– Too Big To Fail?: 10 Banks Own 77 Percent Of All U.S. Banking Assets (The Economic Collapse, July 18th, 2011):

Back during the financial crisis of 2008, the American people were told that the largest banks in the United States were “too big to fail” and that was why it was necessary for the federal government to step in and bail them out. The idea was that if several of our biggest banks collapsed at the same time the financial system would not be strong enough to keep things going and economic activity all across America would simply come to a standstill. Congress was told that if the “too big to fail” banks did not receive bailouts that there would be chaos in the streets and this country would plunge into another Great Depression. Since that time, however, essentially no efforts have been made to decentralize the U.S. banking system. Instead, the “too big to fail” banks just keep getting larger and larger and larger. Back in 2002, the top 10 banks controlled 55 percent of all U.S. banking assets. Today, the top 10 banks control 77 percent of all U.S. banking assets. Unfortunately, these giant banks are also colossal mountains of risk, debt and leverage. They are incredibly unstable and they could start coming apart again at any time. None of the major problems that caused the crash of 2008 have been fixed. In fact, the U.S. banking system is more centralized and more vulnerable today than it ever has been before.

It really is difficult for ordinary Americans to get a handle on just how large these financial institutions are. For example, the “big six” U.S. banks (Goldman Sachs, Morgan Stanley, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo) now possess assets equivalent to approximately 60 percent of America’s gross national product.

These huge banks are giant financial vacuum cleaners. Over the past couple of decades we have witnessed a financial consolidation in this country that is absolutely unprecedented.

This trend accelerated during the recent financial crisis. While the big boys were receiving massive bailouts, the hundreds of small banks that were failing were either allowed to collapse or they were told that they should find a big bank that was willing to buy them.

As a group, Citigroup, JPMorgan Chase, Bank of America and Wells Fargo held approximately 22 percent of all banking deposits in FDIC-insured institutions back in 2000.

By the middle of 2009 that figure was up to 39 percent.

That is not just a trend – that is a landslide.

Sadly, smaller banks continue to fail in large numbers and the big banks just keep growing and getting more power.

Today, there are more than 1,000 U.S. banks that are on the “unofficial list” of problem banking institutions.

In the absence of fundamental changes, the consolidation of the banking industry is going to continue.

Meanwhile, the “too big to fail” banks are flush with cash and they are getting serious about expanding. The Federal Reserve has been extremely good to the big boys and they are eager to grow.

For example, Citigroup is becoming extremely aggressive about expanding….

Citigroup has been hiring dozens of investment bankers, dialing up advertising and drawing up plans to add several hundred branches worldwide, including more than 200 in major cities across the United States.

Hopefully the big banks will start lending again. The whole idea behind the bailouts and all of the “quantitative easing” that the Federal Reserve did was to get money into the hands of the big banks so that they would lend it out to ordinary Americans and get the economy rolling again.

Well, a funny thing happened. The big banks just sat on a lot of that money.

In particular, what they did was they deposited much of it at the Fed and drew interest on it.

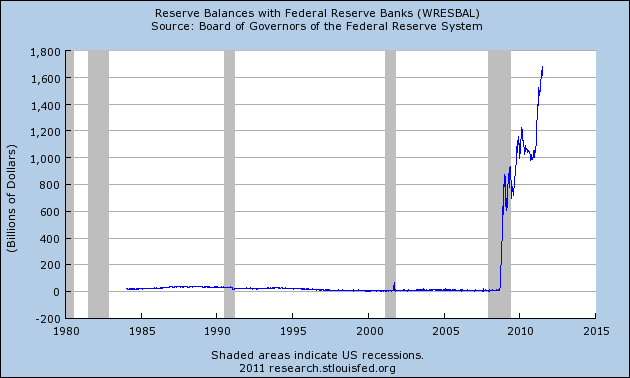

Since 2008, excess reserves parked at the Fed have grown by nearly 1.7 trillion dollars. Just check out the chart posted below….

The American people were promised that TARP and all of the other bailouts would enable the big banks to lend out lots of money which would help get the economy going for ordinary Americans again.

Well, it turns out that in 2009 (the first full year after Congress passed the bailout legislation) U.S. banks posted their sharpest decline in lending since 1942.

Lending has never fully recovered since the crash of 2008. The big financial institutions like Goldman Sachs, Morgan Stanley and JPMorgan Chase have been able to get all the cash that they need, but they have not passed that generosity along to ordinary Americans.

In fact, the biggest U.S. banks have actually reduced small business lending by about 50 percent since the crash of 2008.

That doesn’t sound like what we were promised.

These “too big to fail” banks have been able to borrow gigantic amounts of money from the Fed for next to nothing and yet they still refuse to let credit flow to local communities. Instead, the big banks have found other purposes for all of the super cheap money that they have been getting from the Fed as Ellen Brown recently explained….

It can be very profitable indeed for the big Wall Street banks, but the purpose of the near-zero interest rates was supposed to be to get banks to lend again. Instead, they are, indeed, paying “outrageous bonuses to their top executives;” using the money to engage in the same sort of unregulated speculation that nearly brought down the economy in 2008; buying up smaller banks; or investing this virtually interest-free money in risk-free government bonds, on which taxpayers are paying 2.5 percent interest (more for longer-term securities).

What makes things even worse is that these big banks often pay next to nothing in taxes.

For example, between 2008 and 2010, Wells Fargo made a total profit of 49.37 billion dollars.

Over that same time period, their tax bill was negative 681 million dollars.

Do you understand what that means? Over that 3 year time period, Wells Fargo actually got 681 million dollars back from the U.S. government.

Isn’t that just peachy?

Meanwhile, the big financial giants have not learned their lessons and they continue to do business pretty much as they did it prior to 2008.

The big banks continue to roll up massive amounts of risk, debt and leverage.

Today, Wall Street has become one giant financial casino. More money is made on Wall Street by making side bets (commonly referred to as “derivatives“) than on the investments themselves.

If the bets pay off for the big financial institutions, mind blowing profits can be made. But if the bets go against the big financial institutions (as we saw in 2008), firms can collapse almost overnight.

In fact, it was derivatives that almost brought down AIG. The biggest insurance company in the world almost folded in 2008 because of a whole bunch of really bad bets.

The danger from derivatives is so great that Warren Buffet once called them “financial weapons of mass destruction”. It has been estimated that the notional value of the worldwide derivatives market is somewhere in the neighborhood of a quadrillion dollars.

The largest banks have tens of trillions of dollars of exposure to derivatives. When the next great financial collapse happens, derivatives will almost certainly be at the center of it once again. These side bets do not create anything real for the economy – they just make and lose huge amounts of money. We never know when the next great derivatives crisis will strike. Derivatives are essentially like a “sword of Damocles” that perpetually hangs over the U.S. financial system.

When I start talking about derivatives I get a lot of people in the financial community mad at me. On Wall Street today you can bet on just about anything you can imagine. Almost everyone in the financial world has gotten so used to making wild bets that they couldn’t even imagine a world without them. If anyone even tried to put significant limits on futures, options and swaps it would cause Wall Street to throw a hissy fit.

But someday the dominoes are going to start to fall and the house of cards is going to come crashing down. It is an open secret that our financial system is fundamentally unsound. Even a lot of people working on Wall Street will admit that. It is just that people are so busy making such big piles of money that nobody wants the party to stop.

It is only a matter of time until some of these big banks get into a huge amount of trouble again. When that happens, we might really find out whether they are “too big to fail” or whether we could get along just fine without them.