– “A 2015-like Market Crash In Chinese Commodities Is Inevitable”:

Is Everyone Wrong On The “Causation” Of The Commodity Bubble? While it appeared ‘retail’ was responsible for the panic-buying chaotic volume surge in Chinese commodities, Axiom Capital Management’s Gordon L Johnson points out that in fact… China Bank Special Interest Vehicles’ “Bold” Commodity Speculation Is The Real Budding Black Swan

WMP Speculation Likely Cause for the ’16 Commodity Rally, Not Retail Investors (“Cab-Drivers”).

In ‘09 when deposit growth in China’s then ~$11tn banking system started to crash, China’s banks, in an attempt to avoid becoming illiquid while also maintaining their mandate to lend just 75% of deposits to maintain “healthy” bal. sheets, began issuing Wealth-Management-Products (“WMPs”) at an unprecedented clip. Without going into the nuances, WMPs are unregulated, off-bal. sheet (“OBS”), high-interest bearing savings-plans/money-mrkt-funds, which are comprised of banks’ riskiest loans (thus, their ability to offer rates above traditional bank savings accounts); they are also not required to reserve bank capital to cover potential defaults – these products often involve high-risk debts held by Chinese companies in industries beset by overcapacity.

WMPs are offered to investors via bank-controlled OBS Special Interest Vehicles (“SIVs”), which are capitalized with the proceeds from the WMP deposits from retail investors. The SIV then levers up (i.e., borrows) 5:1, or in some cases 10:1, via short-term/overnight paper (to keep the borrowing costs low [or the interest on the leverage would “kill” the SIV’s returns]) – CDO-like leverage on top of leverage – to generate the needed 5%-15% returns promised to retail investors.

Initially, the desired 5%-15% s-term WMP returns were met by the underlying high-risk loans, but then the loans went bad; then, they were targeted at real-estate, & shortly thereafter China’s real-estate mrkt crashed; subsequently, they targeted China’s stock mrkt, via margin lending, but when margin volumes collapsed 64% 6/15-3/16, this ave. to generate “quick returns” dried up.

Now, highly-levered WMPs are targeting the commodity-futures mrkts.

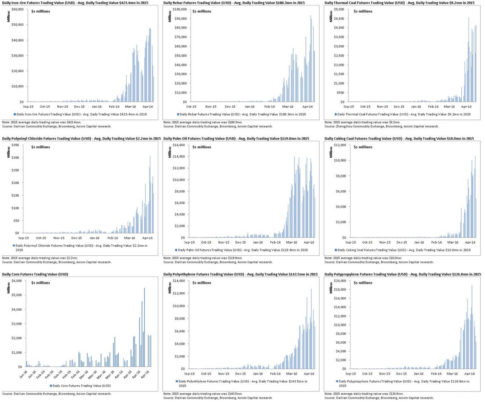

The proof? Well, while Shanghai rebar futures contracts avg.’d $180mn/day in Jan. ’16, this amount surged to $51.4bn/day in Apr. ’16 (a 285x increase) – yes, you heard that right. In fact iron-ore, coking-coal, & polypropolyene futures avg. daily trading values Apr. vs. Jan. ’16 are up 114x, 1,056x, & 150x.

Given the sheer scale (tens of trillions RMB), we blv this is all bank risk (not retail/cabbie-risk).

Crash Imminent? Given this is being funded by over-levered OBS entities of banks, the scale is enormous vs. both China’s economy & banks’ capital, & subsidization is mainly in the overnight mrkt – meaning one day we could wake up & it could all be “over” (via a rumor gov’t regulation is changing, a default, or interest rate vol.) – we blv a ’15-like Chinese mrkt crash in global commodities is nearing/inevitable.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP