From the article:

“Condescending as the entire article is to gold owners, he even goes so far to quote the Hebrew Bible!”

– 4 Mainstream Media Articles Mocking Gold That Should Make You Think (Liberty Blitzkrieg, July 29, 2015):

For those of you who have been reading my stuff since all the way back to my Wall Street years at Sanford Bernstein, thanks for staying along for the ride. I appreciate your support immensely considering that I essentially no longer write about financial markets at all, and for many of you, that remains your profession and primary area of interest.

There are many reasons why I stopped commenting on markets, but the main reason is that I started to recognize I wasn’t getting it right. In fact, in some cases I was getting it spectacularly wrong. Whenever this happens, I try to isolate the problem and fix it. In this case there was no fix, because much of why I was no longer getting it right was rooted in the fact that my heart, soul and passion had moved onto other things. My interests had expanded, and I started a blog to express myself on myriad other matters I deemed important. Providing relevant market information needs intense focus, and my focus had shifted elsewhere. I recognized that I wasn’t intellectually interested enough in centrally planned markets to provide insightful analysis, and so I stopped.

This doesn’t mean I won’t start up again. When central planners do lose control, I may indeed become far more interested in opining on such matters. Time will tell. In the interim, financial markets do still play an important role in the bigger picture of social, political and economic trends I passionately care about. The stability and increase in financial assets (stocks and bonds) is of huge importance to the propaganda machine, in particular keeping the non-oligarchic, non-politically connected 1% in line and believing the hype (see: The Stock Market: Food Stamps for the 1%).

So while I won’t claim to know when the paradigm shift will begin in earnest, I do rely on people who have gotten macro forecasts right, and there is no one better than Martin Armstrong. Years ago, he was saying that nothing goes up in a straight line and that gold would experience a severe correction before beginning its real bull market. We are seeing his prediction unfold before our very eyes. What he also said is that as gold approached the $1,000 per/oz mark or even below, everyone would proclaim that “gold is dead” and start making comically bearish statements. In a nutshell, negative sentiment would plunge to levels not seen in years, if not more than a decade. We are starting to see this now.

Here are four mainstream media articles that provide some evidence we may be approaching a sentiment low. Some of them I’m sure you’ve seen, others perhaps not. What amazes me is how they’ve all come out within the last two weeks.

1) From the Wall Street Journal: Let’s Be Honest About Gold: It’s a Pet Rock

Here are a few choice excerpts:

Gold is supposed to be a haven amid hard times and soft money. So why, even as Greece has defaulted, the euro has sunk against the dollar, and the Chinese stock market has stumbled, has gold been sitting there like a pet rock?

Many people may have bought gold for the wrong reasons: because of its glittering 18.7% average annual return between 2002 and 2011, because of its purportedly magical inflation-fighting properties, because it is supposed to shine in the darkest of days. But gold’s long-term returns are muted, it isn’t a panacea for inflation, and it does well in response to unexpected crises—but not long-simmering troubles like the Greek situation. And you will put lightning in a bottle before you figure out what gold is really worth.

With greenhorns in gold starting to figure all this out, the price has gotten tarnished. It is time to call owning gold what it is: an act of faith. As the Epistle to the Hebrews defined it forevermore, “Faith is the substance of things hoped for, the evidence of things not seen.” Own gold if you feel you must, but admit honestly that you are relying on hope and imagination.

Recognize, too, that gold bugs—the people who believe in owning the yellow metal no matter what—often resemble the subjects of a laboratory experiment on the psychology of cognitive dissonance.

So, if buying gold is an act of faith, how much money should you put on the line?

Anything much above that is more than an act of faith; it is a leap in the dark. Not even gold’s glitter can change that.

Think about some of the words and phrases used in this WSJ article:

“Pet rock.”

“Greenhorns in gold (greenhorn means a person who lacks experience and knowledge).”“It is time to call owning gold what it is: an act of faith.”

“Gold bugsoften resemble the subjects of a laboratory experiment on the psychology of cognitive dissonance (this is actually true in many ways).”

