– China Surpasses India As Biggest Buyer Of Gold Following Record 2013 Imports, Consumption (ZeroHedge, Feb 10, 2014):

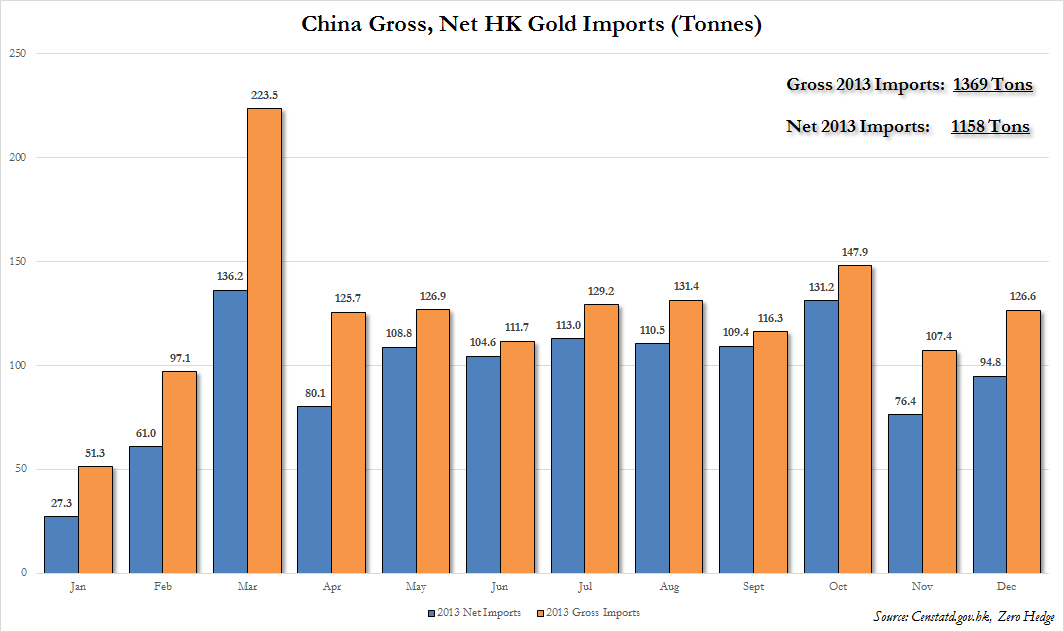

Two weeks ago we learned what many had already known just by extrapolating simple trends: in 2013 Chinese net imports of gold from Hong Kong alone rose to over 1000 tons of gold, or 1158 to be precise – 100 tons more than China’s official gold holdings of 1054 tons which have not “budged” in the past four years – following another significant net monthly import of 94.8 tons of the precious metal in December (and 126.6 gross). This means total gold imports in 2013 was more than double the 557 tons imported in 2012, and as a result China has now officially surpassed India as the world’s biggest buyer of gold (although the title may swing back to India once gold price controls are relaxed, or if the government were to count all the gold smuggled into the country via illegal channels).

As the chart below shows, no matter what the price of paper gold does, the Chinese bid remains unwavering.

Reuters summarizes China’s insatiable apetite for the yellow metal:

China’s gold consumption jumped 41 percent in 2013 to exceed 1,000 tonnes for the first time, an industry body said on Monday, as a sharp slide in prices attracted buyers for jewellery and bullion.

The demand surge has helped China become the No. 1 gold consumer and should support prices, which took a hit last year from expectations of a tapering of commodities-friendly economic stimulus by the U.S. Federal Reserve and a drop in demand in the other major buyer India.

Gold consumption in China grew to 1,176.40 tonnes last year, with jewellery demand climbing 43 percent to 716.50 tonnes and bullion demand soaring 57 percent to 375.73 tonnes, the China Gold Association said on its website.

Chinese demand hit a record as gold prices fell for the first time in 13 years amid an improving global economy and a rally in equities. Prices tumbled 28 percent in 2013.

“The sharply lower prices attracted a lot of Chinese consumers looking for bargains,” said Chen Min, an analyst at Jinrui Futures in Shenzhen.

“Gold will continue to be an attractive investment in China in the near term as prices look steady near $1,200 an ounce,” Chen said.

As a reminder, official gold holdings are not included in these numbers:

China’s gold consumption figures do not include demand from the central bank, whose gold reserves stand at 33.89 million ounces (1,054 tonnes), unchanged since April 2009, according to the latest figures on the central bank’s website.

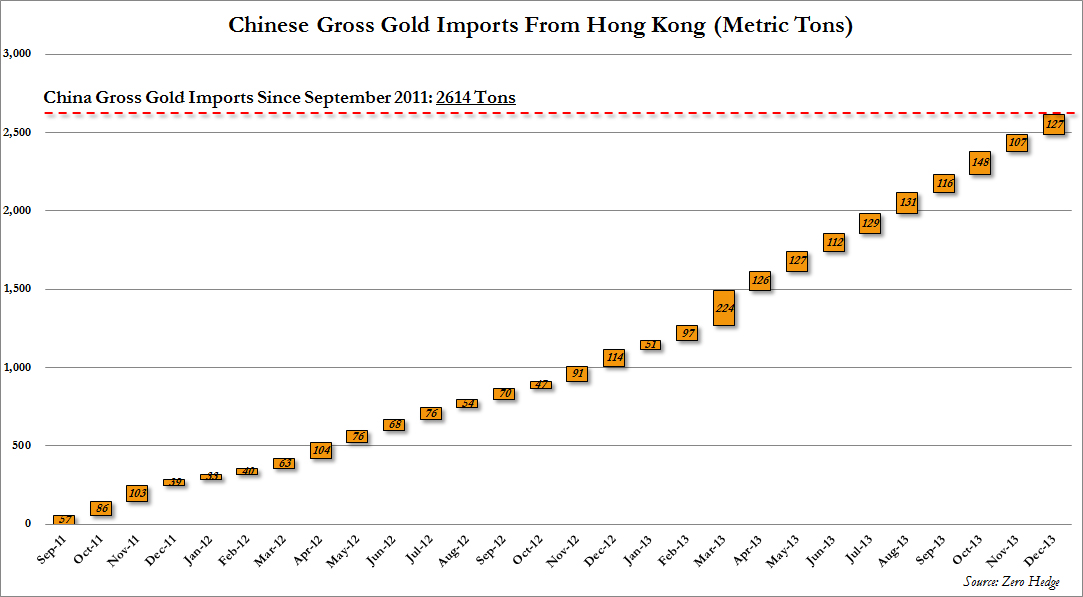

Regarding said PBOC gold holdings, Reuters confirms what our readers have known since September 2011:

China last announced a rise in its gold reserves in April 2009 and has not revised the figure since, though there had been recent market speculation that the bank had been accumulating gold reserves and would announce a new figure.

Of course, we doubt anyone would be surprised by the unveiling of any updated PBOC holdings especially after one considers just how ravenous China’s gross imports since our September 2011 article have been, summarized best by the following chart.

As we have said before: keep an eye on the “gold holdings” of the GLD and other US paper gold ETFs, whose drop in holdings for now has offset Chinese accumulation on the margin. Once GLD gold holdings solidly resume their climb higher, that will be the key upward gold price inflection point.