FYI.

– Central Banks Are Now Printing $200 Billion Per Month… Without a Crisis:

A tidal wave of inflation is rapidly moving through the financial system.

Most investors only pay attention to the Federal Reserve. And they are missing the BIG PICTURE for Central Bank monetary policy.

The Fed is tightening policy by hiking rates. But the rest of the world’s Central Banks are printing a combined $200 BILLION in QE every single month.

Yes, $200 billion. At a time when the financial system is out of crisis and the Fed’s put its own “print” button on “pause.”

This is an all-time record… greater even that the global money printing that occurred at the depth of the 2008 Crisis when Central banks were desperate to prop the system up.

Indeed, at $200 billion per month, we’re talking about an annualized pace of over $2 TRILLION in money printing every year.

If you don’t believe this will unleash inflation, consider that already in the US, inflation has exceeded the Fed’s targets on ALL FOUR of its measures.

Bear in mind, these are the “official” measures of inflation… the ones that don’t include things like food, or energy. When you account for the rise in the REAL cost of living in the US, REAL inflation in the US is closer to 6%.

And this is happening at a time when the Fed is hiking rates and NOT printing money.

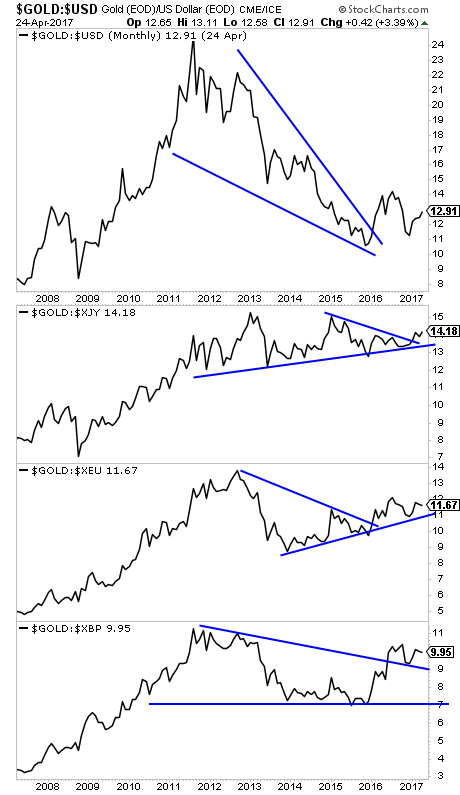

If you don’t take my word for it, take a look at Gold priced in the $USD, Japanese Yen, Euro, and British Pound. The precious metal has begun to break of to the upside in all major world currencies.

Gold “smells” what’s coming. It’s inflation. And smart investors are preparing for it now.

We offer a FREE Special Investment Report featuring a unique investment opportunity through which you can buy Gold at the absurdly cheap valuation of just $273 per ounce.

Less than 1 in 100,000 investors know about this opportunity. But the early birds have already seen double-digit returns in 2017 thus far.

To pick up a copy of our FREE Special Report, swing by:

http://www.phoenixcapitalmarketing.com/goldmountain.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP