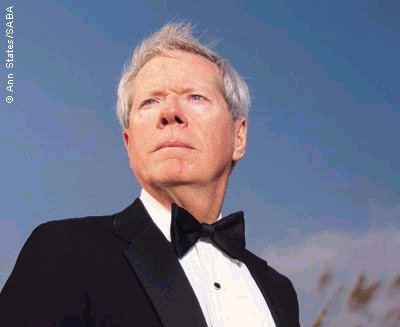

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

– Saving the Rich and Losing the Economy (OpEdNews, Sep. 26, 2011):

Economic policy in the United States and Europe has failed, and people are suffering.

Economic policy failed for three reasons:

(1) policymakers focused on enabling off-shoring corporations to move middle class jobs, and the consumer demand, tax base, GDP, and careers associated with the jobs, to foreign countries, such as China and India, where labor is inexpensive;

(2) policymakers permitted financial deregulation that unleashed fraud and debt leverage on a scale previously unimaginable;

(3) policymakers responded to the resulting financial crisis by imposing austerity on the population and running the printing press in order to bail out banks and prevent any losses to the banks regardless of the cost to national economies and innocent parties.

Jobs off-shoring was made possible because the collapse of the Soviet Union resulted in China and India opening their vast excess supplies of labor to Western exploitation. Pressed by Wall Street for higher profits, US corporations relocated their factories abroad. Foreign labor working with Western capital, technology, and business know-how is just as productive as US labor. However, the excess supplies of labor (and lower living standards) mean that Indian and Chinese labor can be hired for less than labor’s contribution to the value of output. The difference flows into profits, resulting in capital gains for shareholders and performance bonuses for executives.

As reported by Manufacturing and Technology News (September 20, 2011) the Quarterly Census of Employment and Wages reports that in the last 10 years, the US lost 54,621 factories, and manufacturing employment fell by 5 million employees. Over the decade, the number of larger factories (those employing 1,000 or more employees) declined by 40 percent. US factories employing 500-1,000 workers declined by 44 percent; those employing between 250-500 workers declined by 37 percent, and those employing between 100-250 workers shrunk by 30 percent.

These losses are net of new start-ups. Not all the losses are due to off-shoring. Some are the result of business failures.

US politicians, such as Buddy Roemer, blame the collapse of US manufacturing on Chinese competition and “unfair trade practices.” However, it is US corporations that move their factories abroad, thus replacing domestic production with imports. Half of US imports from China consist of the off-shored production of US corporations.

The wage differential is substantial. According to the Bureau of Labor Statistics, as of 2009, average hourly take-home pay for US workers was $23.03. Social insurance expenditures add $7.90 to hourly compensation and benefits paid by employers add $2.60 per hour for a total labor compensation cost of $33.53.

In China as of 2008, total hourly labor cost was $1.36, and India’s is within a few cents of this amount. Thus, a corporation that moves 1,000 jobs to China saves $32,000 every hour in labor cost. These savings translate into higher stock prices and executive compensation, not in lower prices for consumers who are left unemployed by the labor arbitrage.

Republican economists blame “high” US wages for for the current high rate of unemployment. However, US wages are about the lowest in the developed world. They are far below hourly labor cost in Norway ($53.89), Denmark ($49.56), Belgium ($49.40), Austria ($48.04), and Germany ($46.52). The US might have the world’s largest economy, but its hourly workers rank 14th on the list of the best paid. Americans also have a higher unemployment rate. The “headline” rate that the media hypes is 9.1 percent, but this rate does not include any discouraged workers or workers forced into part-time jobs because no full-time jobs are available.

The US government has another unemployment rate (U6) that includes workers who have been too discouraged to seek a job for six months or less. This unemployment rate is over 16 percent. Statistician John Williams (Shadowstats.com) estimates the unemployment rate when long-term discouraged workers (more than six months) are included. This rate is over 22 percent.

Most emphasis is on the lost manufacturing jobs. However, the high speed Internet has made it possible to offshore many professional service jobs, such as software engineering, Information Technology, research and design. Jobs that comprised ladders of upward mobility for US college graduates have been moved off shore, thus reducing the value to Americans of many university degrees. Unlike former times, today an increasing number of graduates return home to live with their parents as there are insufficient jobs to support their independent existence.

All the while, the US government allows in each year one million legal immigrants, an unknown number of illegal immigrants, and a large number of foreign workers on H-1B and L-1 work visas. In other words, the policies of the US government maximize the unemployment rate of American citizens.

Republican economists and politicians pretend that this is not the case and that unemployed Americans consist of people too lazy to work who game the welfare system. Republicans pretend that cutting unemployment benefits and social assistance will force “lazy people who are living off the taxpayers” to go to work.

To deal with the adverse impact on the economy from the loss of jobs and consumer demand from offshoring, Federal Reserve chairman Alan Greenspan lowered interest rates in order to create a real estate boom. Lower interest rates pushed up real estate prices. People refinanced their houses and spent the equity. Construction, furniture and appliance sales boomed. But unlike previous expansions based on rising real income, this one was based on an increase in consumer indebtedness.

There is a limit to how much debt can increase in relation to income, and when this limit was reached, the bubble popped.

When consumer debt could rise no further, the large fraudulent component in mortgage-backed derivatives and the unreserved swaps (AIG, for example) threatened financial institutions with insolvency and froze the banking system. Banks no longer trusted one another. Cash was hoarded. Treasury Secretary Paulson browbeat Congress into massive taxpayer loans to financial institutions that functioned as casinos. The Paulson Bailout (TARP) was large but insignificant compared to the $16.1 trillion (a sum larger than US GDP or national debt) that the Federal Reserve lent to private financial institutions in the US and Europe.

In making these loans, the Federal Reserve violated its own rules. At this point, capitalism ceased to function. The financial institutions were “too big to fail,” and thus taxpayer subsidies took the place of bankruptcy and reorganization. In a word, the US financial system was socialized as the losses of the American financial institutions were transferred to taxpayers.

European banks were swept up into the financial crisis by their unwitting purchase of the junk financial instruments marketed by Wall Street. The financial junk had been given investment grade rating by the same incompetent agency that recently downgraded US Treasury bonds.

The Europeans had their own bailouts, often with American money (Federal Reserve loans). All the while Europe was brewing an additional crisis of its own. By joining the European Union and (except for the UK) accepting a common European currency, the individual member countries lost the services of their own central banks as creditors. In the US and UK, the two countries’ central banks can print money with which to purchase US and UK debt. This is not possible for member countries in the EU.

When financial crisis from excessive debt hit the PIIGS (Portugal, Ireland, Italy, Greece, and Spain) their central banks could not print euros in order to buy up their bonds, as the Federal Reserve did with “quantitative easing.” Only the European Central Bank (ECB) can create euros, and it is prevented by charter and treaty from printing euros in order to bail out sovereign debt.

In Europe, as in the US, the driver of economic policy quickly became saving the private banks from losses on their portfolios. A deal was struck with the socialist government of Greece, which represented the banks and not the Greek people. The ECB would violate its charter and together with the IMF, which would also violate its charter, would lend enough money to the Greek government to avoid default on its sovereign bonds to the private banks that had purchased the bonds. In return for the ECB and IMF loans, and in order to raise the money to repay them, the Greek government had to agree to sell to private investors the national lottery, Greece’s ports and municipal water systems, a string of islands that are a national preserve, and in addition to impose a brutal austerity on the Greek people by lowering wages, cutting social benefits and pensions, raising taxes, and laying off or firing government workers.

In other words, the Greek population is to be sacrificed to a small handful of foreign banks in Germany, France and the Netherlands.

The Greek people, unlike “their” socialist government, did not regard this as a good deal. They have been in the streets ever since.

Jean-Claude Trichet, head of the ECB, said that the austerity imposed on Greece was a first step. If Greece did not deliver on the deal, the next step was for the EU to take over Greece’s political sovereignty, make its budget, decide its taxation, decide its expenditures and, from this process, squeeze out enough from Greeks to repay the ECB and IMF for lending Greece the money to pay the private banks.

In other words, Europe under the EU and Jean-Claude Trichet is a return to the most extreme form of feudalism in which a handful of rich are pampered at the expense of everyone else.

This is what economic policy in the West has become — a tool of the wealthy used to enrich themselves by spreading poverty among the rest of the population.

On September 21, the Federal Reserve announced a modified QE 3. The Federal Reserve announced that the bank would purchase $400 billion of long-term Treasury bonds over the next nine months in an effort to drive long-term US interest rates even further below the rate of inflation, thus maximizing the negative rate of return on the purchase of long-term Treasury bonds. The Federal Reserve officials say that this will lower mortgage rates by a few basis points and renew the housing market.

The officials say that QE 3, unlike its predecessors, will not result in the Federal Reserve printing more dollars in order to monetize US debt. Instead, the central bank will raise money for the bond purchases by selling holdings of short-term debt. Apparently, the Federal Reserve believes it can do this without raising short-term interest rates, because back during the recent debt-ceiling-government-shutdown-crisis, the Federal Reserve promised banks that it would keep the short-term interest rate (essentially zero) constant for two years.

The Fed’s new policy will do far more harm than good. Interest rates are already negative. To make them more so will have no positive effect. People aren’t buying houses because interest rates are too high, but because they are either unemployed or worried about their jobs and do not see a recovering economy.

Already insurance companies can make no money on their investments. Consequently, they are unable to build their reserves against claims. Their only alternative is to raise their premiums. The cost of a homeowner’s policy will go up by more than the cost of a mortgage will decline. The cost of health insurance will go up. The cost of car insurance will rise. The Federal Reserve’s newly announced policy will impose more costs on the economy than it will reduce.

In addition, in America today savings earn nothing. Indeed, they produce an ongoing loss as the interest rate is below the inflation rate. The Federal Reserve has interest rates so low that only professionals who are playing arbitrage with algorithm programmed computer models can make money. The typical saver and investor can get nothing on bank CDs, money market funds, municipal and government bonds. Only high-risk debt, such as Greek and Spanish bonds, pay an interest rate that is higher than inflation.

For four years interest rates, when properly measured, have been negative. Americans are getting by, maintaining living standards, by consuming their capital. Even those with a cushion are eating their seed corn. The path that the US economy is on means that the number of Americans without resources to sustain them will be rising. Considering the extraordinary political incompetence of the Democratic Party, the right-wing of the Republican Party, which is committed to eliminating income support programs, could find itself in power. If the right-wing Republicans implement their program, the US will be beset with political and social instability. As Gerald Celente says, “when people have nothing left to lose, they lose it.”