– Marc Faber Blasts “A Corrupt System That Rewards Stupidity” (ZeroHedge, Oct 11, 2013):

Authored by Marc Faber, originally posted at The Daily Reckoning blog,

For the greater part of human history, leaders who were in a position to exercise power were accountable for their actions. If they waged wars or had to defend their territories from invading hostile forces, they frequently lost their lives, territories, armies, power and crowns. I don’t deny that some leaders were irresponsible, but in general, they were fully aware that they were responsible for their acts and, therefore, they acted responsibly.

The problem we are faced with today is that our political and (frequently) business leaders are not being held responsible for their actions. Thomas Sowell sums it up well:

“It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.”

When political leaders or economic policymakers are seen to fail, the worst that will happen to them is that they won’t be re-elected or reappointed. They then become a lobbyist or an adviser or consultant, and give speeches, earning in the process a high income on top of their pension.

Similarly, many corporate executives and fund managers who have no personal stake in the business that employs them will receive generous pensions even if they fail to do their job properly and are dismissed. (This doesn’t apply to hedge fund managers, most of whose wealth is invested in their funds.) In other words, probably for the first time in history, we have today a system where leaders are not only not punished for their failures, but are actually rewarded…

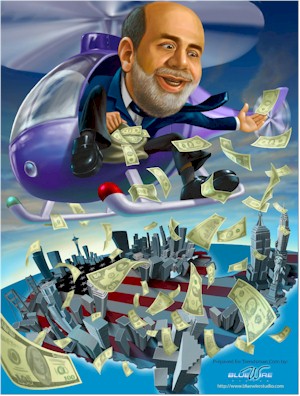

Recently, Warren Buffett said that the Fed was the world’s largest hedge fund. He is wrong. The world’s largest hedge funds are owned by people who are risk takers with their own money, since they are usually the largest investors in their funds. The academics at the Fed are playing with other people’s money.

However, if we consider that the Fed, led by its chairman, is the most powerful organization in the world — because by printing money, it can finance the government (fiscal deficits) and wars, manipulate the cost of money (interest rates), directly intervene in the economy by bailing out failing institutions (banks) or countries (Greece, etc.), intervene in the foreign exchange market and even influence elections — then the question arises whether it makes sense that so much power should be given to Fed members, who are “group thinking” academics and most of whom have never worked in the private sector. In my opinion, the enormous power of the “academic” Fed is a frightening thought. My friend Fred Sheehan recently quoted from Johann Peter Eckermann’s conversation with Goethe, Feb. 1, 1827. We talked about the professors who, after they had found a better theory, still ignored it. From Eckermann and Goethe:

“‘This is not to be wondered at,’ said Goethe; ‘such people continue in error because they are indebted to it for their existence. They would have to learn everything over again, and that would be very inconvenient.’

“‘But,’ said I, ‘how can their experiments prove the truth when the basis for their evaluation is false?’

“‘They do not prove the truth,’ said Goethe, ‘nor is such the intention; the only point with these professors is to prove their own opinion. On this account, they conceal all experiments that would reveal the truth and show their doctrine untenable. Then the scholars — what do they care for truth? They, like the rest, are perfectly satisfied if they can prate away empirically; that is the whole matter.’”

Fortunately, there is an institution that exercises control over the academics at the Fed; it is called the market economy. As I have just explained, the Fed is an immensely powerful organization, but over time, the market economy is a more powerful force that can outsmart the academics because it is adaptive and dynamic. Just consider the following. Since the implementation of QE1 at the end of 2008, money supply has exploded, but the “real” economy has hardly responded.

I know that the neo-Keynesians will argue that the Fed didn’t expand its asset purchases sufficiently. But then, as I’ve mentioned before, Mr. Bernanke opined at a press conference held on Sept. 13, 2012:

“We do think that these policies [QE3] can bring interest rates down — not just Treasury rates, but a whole range of rates, including mortgage rates and rates for corporate bonds and other types of important interest rates.”

And what has happened? Interest rates have increased. According to David Rosenberg, it is actually the fifth-worst sell-off in the 10-year Treasury note since the 1960s. Whereas we can all agree that many factors other than the Fed’s policies have had an impact on the economy (regulation, Obamacare, etc.), it is crystal clear that the Fed’s QE3 and QE4 policies have completely failed in their stated objectives. This is now an instance where the market economy has badly humbled the professors at the Fed.

When the Fed announced QE1 in late 2008, it was clear to me that monetary inflation would lead to some price increases somewhere in the system. My initial thought was that QE1 would boost gold and commodities (in December 2008, oil touched a low of $32 per barrel) as well as equities around the world, which were at the time extremely oversold. But it didn’t cross my mind that money printing would most benefit gaming stocks and the high-end luxury sector of the economy (art, vintage cars, wines, high-end real estate, etc.).

