The rush by retail investors into bullion coins is creating shortages as mints across the world struggle to meet the surge in demand, dealers and mint officials say.

The scarcity is lifting coin premiums to as much as 5 per cent above the spot gold price, a level reached briefly after the collapse of Lehman Brothers last September, when coin shortages also surfaced.

Spot gold in London on Wednesday traded at $972 an ounce, below last week’s peak of $1,004.5.

“There is demand for double or triple what the US mint is able to produce,” said Michael Kramer, president of MTB in New York, one of the four US gold dealers authorised to purchase bullion coins directly from the government’s mint.

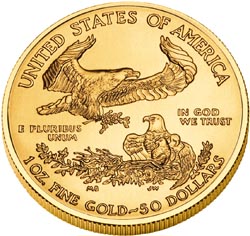

The US Mint has sold 193,500 ounces of its popular American Eagle gold coin in the first seven weeks of this year, the same amount it shipped during the whole of 2007 and about the same as in the first six months of last year.

“The demand is extraordinary. All the coins we got on Monday are gone today [Tuesday] and we will not be able to take any order until the following week,” Mr Kramer said. “It is the same with other mints.”

Bullion coins used to be bought mainly by collectors and gold bugs, but the financial crisis is leading regular retail investors to embrace them, dealers say.

Although the surge in coin demand is a bullish signal for gold prices, the fact that mints cannot match demand means that the potential extra consumption does not push spot prices higher, but just drives premiums above normal levels.

The Rand Refinery in Johannesburg, which mints the world’s most popular gold coin, South Africa’s Krugerrand, said demand was above its maximum capacity, even after doubling last month to 20,000 ounces from 10,000 ounces a week.

Johan Botha, head of precious metals sales at the Rand Refinery, said there was demand for more from international investors, pointing to strong sales to Switzerland, the UK and Germany. “If we were able to produce 30,000 ounces,the market would absorb it,” he said.

Mr Kramer said MTB had Krugerrand orders equal to three months of refinery supplies to the company.

The New Zealand Mint said it was doing as much business in a day as in a month a year ago, mostly servicing global investors.

Michael O’Kane, head of gold sales at the New Zealand Mint, said: “Most mints and bullion manufacturers are struggling to meet current demand levels.”

25 Feb 2009 7:37pm

Source: The Financial Times