– $60 Trillion Of World Debt In One Visualization (ZeroHedge, Aug 6, 2015):

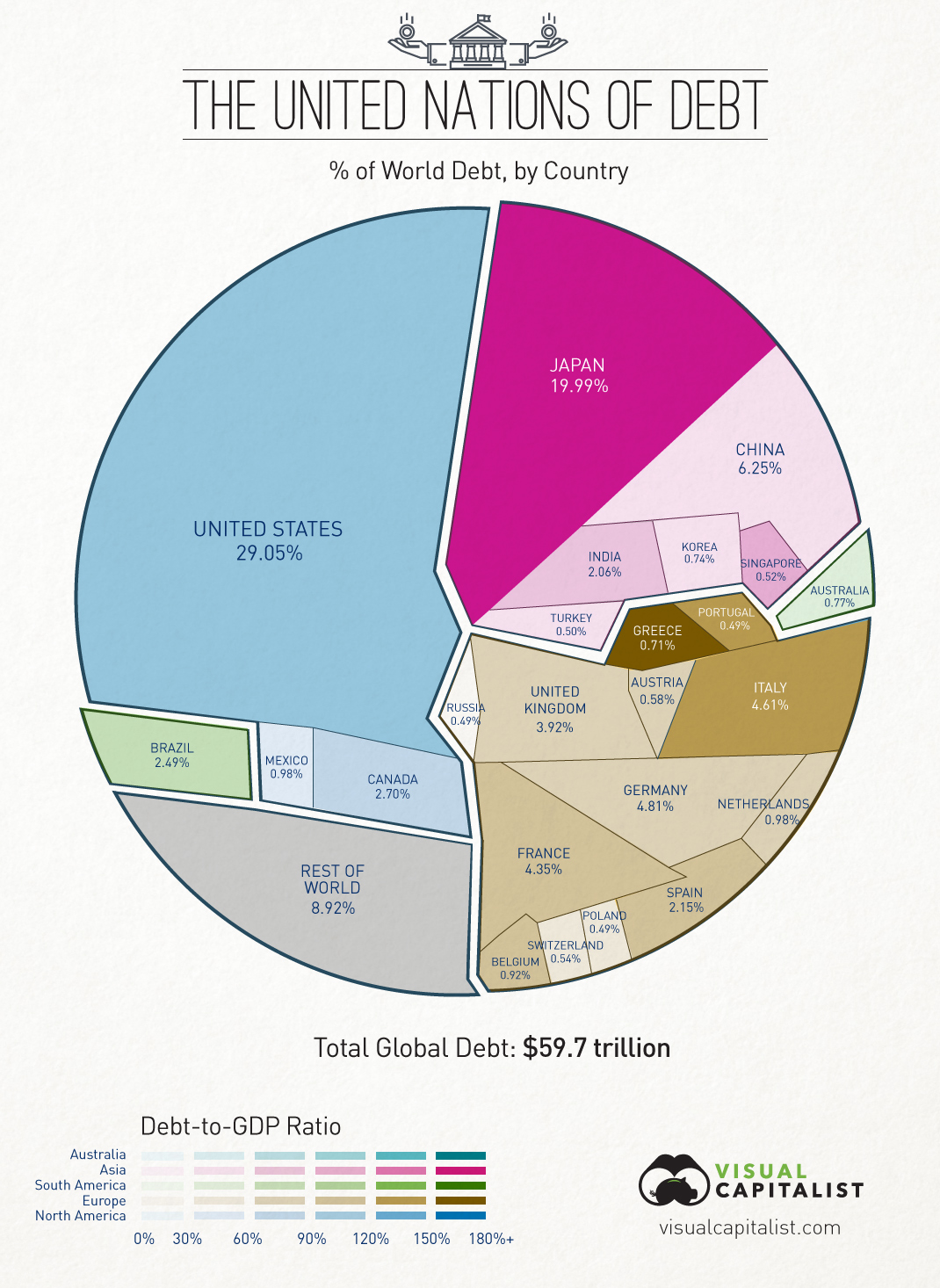

Today’s visualization breaks down $59.7 trillion of world debt by country, as well as highlighting each country’s debt-to-GDP ratio using colour. The data comes from the IMF and only covers external government debt.

It excludes the debt of country’s citizens and businesses, as well as unfunded liabilities which are not yet technically incurred yet. All figures are based on USD.

Courtesy of: Visual CapitalistThe numbers that stand out the most, especially when comparing to the previous world economy graphic:

- The United States constitutes 23.3% of the world economy but 29.1% of world debt. It’s debt-to-GDP ratio is 103.4% using IMF figures.

- Japan makes up only 6.18% of total economic production, but has amounted 19.99% of global debt.

- China, the world’s second largest economy (and largest by other measures), accounts for 13.9% of production. They only have 6.25% of world debt and a debt-to-GDP ratio of 39.4%.

- 7 of the 15 countries with the most total debt are European. Together, excluding Russia, the European continent holds over 26% of total world debt.

Combining the debt of the United States, Japan, and Europe together accounts for 75% of total global debt.

Source: Visual Capitalist

Interesting article, however, my statistics are updated daily on USdebtclock.org

I think the world debt situation is far worse than described.

Here are some of today’s numbers; First # are public debt to GDP ratio, Second # is External debt to GDP ratio:

US Public = 73.7%; External debt to GDP Ratio: 97.9%

Japan public: 230.2%; External debt to GDP ratio: 57.8%

China public: 23.1%; External debt to GDP ratio: 6.7%

UK public: 92.4%; External debt to GDP ratio: 315.9%

Italy public: 136.6%; External debt to GDP ratio: 126.8%pai

Germany public:80.1%; External debt to GDP ratio: 160.7%

Canada public: 86.1%; External debt to GDP ratio: 6.7%

India public: 51.7%; External debt to GDP ratio:19.8%

Brazil public: 59.4%; External debt to GDP ratio: 22.2%

Spain public:98.5%; External debt to GDP ratio:159.7%

Greece public: 170.6%; External debt to GDP ratio: 216.7%

USA public: 73.7%; External debt to GDP ratio: 97.9%

Russia public 7.9%; External debt to GDP ratio: 40.2%

Portugal public 130.2%; External debt to GDP ratio: 235.8%

Mexico public 37.2%; External debt to GDP ratio: 34.8%

Ireland public 128%; External debt to GDP ratio: 812.6%

Why nobody ever mentions the incredible debt Ireland is carrying is beyond me.

I thought it worthwhile to include all debt levels that exceeded 1%……

If one goes to http://www.usworlddebtclock.org, and clicks on World, most of the nations are listed there……

This is a constantly changing debt list, worth knowing about, and it includes most of the nations of the world.

In my opinion, looking at the debt levels in this article, there are a couple of scary points…..One is the fact Japan has a public debt level of 230.2%, a public debt of 57.8% and a global debt of 19.9%. Until Fukushima, Japan was one of the world’s largest lending nations and the highest savings rate in the world. Since Fukushima has thrown a huge monkey wrench into their economy. one might admit the fact Fukushima was a problem. Instead, they continue to lie about it, nothing is being done regardless of the damage they are doing to the entire world….especially Japan and the west coast of North America. Japan ought to be endeavoring to do something instead of just floating more lies.

The debt level of all the Euro nations and the US ought to tell everyone the west is in trouble………The endless lies about the environment and the economy ought to send up signals to everyone…….

I just cannot believe the utter stupidity of this idiot.

With world trade in stagnation, and absolutely no false banksters initiated artificial “growth” it is essential that Governments worldwide cut down on their spending, on support, projects, etc and concentrate on foundation basics.

To pronounce the end of “austerity” can only mean pumping more money out into the economies.

In a world with relative economic stagnation and potential war, this can only ne done by a) borrowing or b) taxation, or a blend of both.

Witn world debt and every country’s national debt totally unsustainable as well as unplayable, this is suicide, and MUST be the actual button the Rothschilds want pushing to bring about the financial collapse. The end must be real close now.

http://www.telegraph.co.uk/business/2017/04/19/austerity-five-years-belt-tightening-imf-says-rich-world-has/

it’s funny money that represents power.