But in hindsight, it is clear that monetary inflation doesn’t flow equally into all sectors of the economy; in the current conditions, it has boosted the wealth and incomes of the most affluent people (unlike in the 1970s, when negative interest rates in real terms boosted wages and consumer prices).

According to the Pew Research Center:

“During the first two years of the nation’s economic recovery, the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%. From 2009-11, the mean wealth of the 8 million households in the more affluent group rose to an estimated $3,173,895 from an estimated $2,476,244, while the mean wealth of the 111 million households in the less affluent group fell to an estimated $133,817 from an estimated $139,896.”

The Pew Research Center further notes:

“The Census Bureau data also indicate that among less-affluent households, fewer directly owned stocks and mutual fund shares in 2011 (13%) than in 2009 (16%), meaning a smaller share enjoyed the fruits of the stock market rally. Likewise, fewer had individual retirement accounts (IRAs) or Keogh accounts (22% in 2011 versus 24% in 2009), and the same share had 401(k) or Thrift Savings Plan accounts (39% in both years).

“Among affluent households, there was also a decline in the share directly owning stock and mutual fund shares during this period (59% in 2011 versus 62% in 2009), but a slight increase in the share with IRAs or Keogh accounts (70% versus 68%) and a larger increase in the share with 401(k) or Thrift Savings Plan accounts (65% versus 61%).”

I should add that if we took just the richest 0.2% of all households in the world, their capital appreciation since 2009 would be far higher than the 28% wealth increase of households in the upper 7% of the wealth distribution (most likely in excess of 100%). During the press conference that followed the Fed’s decision not to proceed with a “taper,” Mr. Bernanke was asked why most Americans saw no income and wealth growth. The money counterfeiter responded that this was not the Fed’s problem.

Clearly, it has never occurred to the professors at the Fed that Fed policies favor only large asset holders and, by creating bubbles, destroy the assets of the majority. Thus, two factors have benefited the gaming industry.

First, the Fed’s monetary inflation has boosted the wealth of the world’s most affluent people through rising asset prices and the U.S. current account deficit, which shifted money to Asia and to resource producers (mostly oil producers) because money printing boosted oil prices. Wealthy Asians, Russians and Middle Easterners have a higher gambling propensity than Westerners and make up a large share of high rollers.

Second, we had highly expansionary fiscal policies, which permitted entitlement programs to expand and ordinary people to gamble in casinos. Gambling in casinos and online has, of course, been encouraged by the public’s loss of faith in the stock market, which they perceive to be rigged.

Alan Newman, who writes the excellent Crosscurrents newsletter, recently commented that “the charade endures” and that “the markets are not fair. Equal treatment is a myth. While the SEC would insist that all investors are equal, it is patently clear some ‘investors’ are more equal than others.”

The problem we are faced with today is that our political and (frequently) business leaders are not being held responsible for their actions. Thomas Sowell sums it up well:

“It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.”

When political leaders or economic policymakers are seen to fail, the worst that will happen to them is that they won’t be re-elected or reappointed. They then become a lobbyist or an adviser or consultant, and give speeches, earning in the process a high income on top of their pension.

Similarly, many corporate executives and fund managers who have no personal stake in the business that employs them will receive generous pensions even if they fail to do their job properly and are dismissed. (This doesn’t apply to hedge fund managers, most of whose wealth is invested in their funds.) In other words, probably for the first time in history, we have today a system where leaders are not only not punished for their failures, but are actually rewarded…

Recently, Warren Buffett said that the Fed was the world’s largest hedge fund. He is wrong. The world’s largest hedge funds are owned by people who are risk takers with their own money, since they are usually the largest investors in their funds. The academics at the Fed are playing with other people’s money.

However, if we consider that the Fed, led by its chairman, is the most powerful organization in the world — because by printing money, it can finance the government (fiscal deficits) and wars, manipulate the cost of money (interest rates), directly intervene in the economy by bailing out failing institutions (banks) or countries (Greece, etc.), intervene in the foreign exchange market and even influence elections — then the question arises whether it makes sense that so much power should be given to Fed members, who are “group thinking” academics and most of whom have never worked in the private sector. In my opinion, the enormous power of the “academic” Fed is a frightening thought. My friend Fred Sheehan recently quoted from Johann Peter Eckermann’s conversation with Goethe, Feb. 1, 1827. We talked about the professors who, after they had found a better theory, still ignored it. From Eckermann and Goethe:

“‘This is not to be wondered at,’ said Goethe; ‘such people continue in error because they are indebted to it for their existence. They would have to learn everything over again, and that would be very inconvenient.’

“‘But,’ said I, ‘how can their experiments prove the truth when the basis for their evaluation is false?’

“‘They do not prove the truth,’ said Goethe, ‘nor is such the intention; the only point with these professors is to prove their own opinion. On this account, they conceal all experiments that would reveal the truth and show their doctrine untenable. Then the scholars — what do they care for truth? They, like the rest, are perfectly satisfied if they can prate away empirically; that is the whole matter.’”

Fortunately, there is an institution that exercises control over the academics at the Fed; it is called the market economy. As I have just explained, the Fed is an immensely powerful organization, but over time, the market economy is a more powerful force that can outsmart the academics because it is adaptive and dynamic. Just consider the following. Since the implementation of QE1 at the end of 2008, money supply has exploded, but the “real” economy has hardly responded.

I know that the neo-Keynesians will argue that the Fed didn’t expand its asset purchases sufficiently. But then, as I’ve mentioned before, Mr. Bernanke opined at a press conference held on Sept. 13, 2012:

“We do think that these policies [QE3] can bring interest rates down — not just Treasury rates, but a whole range of rates, including mortgage rates and rates for corporate bonds and other types of important interest rates.”

And what has happened? Interest rates have increased. According to David Rosenberg, it is actually the fifth-worst sell-off in the 10-year Treasury note since the 1960s. Whereas we can all agree that many factors other than the Fed’s policies have had an impact on the economy (regulation, Obamacare, etc.), it is crystal clear that the Fed’s QE3 and QE4 policies have completely failed in their stated objectives. This is now an instance where the market economy has badly humbled the professors at the Fed.

When the Fed announced QE1 in late 2008, it was clear to me that monetary inflation would lead to some price increases somewhere in the system. My initial thought was that QE1 would boost gold and commodities (in December 2008, oil touched a low of $32 per barrel) as well as equities around the world, which were at the time extremely oversold. But it didn’t cross my mind that money printing would most benefit gaming stocks and the high-end luxury sector of the economy (art, vintage cars, wines, high-end real estate, etc.).

But in hindsight, it is clear that monetary inflation doesn’t flow equally into all sectors of the economy; in the current conditions, it has boosted the wealth and incomes of the most affluent people (unlike in the 1970s, when negative interest rates in real terms boosted wages and consumer prices).

According to the Pew Research Center:

“During the first two years of the nation’s economic recovery, the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%. From 2009-11, the mean wealth of the 8 million households in the more affluent group rose to an estimated $3,173,895 from an estimated $2,476,244, while the mean wealth of the 111 million households in the less affluent group fell to an estimated $133,817 from an estimated $139,896.”

The Pew Research Center further notes:

“The Census Bureau data also indicate that among less-affluent households, fewer directly owned stocks and mutual fund shares in 2011 (13%) than in 2009 (16%), meaning a smaller share enjoyed the fruits of the stock market rally. Likewise, fewer had individual retirement accounts (IRAs) or Keogh accounts (22% in 2011 versus 24% in 2009), and the same share had 401(k) or Thrift Savings Plan accounts (39% in both years).

“Among affluent households, there was also a decline in the share directly owning stock and mutual fund shares during this period (59% in 2011 versus 62% in 2009), but a slight increase in the share with IRAs or Keogh accounts (70% versus 68%) and a larger increase in the share with 401(k) or Thrift Savings Plan accounts (65% versus 61%).”

I should add that if we took just the richest 0.2% of all households in the world, their capital appreciation since 2009 would be far higher than the 28% wealth increase of households in the upper 7% of the wealth distribution (most likely in excess of 100%). During the press conference that followed the Fed’s decision not to proceed with a “taper,” Mr. Bernanke was asked why most Americans saw no income and wealth growth. The money counterfeiter responded that this was not the Fed’s problem.

Clearly, it has never occurred to the professors at the Fed that Fed policies favor only large asset holders and, by creating bubbles, destroy the assets of the majority. Thus, two factors have benefited the gaming industry.

First, the Fed’s monetary inflation has boosted the wealth of the world’s most affluent people through rising asset prices and the U.S. current account deficit, which shifted money to Asia and to resource producers (mostly oil producers) because money printing boosted oil prices. Wealthy Asians, Russians and Middle Easterners have a higher gambling propensity than Westerners and make up a large share of high rollers.

Second, we had highly expansionary fiscal policies, which permitted entitlement programs to expand and ordinary people to gamble in casinos. Gambling in casinos and online has, of course, been encouraged by the public’s loss of faith in the stock market, which they perceive to be rigged.

Alan Newman, who writes the excellent Crosscurrents newsletter, recently commented that “the charade endures” and that “the markets are not fair. Equal treatment is a myth. While the SEC would insist that all investors are equal, it is patently clear some ‘investors’ are more equal than others.”