– Japanese Stocks In Freefall – TOPIX Plunges Almost 5% To 4-Month Lows; Nikkei Down 15% In 2014 (ZeroHedge, Feb 3, 2014):

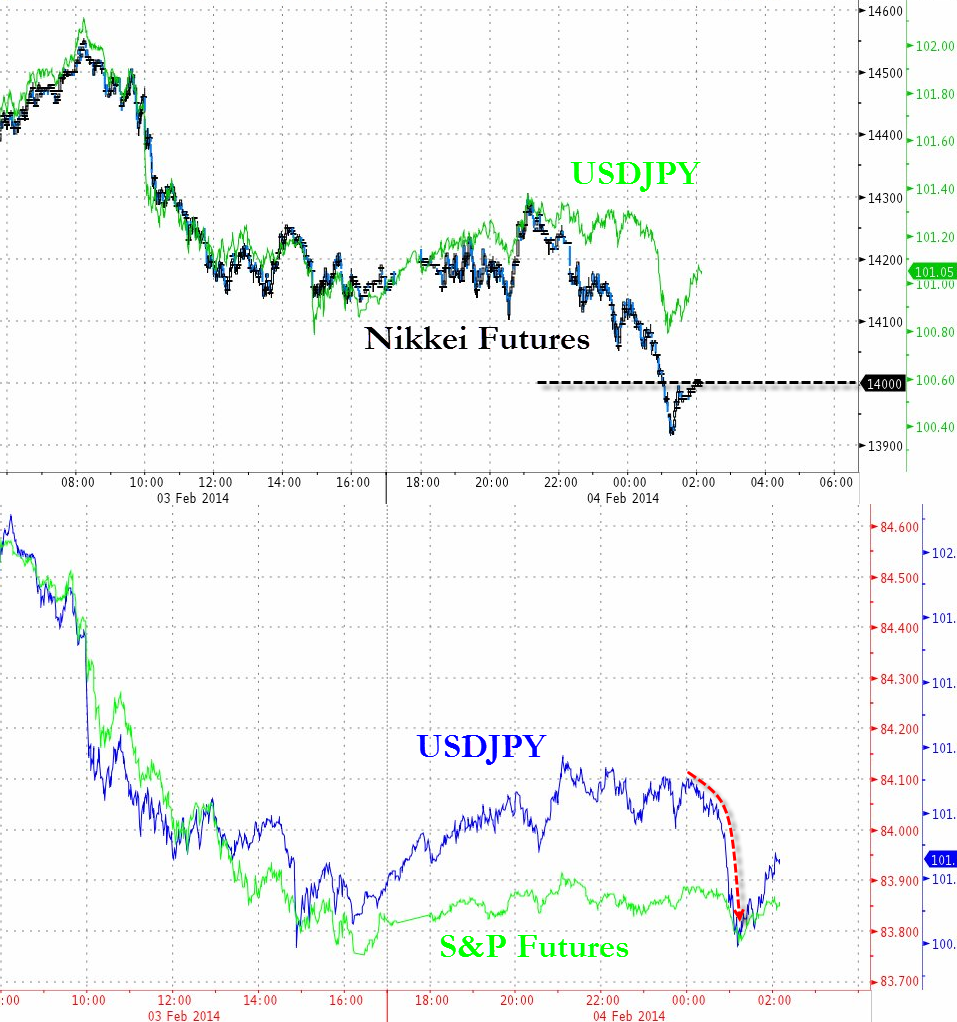

UPDATE: USDJPY has re-tumbled back below 101.00, recoupling with S&P 500 futures from the tried-and-failed attempt to ramp stocks overnight. It seems the short-JPY-driven carry traders have backed away from risk for now, no matter how much the BoJ primes the pump.

Nikkei futures are under 14,000 and down 15% from Dec 31st highs.

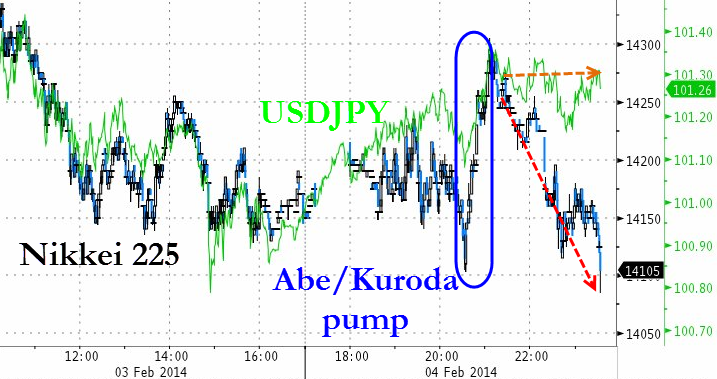

Despite the hope-driven exuberance exhibited immediately post the Abe/Kuroda show, the USDJPY-pumping stock-momentum fest has ended – abruptly. Japan’s Nikkei 225 has lost all its gains and is now trading below US day-session lows (3-month lows) but it is the broader TOPIX index (more akin to the S&P 500) that is collapsing. Down almost 5% on the day (its biggest drop since the May collapse), the TOPIX is at 4-month lows. The TOPIX Real Estate index just hit a bear-market – down 20% from Dec 31st highs. Japanese sell-side shops are in full panic desparation mode as “suggestions” that a sub-14,000 Nikkei will prompt an acceleration of Japan’s QQE money-printing idiocy. This is getting ugly fast.

TOPIX collapses to 4-month lows…

As Bloomberg notes, the sell-side is in full panic mode…

Japan’s central bank will probably boost purchases of ETFs as early as this month if Nikkei 225 drops to about 14,000, Hidenao Miyajima, chief strategist at Parnassus Investment Strategies in Tokyo, says in interview.

But this won’t help as the ramp in USDJPY is not helping…

and The TOPIX Real Estate Index is in Bear market territory – down 20% from Dec 31st highs… and 6 month lows…

Charts: Bloomberg

Fukushima, Fukushima, Fukushima.

It is destroying Japan.

When will they face the truth?

I wish I knew Japanese, the group “New World Order” is trying to bring light to the discussion I believe with this striking video

https://www.youtube.com/watch?v=wkwTPPDNawA

I will look for the lyrics.