– Gold In Fed Vault Drops Under 6,000 Tons For The First Time, After 10th Consecutive Month Of Redemptions (ZeroHedge, March 31, 2015):

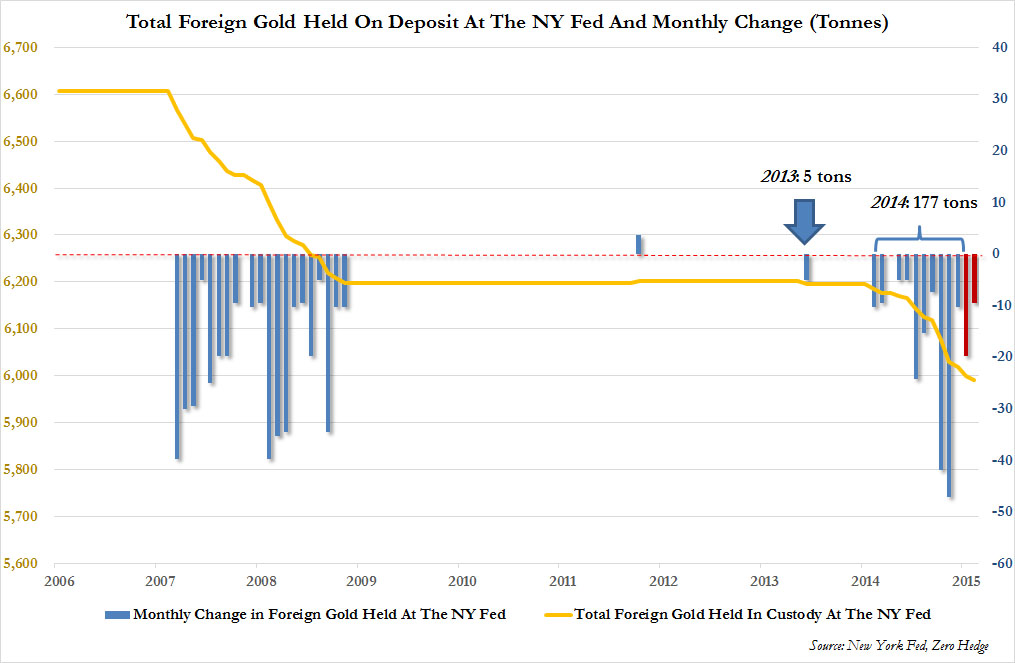

Two months ago, when looking at the most recent physical gold withdrawal numbers reported by the Fed, we observed something peculiar: between the publicly reported surprise redemption by the Netherlands (122 tons) and the just as surprise redemption by the Bundesbank (85 tons), at least 207 tons of gold should have vacated the NY Fed’s gold vault. Instead, the Fed reported that in all of 2014 “only” 177 tons of gold were shipped out of the massive gold vault located 90 feet below 33 Liberty Street. Somehow the delta between what we “shipped” and what was “received” in the past year was a whopping 30 tons, or about 15% of the total – a gap that is big enough to make even China’s outright fraudulent trade numbers seems sterling by comparison.

This prompted us to ask:

“what happened? Did an intern input the Fed’s gold redemptions figures for December, supposedly a different intern than the one who works at the IMF and who caused a stir earlier this week when the IMF, allegedly erroneously, reported that the Dutch – after secretly repatriating 122 tons of gold – had also bought 10 tons of gold in the open market for the first time in nearly a decade.

Or perhaps some “other” bank, central or commercial, decided to offset the redemptions by the Netherlands and Germany, and inexplicably added 30 tons of gold in December? The question then becomes: “who” deposited said gold, especially when one considers that even the adjoining JPM vault which is allegedly connected to the NY Fed by a tunnel, only contains some 740K ounces of gold, or about 23 tonnes.

Or is it simply that when it comes to accurately reporting the flows of physical gold, classical math is incapable of keeping track of the New Normal gold moves, and the Fed has decided that even when dealing with physical gold there is a “settlement” period?

We still don’t know the answer, and while the Fed has not revised its vault gold data, one thing is clear: the slow, stealthy and steady withdrawal of gold from the NY Fed continues.

According to the most recent earmarked gold data reported by the Fed, in the month of February another 10 tons of gold departed the NY Fed, following 20 tons in the month before – the tenth consecutive month of redemptions – which if one assumes is merely the delayed relocation of gold previously demanded for delivery, has crossed the Atlantic and is now to be found in Frankfurt.

This means that after 177 tons of gold were withdrawn in 2014 – the largest year of gold redemptions since 2008 when 230 tons of gold departed the NY Fed vault – another 30 tons of parked gold has been recalled to their native lands so far in 2015.

This also means that for the first time in the 21st century the total gold tonnage held at the NY Fed is now under 6000 tons, or 5,989.5 to be precise.

But most importantly it means that all of the 207 tons in Dutch and German withdrawals are now accounted for with a matched and offsetting “departure” at the Fed. Which is why the next monthly update of the Fed’s earmarked gold will be especially interesting: if March data shows that the withdrawals continue, it will mean that either Germany, or some other sovereign, has continued to redeem their gold which for some reason they no longer trust is safe lying nearly 100 feet below street level on the Manhattan bedrock.