the next 18 months. Forget all the ritual incantation emanating from the central bankers about fighting deflation and stimulating growth. The ECB has launched into a massive bond buying campaign for the sole purpose of redeeming Mario Draghi’s utterly foolish promise to make speculators stupendously rich by the simple act of buying now (and on huge repo leverage, too) what he guaranteed the ECB would be buying latter.

So today’s program amounts to a giant bailout in the form of a big fat central bank “bid” designed to prop up prices in the immense parking lot of French, Italian, Spanish, Portuguese etc. debt that has been accumulated by hedge funds, prop traders and other rank speculators since mid-2012. Never before have so few—-perhaps several thousand banks and funds—-been pleasured with so many hundreds of billions of ill-gotten gain. Robin Hood is spinning madly in his grave.

The claim that euro zone economies are sputtering owing to “low-flation” is just plain ridiculous. For the first time in decades, consumers have been blessed with approximate price stability on a year/year basis, and this fortunate outbreak of honest money is mainly due to the global collapse of oil prices—not some insidious domestic disease called “deflation”. Besides, there is not an iota of proof that real production and wealth increases faster at a 2% CPI inflation rate compared to 1% or 0%.

Nevertheless, Draghi had no problem gumming the following absolute gibberish in announcing that his big monetary bazooka would be soon firing at will on the hapless citizens of the E-19.

Today’s monetary policy decision on additional asset purchases was taken…..(because) the prevailing degree of monetary accommodation was insufficient to adequately address heightened risks of too prolonged a period of low inflation.

This assertion is blatantly contradicted by the facts. Outside of the commodities and industrial materials complex, where prices are being weakened by the rapid cooling of China’s construction madness, it is still”creeping inflation as usual” in the EU-19 economies. There is flat out no emergency that could possibly justify an ECB action which will result in the creation out of thin air of what amounts to fraudulent credit equal to nearly 10% of euro zone GDP in less than two years.

And folks, it is fraudulent credit——really dangerous, toxic stuff. The $1.2 trillion of debt securities to be purchased by the ECB (and its constituent national central banks) in the secondary market originally financed that amount of labor, material and capital consumption. Can you actually pay such massive sums to vendors of real goods and services with central bank manufactured digital credits and still pretend that the economy is functioning on the level? If so, why not manufacture $5 trillion or even $15 trillion of ECB credit and buy up the entire euro bond market?

In short, Draghi is presiding over a gargantuan fraud and can’t be so stupid as not to recognize it. Indeed, the dictionary definition of a “charlatan” could not more aptly describe his current gambit:

“….a person falsely claiming to have a special knowledge or skill; a fraud”.

A few weeks ago, I called out the lame case on which Draghi’s “low-flation” humbuggery is based. Nothing has changed since then—so it is self-evident that the ECB’s new bond buying binge is designed to relieve financial speculators of hot merchandize, not long suffering euro zone citizens of the stone cold economies that their overlords in Brussels and the national capitals have confected.

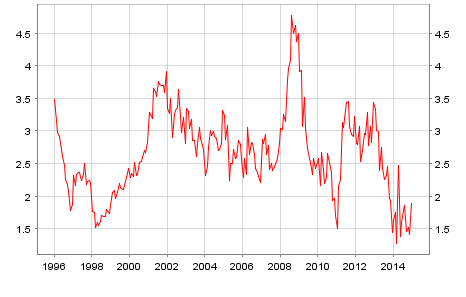

Well, of course the CPI has momentarily weakened. Crude oil has experienced a monumental plunge of more than 50% since mid-2014. That has temporarily dragged down the euro zone’s reported CPI and the math isn’t all that complex. During the last 12 months, euro zone energy prices have fallen by 6.3%, and everything else is still 0.6% higher than a year ago.

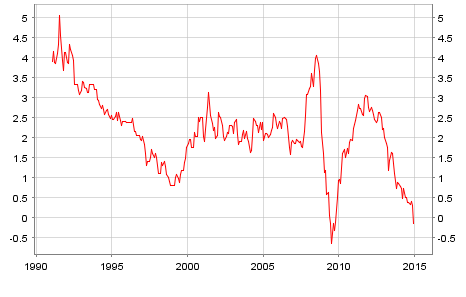

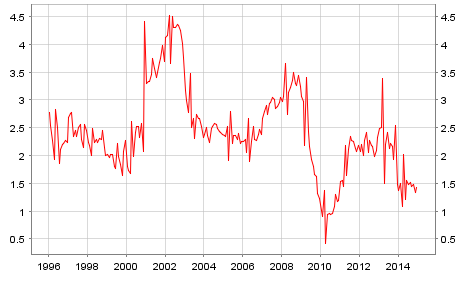

So what’s the emergency? This is the very same CPI blip that occurred when oil collapsed in the second half of 2008. As is evident below, that episode did not generate some cascading plunge into economic darkness. In fact, the Eurozone CPI was back running above 2.5% in no time.