Condescending as the entire article is to gold owners, he even goes so far to quote the Hebrew Bible!

Moving on.

2) From the Washington Post: Gold is Doomed

When you think about it, a bet on gold is really a bet that the people in charge don’t know what they’re doing. Policymakers missed yesterday’s financial crisis, so maybe they’re missing tomorrow’s inflation, too. That, at least, is what a cavalcade of charlatans, cranks, and armchair economists have been shouting for years now, from the penny ads that run on the bottom of websites — did you know that the $5 bill proves the stock market is on the cusp of crashing? — to Glenn Beck infomercials and even hedge fund conferences. Indeed, John Paulson, who made more fortunes than you can count betting against subprime, has been piling into gold for six years now, because he thinks “the consequences of printing money over time will be inflation.” They all do. Goldbugs act like the Federal Reserve’s public balance sheet is a secret only they have discovered, and that it’s only a matter of time until prices explode like they did in the 1970s United States, if not 1920s Germany.

But economists do, for the most part, know what they’re doing. Sure, they missed the crash coming in 2008, but that wasn’t because they didn’t understand how bank runs work. It was because they didn’t understand that unregulated lenders had become vulnerable to runs. And the economists who haven’t forgotten their history knew that this inflation fear mongering was all wrong too. Specifically, there’s a difference between the central bank buying bonds, a.k.a. printing money, when interest rates are zero and when they’re not. In the first case, money and short-term bonds both pay the same amount of interest — none — so, as Paul Krugman has explained over and over again, printing one to buy the other won’t change anything. Banks won’t lend out any new money, and will just sit on it as a store of value instead. That’s what happened when interest rates fell to zero in 2000s Japan, and it’s what is happening now in the U.S., U.K., Japan, and Europe.

It almost makes you feel bad for the goldbugs, until you remember that some substantial number of them are just trying to scare seniors out of their money. But the ones who aren’t really thought the 1970s showed that gold went up when inflation did, so the fact that gold was going up now meant inflation couldn’t be far behind. They didn’t understand that the price of gold doesn’t depend on how much inflation there is, but rather on how much inflation there is relative to interest rates. So now that rates are rising, gold, as you can see below, is falling. Wait a minute, rates are rising? Well, yes. The Federal Reserve hasn’t actually raised rates yet, but it has talked about it enough that markets have reacted as if it already did. That’s been enough to make real rates positive again.

While I agree that many gold bugs do deserve the criticism they get, it’s interesting to see the way in which the Washington Post demonizes them as:

“Just trying to scare seniors out of their money.”

But the purpose of the above article is less about demonizing gold bugs, and more about praising the existing system of crank central planners that no one other than starry eyed pundits and thieving oligarchs actually support (see: “Revolution is Coming” – The Top 20 Responses to Jon Hilsenrath’s Idiotic WSJ Article).

Here are some examples:

But economists do, for the most part, know what they’re doing.

Paul Krugman has explained over and over again, printing one to buy the other won’t change anything.

This story is far from over, as the Fed has yet to raise interest rates. Talk to me about victory when rates normalize.

Moving along to the next article:

3) From Bloomberg: Gold Is Only Going to Get Worse

The problem for gold isn’t just that prices are dropping. For many, the metal also has lost its charisma.

Prices will drop to $984 an ounce before January, according to the average estimate in a Bloomberg News survey of 16 analysts and traders. That would be the lowest since 2009 and a 10 percent retreat from Tuesday’s settlement. Speculators are shorting the metal for the first time since U.S. government data began in 2006, and holders of exchange-traded products are selling at the fastest pace in two years.

“Gold is out of fashion like flared trousers: no one wants it,” said Robin Bhar, an analyst at Societe Generale SA in London. “It’s not going to collapse, but we think it is going to be at a lower level in the not-too-distant future.”

