Related info:

– Why Did George Soros Forgive Donald Trump As Much As $312 MILLION In Debt For No Apparent Reason?

– Hillary Clinton & Donald Trump Are Both Elite Puppets, Serving The Same Masters

– Jamie Dimon Named Chairman Of Business Roundtable Scoring Another Key D.C. Post For Wall Street:

Just days after being appointed to Trump’s “Strategic and Policy Forum,” JP Morgan CEO, Jamie Dimon, has been named Chairman of Business Roundtable. Obviously, this is yet another prominent D.C. position for Wall Street just as Trump gets set to take the White House amid promises to “drain the swamp.”

Per a press release posted to the Business Roundtable website, Dimon will take over the Chairman position from Doug Oberhelman, the CEO of Caterpillar, and will serve a two-year term that will last through December 21, 2018.

“Jamie is one of the most accomplished business leaders in America,” Oberhelman said. “He is a strong and positive force for sound economic policies and the need for a diverse and skilled workforce. His depth of understanding and optimistic vision of America’s future make him exactly the right person to lead Business Roundtable to work with the new Administration and Congress.”

“It is an honor to be selected to lead Business Roundtable,” Dimon said. “Given the quality and diversity of its membership, the organization is uniquely positioned to advocate for meaningful solutions that create economic growth and opportunity for all. With a new President and Congress soon to take office, there is a real opportunity for Business Roundtable to be a positive influence and show how business plays a critical role in this growth.

“The results of the U.S. election reflected in some part the frustration that so many people have with the lack of economic opportunity and the challenges they face. By helping to bridge the divide between political parties and working collaboratively to find solutions, Business Roundtable can play a key role in fostering economic mobility and sustained growth. Working together, the business community and government can foster a healthy and vibrant business climate that creates opportunity for everyone in this country.

“I want to thank Doug for his leadership at Business Roundtable and as an effective advocate for what’s best for the country — a strong economy, people working in good-paying jobs and a business climate that supports investment and innovation.”

For those not familiar with the organization, Business Roundtable promotes itself as an association of nearly 200 CEOs who “promote policies to improve U.S. competitiveness, strengthen the economy, and spur job creation.”

Business Roundtable is an association of chief executive officers of leading U.S. companies working to promote sound public policy and a thriving U.S. economy.

Business Roundtable CEO members lead companies with more than $6 trillion in annual revenues and nearly 15 million employees. The combined market capitalization of Business Roundtable member companies is the equivalent of nearly one-quarter of total U.S. stock market capitalization, and Business Roundtable members invest $103 billion annually in research and development – equal to 30 percent of U.S. private R&D spending. Our companies pay $226 billion in dividends to shareholders and generate $412 billion in revenues for small and medium-sized businesses annually. Business Roundtable companies also make more than $7 billion a year in charitable contributions.

Established in 1972, Business Roundtable applies the expertise and experience of its CEO members to the major issues facing the nation. Through research and advocacy, Business Roundtable promotes policies to improve U.S. competitiveness, strengthen the economy, and spur job creation.

For a D.C. swamp that was supposed to be drained in just over a month a lot of wall street’s most prominent swamp dwellers seem to be finding new homes there.

* * *

For those who missed it, here is further background on the President’s Strategic and Policy Forum that will be chaired by Blackstone’s Stephen Schwarzmann.

Shortly after Donald Trump picked former Goldman partner Steven Mnuchin as Treasury Secretary, he was rumored to be considering another Goldmanite, current President and COO Gary Cohn – who as reported earlier this week is already contemplating “life after Goldman” – for energy secretary. The follows a previous report that Trump may appoint Cohn as head of the Office of Management and Budget. So, as Trump wonders which other Goldman banker to poach to fully outsource financial management of the US directly to Goldman, a taxpayer-backed hedge fund which has already taken over the world’s central banks, he decided to spread the Wall Street love and earlier today announced that he has created an economic panel chaired by Blackstone’s Stephen Schwarzmann, whose members will also include such illustrious “non-swampies” as Jamie Dimon and Larry Fink, as well as various other “prominent U.S. business leaders” to get Wall Street’s advice on such matters as … job creation.

The President’s Strategic and Policy Forum will begin meeting with Trump in February after his inauguration. From the announcement:

President-elect Donald J. Trump today announced that he is establishing the President’s Strategic and Policy Forum. The Forum, which is composed of some of America’s most highly respected and successful business leaders, will be called upon to meet with the President frequently to share their specific experience and knowledge as the President implements his plan to bring back jobs and Make America Great Again. The Forum will be chaired by Stephen A. Schwarzman, Chairman, CEO, and Co-Founder of Blackstone.