The truth of the matter is that the EU-19 is in clover because it’s consumers get a big break; and, on the other side of the economic equation, it produces almost no oil. Europe’s production is mainly in the UK and Norway and they have their own currencies. Accordingly, the ECB should be putting its printing presses on an extended sabbatical and declaring victory on the achievement of its “price stability” objective.

Indeed, the notion that the hairline puncture of the zero inflation line shown above is a precursor of a deflationary calamity amounts to economic voodoo. There has been no structural change whatsoever in the Eurozone economy since 2008 when the last oil-driven CPI drop occurred, and therefore no empirical basis for the notion that wages and prices are about to descend into an accelerating downward spiral. If anything Brussels’s dirigisme regime has made prices and wages even more “rigid” and “sticky” owing to it’s avalanche of new regulations, subsidies and other economic interventions.

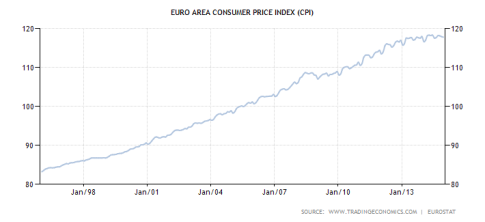

The plain fact is that the euro zone like the rest of the DM has an inflationary bias that is embedded in six decades of history during which the euro and its predecessor currencies lost purchasing power month-in-and-month-out. So households are finally getting what will undoubtedly be a short respite from the inflation tax, but that is the extent of it. There is not one rational reason to believe that the relentless upward march of the price level shown below will not presently resume its well-worn path.

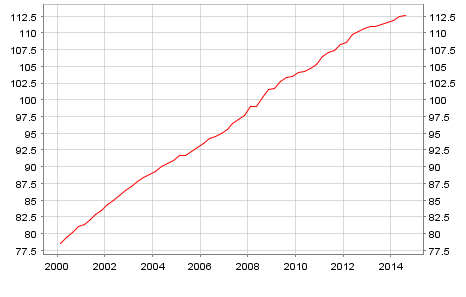

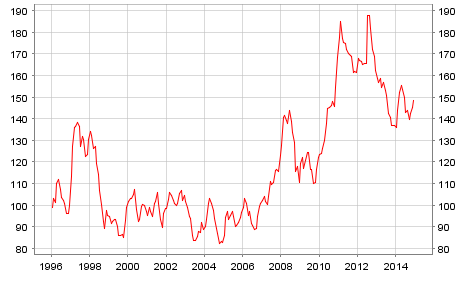

The euro zone deflation story is pure cock and bull, and that proposition doesn’t take much investigation to document. First and foremost, there is no sign of a wage collapse, yet how do you get a deflationary spiral if wages continue to rise?

As shown below, owing to heavy unionization and protectionist labor laws, euro zone wage rates have been on a long-running one-way escalator, and show no sign of “deflation”. Total compensation per worker is up 1.3% during the last twelve months—-an identical rate to the 1.3% recorded during the year before that, and not much below the 1.7% annual rate of gain that has been recorded since mid-2010.

If you take purely euro zone produced items the story is the same. In the case of total services, the December LTM price change is 1.25%—-a figure that has been visited twice before this century without untoward effects.

In the specific case of housing services and rentals, the LTM inflation rate is not much under 2%—-a level which has prevailed for the past several years.

Likewise, the inflation rate for euro zone produced recreation and personal services shows no signs of plunging into the abyss. It’s LTM rate of increase is about 1.5%, and is in the general zone that has prevailed for most of this century.

The same is true of transport services. The index is still rising at a 1.5% rate, and while below the 2.5% trend of the last decade or so, the larger point is self-evident. Isn’t it a good thing for productivity and growth that the euro zone’s inflation rate for transport of people and goods is abating slightly? Where’s the fire?

In short, the euro zone’s momentary spat of year-over-year price stability is almost entirely owing to the global decline of commodities since the China bubble driven peaks of 2012; and also the lagged effect of the Euro’s strength prior to mid-2014.

In the case of non-food commodities including energy, for example, the producer price index is down about 25% from it 2011/12 peak. Since the euro zone imports a heavy share of its energy and industrial commodities, isn’t this decline a welcome development?

And there’s more. Commodity prices are still double their pre-2005 level. In other words, the giant global commodity bubble generated by the runaway credit boom in China, the BRICs and their EM satellites has finally started to cool, and this relief is now washing through the euro zone price indices. Rather than an existential crisis, the cooling of euro zone inflation is mainly a welcome surcease from the utterly aberrational credit bubble that was foisted on the global economy by central banks over the past decade.

Even in the case of food commodities, the sharp decline since 2012 is a menace only to the French farmers, at worst. How can it be said that a 20% reduction in food costs is harming the living standard of 350 million euro zone consumers or is a causing the macro-economy’s chronic underperformance?

Finally, where prices are falling outside of imports, commodities and the processed industrial goods which embody them, this result has nothing to do with short-term monetary policy. The price index for euro zone communications services, for example, is negative 2.5% on an LTM basis—–but that is nothing new. Owing to the communications technology revolution and a modest degree of deregulation, prices in this sector have been falling for the better part of two decades, and its been a boon for economic growth and consumer welfare, too.

In short, the euro zone deflation scare has nothing to do with empirical reality or common sense economics. Instead, it is pure propaganda emanating from the policy apparatchiks in Frankfurt and Brussels, and aped and amplified by the casino’s stock peddlers who claim to be “economists” and “strategists”.

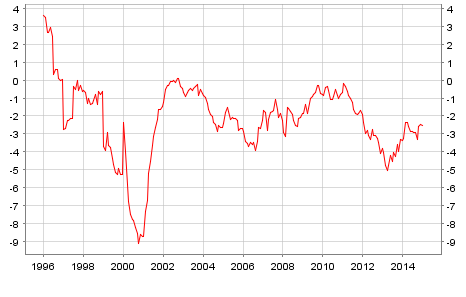

It goes without saying, of course, that the evidence for Draghi’s QE that you can’t find in the inflation curves is screamingly apparent in the bond price curves. They have gone damn near parabolic in the 30 months since Draghi’s “whatever it takes” ukase. The windfall profits which have accrued to riders on the Draghi curve are flat out obscene.

This morning all euro zone sovereign debt is trading at absurdly low yields. Even as Draghi foams at the mouth about the ECB’s determination to get inflation back close to its arbitrary 2% target, the Italian 10-year bond is trading at 1.56%, the Spanish 10-year at 1.42% and the French bond at the nearly insane level of 0.70%. Or as one wag recently noted, European debt yields has not traded this low since the black plague leveled the people and their sovereigns, alike.

Now self-evidently, the speculators who have ridden the Italian bond down from 7% don’t see any contradiction between Draghi’s pledge of 2% inflation come hell or high water and today’s nominal yield of 1.56%. They don’t care, they don’t discount, and they most certainly do not engage in “price discovery”. Instead, they hover with their finger on the “sell” button ready to unload at any moment their vastly over-priced stash on the stupid apparatchiks who run the ECB.

Exactly, the same can be said for the Spanish and French curves below. The fast money traders, of course, do not recognize that Spain’s public debt ratios continue to soar despite the phony “austerity” claimed by the crooks who run its government, and the insurgent anti-austerity political party and Catalonian succession movement that are likely to make it ungovernable in the near future. They just don’t care because there is a patsy in Frankfort ready to relieve their downside risk.

But the most absurd case of price discovery destruction fostered by Draghi’s foolish promise, and now action, is the French 10-year bond yield. French socialism and dirigisme have finally strangled its private economy and sent capital and its best enterprenurial talent scrambling for foreign shores, thereby leaving its bloated public sector—- now at 57% of GDP—-high and dry.

Yes, the above juxtaposition makes all the sense in the world. It is entirely reasonable that a state drifting toward insolvency and/or ruinous taxation should be able to borrow 10-year money at 0.70%. That is, when the fix is in, the central bank printing press is open to buy, the apparatchiks are terrified and one of history’s greatest monetary charlatans is in charge——the speculators have nothing to do but harvest their haul.

So now begins the greatest heist since Bernanke bailed out Wall Street in September 2008.