– Greenspan #Timestamped – “Dow 16,000 Is Not A Bubble” (ZeroHedge, Nov 27, 2013):

The maestro clarifies his ‘experienced’ perspective of spotting bubbles in the following quote from his interview with Bloomberg TV’s Al Hunt:

“This does not have the characteristics, as far as I’m concerned, of a stock market bubble,”

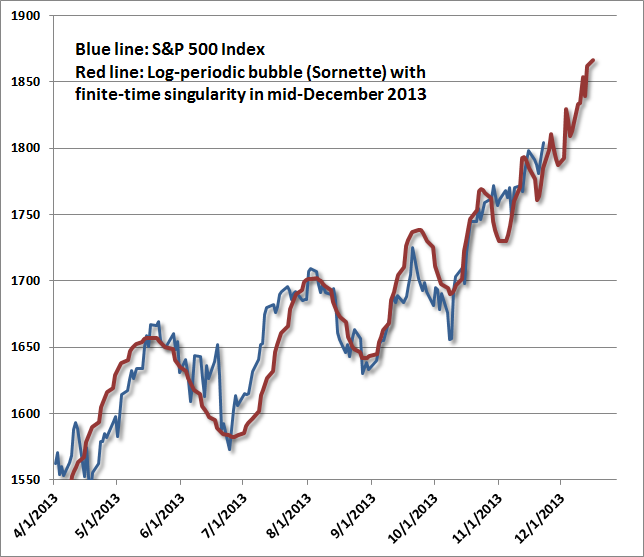

Of course, as we noted here, some would beg to differ; but perhaps what would be useful is for the former Fed head to explain what ‘characteristics’ do constitute a bubble…

Nope, no bubble here…

And here’s his explanation…

“The stock price generally goes up about 7 percent a year for the long term,” Greenspan said. “It didn’t go anywhere since October 2007 and the result of that is we’re just now breaching that. We have had no growth in stock prices for years.”

But as we explained here, there is a reason the Fed can’t see the bubble (aside from not wanting to).

Greenspan is a perfect negative indicator. If he says something is good, prepare for the worst……He was the one pushing all the Mortgage Backed Securities that bankrupted entire nations.

16K looks great. Only problem is the volume. The volume, the number of people playing in the market is a fraction of what it was in 2007. Not only has volume dropped, but 85% of all transactions are bid and skim, where a few individuals buy and sell large amounts of securities in less time than it takes to blink one’s eye. That is skimming, and used to be illegal. Only 15% are actual investors………it is a joke.

Nobody with any sanity can play the market today, unless they are part of the 85% Greedy Gut section. They often get the real numbers before the bell, unlike the rest of us.

It is a total scam.