– “Central Banks Now Own $25 Trillion Of Financial Assets”:

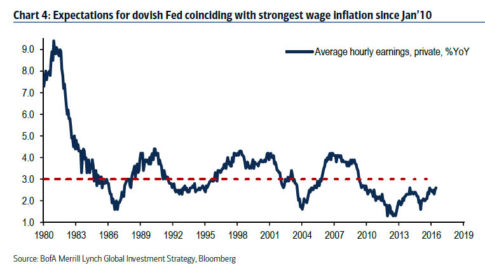

With 85% of Wall Street telling Citi they expect a “dovish hike signal” from Yellen tomorrow, which means a polite request for another BTFD opportunity, even if as BofA says “expectations for a dovish Fed are coinciding with macro strength in the US (most obviously in housing & consumer spending) as well as highest level of wage inflation since Jan’10“…

… here is a quick reminder of where we currently stand from BofA’s Michael Hartnett, from a brief note titled The Liquidity Supernova & the “Keynesian Put.”

* * *

Risk assets are now supported by the new ”Keynesian Put”, the expectation that fiscal measures will be deployed to combat any renewed weakness in the economy/markets (independently of any larger political projects). But asset prices remain primarily supported by excess monetary abundance across the world:

- There have been 667 interest rate cuts by global central banks since Lehman;

- G7 central bank governors Yellen, Kuroda, Draghi, Carney & Poloz have been in their current posts for a collective 17 years, yet only one (Yellen in Dec’15) has actually hiked interest rates during this time;

- Central banks own $25tn of financial assets (a sum larger than GDP of US + Japan, and up $12tn since Lehman);

- There are currently $12.3tn of negative yielding global bonds (28% of total);

- There is currently $8tn of negative yielding sovereign debt (54% of total).

Do not expect any unwind of this $25 trillion in risk asset support to be unwound any time soon, or perhaps ever, or else…

The Crab Nebula supernova

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP