– “De-Dollarization” Deepens: Russia Buys Most Gold In Six Months, Continues Selling US Treasuries (ZeroHedge, Jan 18, 2015):

The rumors of Russia selling its gold reserves, it is now clear, were greatly exaggerated as not only did Putin not sell, Russian gold reserves rose by their largest amount in six months in December to just over $46 billion (near the highest since April 2013). It appears all the “Russia is selling” chatter did was lower prices enabling them to gather non-fiat physical assets at a lower cost. On the other hand, there is another trend that continues for the Russians – that of reducing their exposure to US Treasury debt. For the 20th month in a row, Russia’s holdings of US Treasury debt fell year-over-year – selling into the strength.

Buying low…

Russia gold reserves jump the most in six months in December, near the highest since April 2013…

and selling high…

Russian holdings of US Treasuries are now at the 2nd lowest since 2008…

It would appear the greatest rotations that no one is talking about are the fiat to non-fiat and the paper to physical shifts occurring in China and Russia.

Charts: Bloomberg

Central Bank of Russia released full-year 2014 capital outflows figures, prompting cheerful chatter from the US officials and academics gleefully loading the demise of the Russian economy.

The figures are ugly: official net outflows of capital stood at USD151.5 billion – roughly 2.5 times the rate of outflows in 2013 – USD61 billion. Q1 outflows were USD48.2 billion, Q2 outflows declined to USD22.4 billion, Q3 2014 outflows netted USD 7.7 billion and Q4 2014 outflows rose to USD72.9 billion. Thus, Q4 2014 outflows – on the face of it – were larger than full-year 2013 outflows.

There are, however, few caveats to these figures that Western analysts of the Russian economy tend to ignore. These are:

- USD 19.8 billion of outflows in Q4 2014 were down to new liquidity supply measures by the CB of Russia which extended new currency credit lines to Russian banks. In other words, these are loans. One can assume the banks will default on these, or one can assume that they will repay these loans. In the former case, outflows will not be reversible, in the latter case they will be.

- In Q1-Q3 2014 net outflows of capital that were accounted for by the banks repayment of foreign funding lines (remember the sanctions on banks came in Q2-Q3 2014) amounted to USD16.1 billion. You can call this outflow of funds or you can call it paying down debt. The former sounds ominous, the latter sounds less so – repaying debts improves balance sheets. But, hey, it would’t be so apocalyptic, thus. We do not have aggregated data on this for Q4 2014 yet, but on monthly basis, same outflows for the banking sector amounted to at least USD11.8 billion. So that’s USD 27.9 billion in forced banks deleveraging in 2014. Again, may be that is bad, or may be it is good. Or may be it is simply more nuanced than screaming headline numbers suggest.

- Deleveraging – debt repayments – in non-banking sector was even bigger. In Q4 2014 alone planned debt redemptions amounted to USD 34.8 billion. Beyond that, we have no idea is there were forced (or unplanned) redemptions.

So in Q3-Q4 2014 alone, banks redemptions were scheduled to run at USD45.321 billion and corporate sector redemptions were scheduled at USD72.684 billion. In simple terms, then, USD 118 billion or 78 percent of the catastrophic capital flight out of Russia in 2014 was down to debt redemptions in banking and corporate sectors. Not ‘investors fleeing’ or depositors ‘taking a run’, but partially forced debt repayments.

Let’s put this into a slightly different perspective. Whatever your view of the European and US policies during the Global Financial Crisis and the subsequent Great Recession might be, one corner stone of all such policies was banks’ deleveraging – aka ‘pay down of debt’. Russia did not adopt such a policy on its own, but was forced to do so by the sanctions that shut off Russian banks and companies (including those not directly listed in the sanctions) from the Western credit markets. But if you think the above process is a catastrophe for the Russian economy induced by Kremlin, you really should be asking yourself a question or two about the US and European deleveraging policies at home.

And after you do, give another thought to the remaining USD 33 billion of outflows. These include dollarisation of Russian households’ accounts (conversion of rubles into dollars and other currencies), the forex effects of holding currencies other than US dollars, the valuations changes on gold reserves etc.

As some might say, look at Greece… Yes, things are ugly in Russia. Yes, deleveraging is forced, and painful. Yes, capital outflows are massive. But, a bit of silver lining there: most of the capital flight that Western analysts decry goes to improve Russian balance-sheets and reduce Russian external debt. That can’t be too bad, right? Because if it was so bad, then… Greece, Cyprus, Spain, Italy, Ireland, Portugal, France, and so on… spring to mind with their ‘deleveraging’ drives…

* * *

– Grandmaster Putin’s Golden Trap:

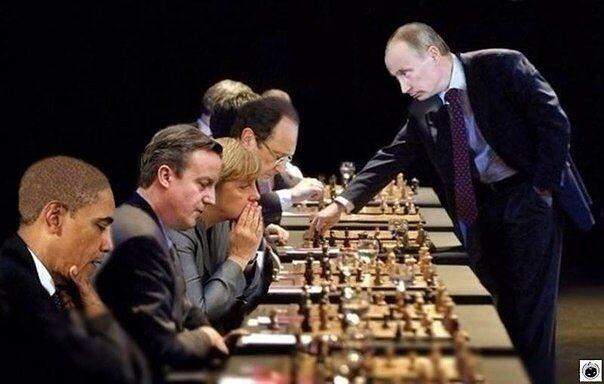

Very few people understand what Putin is doing at the moment. And almost no one understands what he will do in the future.

No matter how strange it may seem, but right now, Putin is selling Russian oil and gas only for physical gold.

Putin is not shouting about it all over the world. And of course, he still accepts US dollars as an intermediate means of payment. But he immediately exchanges all these dollars obtained from the sale of oil and gas for physical gold!

…

– How long will the West be able to buy oil and gas from Russia in exchange for physical gold?

– And what will happen to the US petrodollar after the West runs out of physical gold to pay for Russian oil, gas and uranium, as well as to pay for Chinese goods?

No one in the west today can answer these seemingly simple questions.

And this is called “Checkmate”, ladies and gentlemen. The game is over.

********

The above article was translated buy Kristina Rus – which originally appeared in Russian at http://investcafe.ru/blogs/mbcy/posts/46245#

Perfect summation. The man is a cool, clear and mindful player. He is also very intelligent. I have met chess players who made things too complicated, he keeps it very simple, and so he is winning. Of this, I had no doubt from the onset, the fools in power in the US don’t even know how to play chess, let alone understand the full meaning of the game. Some call it a war game….yes, but it is more than that, it is about surrounding your opponent and winning.

Checkmate. I agree with the author 100%. The louder US media screams, the more I realize he is winning the game.

I listen to the mindless clucking of the fool hen and gelded roosters on the financial channels, even Bloomberg, which used to be somewhat truthful……and look at these charts in disbelief. Denial is a mental disease usually associated with drug and alcohol addiction…….but these fools make the stumble bum look sane.

How can they sit and claim Russia will default when it it the US that is flat broke?

The dollar has been dumped openly by 70% of world economies, secretly by 90%……the people who speak such lies and the fools that listen are crazier than any demented drunk on a street corner.

Today, I read one page from a diary from Gitmo……….ONE PAGE. That one page so disgusted and enraged me that I now realize how deeply the Middle East now hates the US, and they are willing to lose trillions to wipe out the US economy. The US economy is the Achilles heel of the US, Putin and China have shown that very clearly.

The Middle East and the EU have kept the dollar afloat for the past few years. As of now, it is down to the debt ridden EU. Nobody from the Middle East will ever do anything for the US again. That one page is enough to show the world how truly demented and vicious the US has become, and the US now has an open enemy made up of the entire Muslim world. This is a revival of the Middle Ages, and Americans snooze in front of the TV set and sit stupidly wondering why the economy won’t recover.

After that excerpt, the east will work hard to fully isolate and destroy the US economy. Gold is pouring out of our banks, dollars are being exchanged for gold, and the collapse of the dollar is eminent. That excerpt is the final straw………

My people served in the American Revolution. I now profoundly wish they had stayed home in England. The disgust and shame I feel has to be akin to what the Germans felt after WW2.

The US has lost all credibility, trust and respect.

We are washed up, and I don’t think they can spin it otherwise much longer.