– ECB Gives Greek Banks Barely Enough Cash To Cover One Day’s Bank Run (ZeroHedge, June 19, 2015):

Yesterday evening, after what had been a dramatic surge in the Greek bank run which has resulted in over €3 billion in cash withdrawn through Thursday night, the Greek central bank requested an emergency cash dispensation from the ECB under the country’s Emergency Liquidity Assistance program, just one day after the ECB granted the latest €1.1 billion expansion in the ELA. Rarlier today, in an unscheduled session, the ECB did as requested, however it granted Greece far less than the amount it sought, and according to MarketNews reports, the ECB gave Greece just €1.8 billion in addition funds.

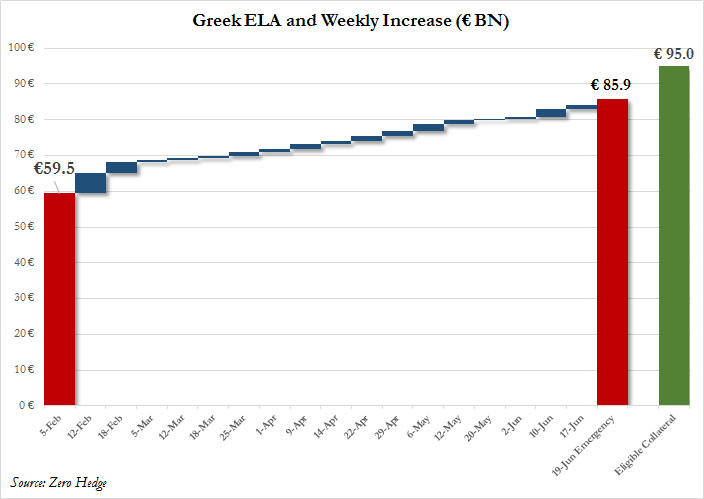

This means that Greek deposits have declined by over €5 billion in the past 7 days alone, as indicated by the surge in the ELA from €80.7 billion on June 10 to €85.9 billion currently.

Worse, as Reuters reported moments ago, on Friday alone there was another €1.2 billion in deposit outflows which means that the entire ELA increase has already been used up, and Greece is again facing the abyss.

Finally, the one question on everyone’s mind, can Greek deposits hit parity with total ELA as we hypothesized a week ago? The answer – no. As the following chart shows, Greece currently has about €95 billion in ELA eligibility and just around €120 BN in deposits left.

Which means that even the “well-meaning” ECB can handle at most 7-8 days more of deposit outflows before it shuts off the Greek ELA account and capital controls are finally imposed leading to the next, far more unpleasant phase of the Greek drama.

It is unlikely that any funds beyond what run the daily economy still are kept in banks at all in Greece. Most of the real money left long ago, so these are the funds of the workers, people who use the money to pay their rent, buy food, and so on……essentially the working poor. When this money dries up, the economy will come to a screeching halt……….

When their economy stops, all those that trade with them will also be affected, and the dominoes will start falling rapidly. It could happen Monday, a week from Monday…..it will happen at some point.

There are huge financial interests struggling to keep the game going. The Enron Accounting practiced by many of these nations when they joined the Euro is about to surface.

I saw the Chinese markets dropped radically, while the carefully controlled US markets hit another high……it is obvious the US market no longer responds to the real world economy. That is what happens when a few greedy guts control all the pieces on the board………………but they don’t control the entire world, and that will be the downfall of the US economy with the Euro, and most of the west.

Too many lies, no truth allowed. It is so obvious as to be laughable.

An article on Spain, and it’s so-called recovery. The second paragraph ought to warn everyone………..it is an IMF report. According to this article, Spain is recovering (regardless 50% of working age people under 25 are unemployed….that is the percentage they admit, makes one wonder what the real numbers involve), so is Portugal, Ireland, Iceland, ETC.

Spain is hurting terribly because none of the working people are earning, just treading water at best. When Greece falls, all the lies and holes in the other Euro economies will be exposed for the world……..They list the nations that exited the so-called bailout programs, but none address the growing unemployment in the real economy.

In Spain, 98% of all real estate inquiries are made by those who don’t speak Spanish, foreign greedy guts who want overseas properties cheap………….

At some point, something has to be done about the greedy guts, they have ruined the western economy, and the next hit is about to crush more millions of people…………

This article is worth reading, from the UK Guardian.

http://www.theguardian.com/business/2015/jun/20/spains-improving-economy-is-not-reaching-everyone

An article on Russian-Greek financial agreements, in the mix and those completed. The gas pipeline is a done deal, but the Greek port is of great value to Russia…..Just look at a globe of the world to see why.

This story is being ignored by US media of course…….paragraph three where the Greek PM says the center of financial gravity has shifted east is far more truthful than acknowledged by western leaders………..

The only story addressing this subject I have found so far, again in the UK Guardian.

http://www.theguardian.com/world/2015/jun/19/greek-prime-minister-vladimir-putin-help-financial-crisis