“Gold is a weird relic of antiquity,” said Brian Barish, who helps oversee about $12.5 billion at Denver-based Cambiar Investors LLC. “It’s not a commodity that has much fundamental demand. It’s pretty, so people use it for jewelry. But it’s unlike iron ore or oil, or copper, or corn. There’s not specific end-use for it. People just like it, so it becomes a discussion about fervor.”

Let’s once again highlight some of the terminology used.

The metal also has lost its charisma

So now it’s magically turned into a human being as opposed to a pet rock.

Speculators are shorting the metal for the first time since U.S. government data began in 2006

“Gold is out of fashion like flared trousers: no one wants it.

“Gold is a weird relic of antiquity.”

Finally, for the last article. This one takes on more of the tone from the WSJ article, basically just calling gold buyers imbeciles.

4) From Market Watch: Two Reasons Why Gold May Plunge to $350 an Ounce.

CHAPEL HILL, N.C. (MarketWatch) — Gold bugs, who have just begun to digest bullion’s more than $100 drop over the past month, need to prepare for the possibility of an even bigger decline.

That, at least, is the forecast of Claude Erb, a former commodities manager at fund manager TCW Group, and co-author (with Campbell Harvey, a Duke University finance professor) of a mid-2012 study that forecast a plunging gold price. They deserve to be listened to, therefore, since — unlike many latter-day converts to the bearish thesis — they forecast a long-term gold bear market when it was only just beginning.

You might think that, with gold now trading more than $500 lower than when the study was released, Erb would declare victory and leave well enough alone. But Erb is doing nothing of the sort. Earlier this week, he told me that the gold community now needs to consider the distinct possibility that gold will trade for as low as $350 an ounce.

Erb uses the five well-know stages of grief to characterize where the gold market currently stands. Those stages are denial, anger, bargaining, depression and acceptance, and he argues that the gold-bug community currently is in the “bargaining” stage.

Erb imagines them saying the functional equivalent of: “So long as gold stays above $1,000 an ounce, I’ll go to church every Sunday.”

Over shorter terms measured in years, according to their research, you must take seriously the possibility that gold won’t just drop below $1,000 an ounce but, eventually, to a far, far lower price as well.

Some choice quotes to think about:

The gold community now needs to consider the distinct possibility that gold will trade for as low as $350 an ounce.

Erb uses the five well-know stages of grief to characterize where the gold market currently stands.

“So long as gold stays above $1,000 an ounce, I’ll go to church every Sunday.”

This is pretty much peak condescension, and once again, notice the religious imagery.

Gold won’t just drop below $1,000 an ounce but, eventually, to a far, far lower price as well.

I didn’t write this article to “call the bottom in gold” or anything like that. I merely want to flag these four articles due to the hyperbolic nature of some of the statements made (they are exhibiting pretty much exactly the same behavior as the gold bugs they mock do). I do think that something is happening on the sentiment front that warrants we are closer to the bottom that the mid-stages of a bear market.

While I certainly accept that gold prices could fall further from here, I don’t think they will go anywhere near $350/oz, or $500/oz. If Claude Erb cares to make a public bet with me on that, he can find me here.

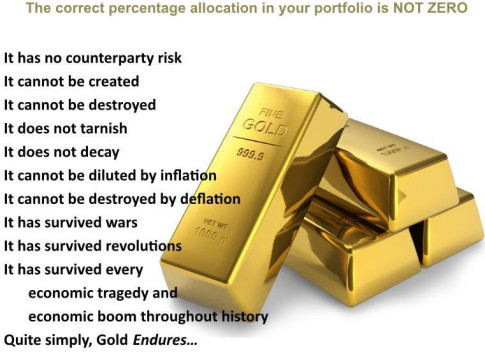

*The image at the top is from the WSJ “gold is a pet rock” article, just in case the text wasn’t condescending enough.

In Liberty,

Michael Krieger

Seems mainstream media is being treated for what it is, lying, misleading false flag propagandists, and we’re not alone in dismissing them.

http://www.goldcore.com/uk/gold-blog/demand-for-gold-bullion-surges-perth-mint-and-u-s-mint-cannot-meet-demand/