Members of the Forum will be charged with providing their individual views to the President – informed by their unique vantage points in the private sector – on how government policy impacts economic growth, job creation, and productivity. The Forum is designed to provide direct input to the President from many of the best and brightest in the business world in a frank, non-bureaucratic, and non-partisan manner.

This is the same Schwarzman who during the Republican primaries in October 2015, characterized Trump as “the P.T. Barnum of America.”

Other members include General Motors Co. chairman and CEO Mary Barra, Cleveland Clinic CEO Toby Cosgrove, Bob Iger of the Walt Disney, Wal-Mart Stores Inc. president and CEO Doug McMillon, and former Boeing Co. chairman James McNerney, as well as the above named Jamie Dimon of JPMorgan Chase and BlackRock Inc.’s Larry Fink,

“This forum brings together CEOs and business leaders who know what it takes to create jobs and drive economic growth,” Trump said in a statement issued by Blackstone. “My administration is committed to drawing on private sector expertise and cutting the government red tape that is holding back our businesses from hiring, innovating, and expanding right here in America.”

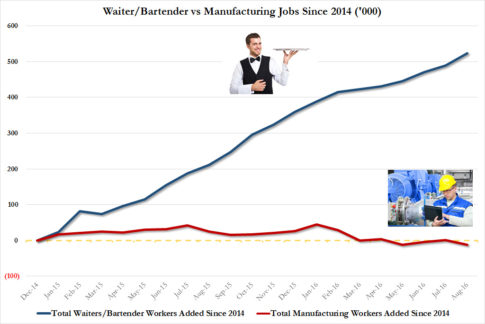

Sadly, it was the private sector’s policies, expertise and “advice” to the Obama administration, that led to this particular outcome:

It also led to record stock buybacks and all time high stock prices, not to mention record CEO compensation, but surely Trump will see right any such attempts to pass “advice” meant to help the people whose only intention is to make a handful of Wall Street oligarchs even richer… right.

Schwarzman, the 69-year-old private equity executive who will chair the forum, said at the Wall Street Journal CEO Council after the election that he is “excited” about the prospects for economic growth in America and expects the business horizon to look “infinitely better” in the next few years.

“Things are going to change, and I think things are going to change a lot,” he said. He did not refer to Trump by name.

In an interview with Bloomberg before the election, Schwarzman said he was undecided between Trump and Clinton. He said the GOP nominee’s plans for economic growth sound “wonderful if you could do that,” but also expressed concerns about his immigration plans.

“If you were really removing a large number of people, that’s got to adversely affect the economy,” he said.

Other panel members are also prominent Clinton fans: Disney’s Iger, 65, supported Hillary Clinton during the campaign and co-hosted a fundraiser for her over the summer. However, he too quickly changed his tune in the days following Trump’s election, when he said he was “hopeful” about what’s to come in an interview with CNBC.

“There is going to be far more energy around attacking the tax code, changing the tax code, closing loopholes on corporate taxes and lowering the base,” he said. “We’re not as competitive as we need to be as a country. I think that is going to be addressed on a timely, meaning a fast basis. That’s certainly good.”

Jim McNerney, former chairman and CEO of Boeing, who is also on the committee, once referred to Trump’s rhetoric on trade as “dangerous.”

The full list of panel members include the following:

- Stephen A. Schwarzman, Chairman, CEO, and Co-Founder of Blackstone

- Paul Atkins, CEO, Patomak Global Partners, LLC, Former Commissioner of the Securities and Exchange Commission

- Mary Barra, Chairman and CEO, General Motors

- Toby Cosgrove, CEO, Cleveland Clinic

- Jamie Dimon, Chairman and CEO, JPMorgan Chase & Co

- Larry Fink, Chairman and CEO, BlackRock

- Bob Iger, Chairman and CEO, The Walt Disney Company

- Rich Lesser, President and CEO, Boston Consulting Group

- Doug McMillon, President and CEO, Wal-Mart Stores, Inc.

- Jim McNerney, Former Chairman, President, and CEO, Boeing

- Adebayo “Bayo” Ogunlesi, Chairman and Managing Partner, Global Infrastructure Partners

- Ginni Rometty, Chairman, President, and CEO, IBM

- Kevin Warsh, Shepard Family Distinguished Visiting Fellow in Economics, Hoover Institute, Former Member of the Board of Governors of the Federal Reserve System

- Mark Weinberger, Global Chairman and CEO, EY

- Jack Welch, Former Chairman and CEO, General Electric

- Daniel Yergin, Pulitzer Prize-winner, Vice Chairman of IHS Markit

For some inexplicable reason, Warren Buffett failed to make the list, if only for the time being.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP