– “Something Has To Give”: Wall Street Finally Noticed The Epic Divergence Between Stocks And Commodities (ZeroHedge, Aug 6, 2015):

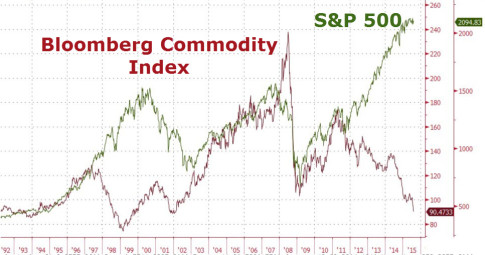

We have shown the following chart, showcasing the unprecedented divergence between commodities and stocks countless times:

And now the sellside is finally starting to notice, and instead of merely falling back on its traditional “but if you ignore energy…” platitudes aimed squarely at the 5-year-old trader market, is taking it seriously. Here is Credit Agricole’s Valentin Marinov with a note released yesterday, which it seems took the market about 24 hours to read and digest.

Stocks still up even as commodities are down – something has to give

The persistent selloff in global commodities (and commodity currencies) of late is attributed to mounting growth concerns (centred on China) as well as USDappreciation in the run up to Fed lift-off. Lower commodity prices have already sent gauges of inflation expectations lower and weighed on global bond yields.

Yet, it seems that these developments are in stark contrasts with the apparent resilience of the developed stock market indices. For example, the VIX index is still trading close to its lowest level this year. The question is then, should we view the apparent resilience of the developed stock markets as a sign that investors are overdoing it selling commodity and risk-correlated currencies. Market shorts seem substantial indeed. It took only some adjustments in RBA’s language to send AUD more than 1.5% higher at one point yesterday.

We are far less sanguine and think that the developed stock markets may be lagging behind other asset classes as investors position ahead of Fed tightening while global economic data continues to fuel market worries. We still see risks on the downside for risk-correlated and commodity currencies going into lift-off, which we expect in September. As highlighted in our recent publication, falling central bank reserves should ultimately bring global asset prices (stocks and bonds) more inline with falling commodity prices and slowing global growth (and global trade). In particular, the FX reserves should fall more on the back of weak (commodity and manufacturing) export revenues. In turn, fears about weakening global demand for stocks and bonds should mount, making current valuations difficult to sustain. Risk appetite should remain subdued and continue to undermine risk-correlated, commodity currencies while propping up safe havens like JPY and EUR. USD should do well as well, but mainly against G10 smalls.

Expect the remainder of the sellside penguin crew to finally “notice” and this gaping divergence in the coming days.