Flashback: Quotes from the Great Depression

– Tim Geithner Glitch In The Matrix Special: Will America Become Greece In Two Years – “No Risk Of That” (ZeroHedge, April 14, 2012):

Geithner April 2011: “Is there a risk that the United States could lose its AAA credit rating? Yes or no?” – Tim Geithner: “No risk of that.”

….

Geithner April 2012: “If we don’t deal with these debt problems we are going to be Greece in two years” – Tim Geithner: “No risk of that.”

On Friday we learned that in 2011, the president paid a less than “fair” 20.5% in taxes on his joint income, substantially less than pretty much most Americans who listen to the now virtually daily sermons on the fairness of class warfare. It prompted us to wonder if the president has not been taking tax advice from the likes of the Treasury secretary, best known not for destroying the US economy, but for having some tax “underpayment” issues of his own, which however TurboTax was delighted to take the blame for. Which explains why now that the president may appear just somewhat disingenuous when discussing tax “fairness”, it is up to the lackey who made tax evasion cool all over again, to defend the “fairness” of the Buffett Rule (shown graphically here) in today’s episode of 60 Minutes. Oddly enough we were expecting Timmy to tell everyone to just use TurboTax… and some creative imagination when it comes to reporting income: he did not, instead he said “If we don’t push for things that make sense, then we’re not governing“. No comment there.

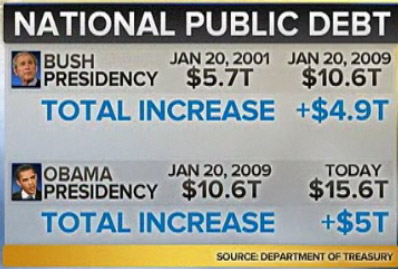

But wait there’s more: in a disastrous attempt to prevent the repeat of last August, when a 3 month showdown over the US debt limit ended up crashing the stock market, and culminated with the downgrade of America’s AAA rating, Geithner, who previously said there is no risk of the US ever being downgraded (4 months before it was), urged Congress against repeating last year’s “very damaging” debate over the debt limit, adding that the economy is stronger than at any time in the past several years. We wonder though – very damaging to whom exactly: the liars who claim that ‘America’s economy is stronger than ever’, courtesy of well over $2 trillion in debt in the past two years? Or that the debt ceiling will be breached all over again before the presidential election, confirming that the Treasury secretary can’t even budget the worst case scenario one year in advance? Finally, since there will be a protracted debt ceiling fight, certainly during the tail end of the presidential campaign, is Geithner’s plea really just to prevent Congress from making him into a running gag punchline for the second year in a row (all the while blaming the Bush presidency as usual)?

But the absolute kicker, and here we flashback to April 2011 when Timmy said there was “No risk” of a US downgrade, was Geithner using his favorite catchphrase, this time in response to whether the US may become Greece in two years: “No risk.”

And scene.

From Bloomberg:

“It would be good for the country, if this time, they did it with less drama and less politics and less damage to the country than they did last summer,” Geithner said on NBC’s “Meet the Press” program today, referring to lawmakers’ reluctance to raise the debt ceiling until an 11th-hour agreement with the Obama administration in August.

Actually it would be far gooder for the country if the debt ceiling debate did not have to arise ever 6 months or so. But since the US economy is now terminally broken, and the Treasury generates more cash from debt issuance than from tax refunds, only idiots could possibly fall for the outgoing Treasury secretary’s sad platitudes at this point.

Geithner has said the U.S. won’t hit its debt limit again until late in the year.

Which means the debt limit will be breached in a few short months as calculated here.

“Americans generally should feel much more confident about the basic strength of the economy than they would have felt any time in the last four or five, six years,” Geithner said. Still, “it’s a very tough economy.”

Well if they were drinking nothing but the same hopium and KoolAid dispersed by the administration over the past 3 years, they would. Alas, they no longer do. And the reality is diametrically opposite.

When all else fails, blame it on Europe and evil, evil speculators who drive oil prices higher, but never on saintly stock speculators who do the same with equities:

“Obviously, we’ve got a lot of challenges ahead and some risks and uncertainty ahead,” Geithner said on ABC. Those risks include the European debt crisis and oil prices, he said.

Finally, for those who wonder why Geithner gets paid the big bucks:

Geithner, asked what the U.S. jobless rate will be on election day, told CBS that “if the economy continues to gradually strengthen like it’s been doing, then the unemployment rate will be lower.”

Actually, it is not the economy strengthening, it is the labor pool imploding. So yes, if civilian labor force ratio drops to 58% or less (a divergence that can be seen perfectly here), the unemployment rate will not only be lower, it will be negative – something which every treasury secretary is all too aware of in an election year.

Timmy “TurboTax” Geithner on tax fairness:

Visit msnbc.com for breaking news, world news, and news about the economy

And the same soon to be employee of the Goldman-Morgan banker complex on the debt issue:

Visit msnbc.com for breaking news, world news, and news about the economy

But the absolute punchline: Tim Geithner on whether there is a risk America could become Greece in two years: “No Risk”

Visit msnbc.com for breaking news, world news, and news about the economy

And from April 2011, when asked if the US will be downgraded: just watch the first 15 seconds…

The only thing inquiring minds want to know is whether the dollar-drachma exchange rate be 1:1?