From the article:

“And we are also finally glad that with every passing day more and more banks, pundits and “straight to CNBC” experts wearing business suits realize what we said 6 years ago, namely that QE will never work as one can’t fix a failed financial system due to record debt problem with more debt and even more props to support an even more failed financial system. And that QE has, is, and will continue failing… for everyone but the 1% of course, who with every passing day continue to tempt not only fate but the guillotines as well. Reference? See the French Revolution, because it is never different this time.”

– The ECB Will Fail Given The “History Lessons Of US And Japan”, Warns Deutsche Bank (ZeroHedge, Jan 18, 2015):

Recall that the stated purpose behind the reason why Mario Draghi’s ECB is about to launch a European government debt monetization program ranging between EUR500 and 1000 billion is to halt deflation, spark credit creation and rekindle inflation. Alas, if that is indeed the case, then as Deutsche Bank said has already determined apriori, it will be a failure. Here’s why from the biggest German bank.

First, a broad strokes preview of what the world’s most confused Central bank will do this week:

[The ECB] is trapped down a dark alley and they will bite. For all the pros and cons of public QE as well as the hows and whens, at the end of the day the market has pushed the ECB into that corner. Within the context of the practical limitations of QE, we have no doubt that Draghi once again will leave a warm fuzzy feeling that they are prepared to do all that it takes. Of course, like OMT, it probably doesn’t mean they are buying BTPs come February 1st, but that doesn’t matter for BTPs. It also doesn’t matter for the Euro zone outlook given the dubitancy of QE efficacy.

And here is why the ECB too will follow its peers, the Fed and BOJ, in failing to boost inflation expectations which at last check were below the Lehman collapse levels and sliding fast (see “The Chart That Terrifies The Fed“)

We suspect whatever the ECB “under delivers on” in substance, it will “over deliver” in terms of perceived commitment and Draghi rhetoric. So net it is hard to be very bearish on peripherals nor core markets. Core markets ultimately benefit from the perception that there just aren’t enough assets out there even for a small program of Euro 500 billion. As the table below shows the free float as defined by other investors is expected to be a paltry 26 percent this year (after Euro 300 billion in purchases for CY 2015). This compares with almost 50 percent in the US.

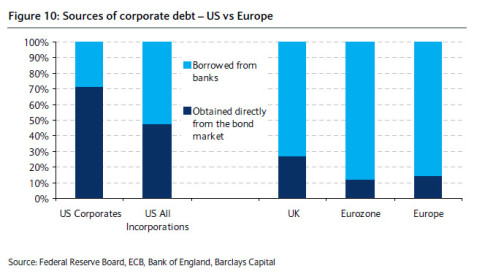

More importantly we doubt inflation expectations will spike sustainably higher on any announcement given the “failed” history lessons of US and Japan as well as doubts about QE making a difference quickly in the Euro zone. This really centers on the issues of the Euro zone’s different financial model (bank not security based) as well as the still ongoing deleveraging of the banks for regulatory purposes.

Ironic, because Zero Hedge pointed out precisely this distinction nearly three years ago in “A Few Quick Reminders Why NOTHING Has Been Fixed In Europe“:

And we are also finally glad that with every passing day more and more banks, pundits and “straight to CNBC” experts wearing business suits realize what we said 6 years ago, namely that QE will never work as one can’t fix a failed financial system due to record debt problem with more debt and even more props to support an even more failed financial system. And that QE has, is, and will continue failing… for everyone but the 1% of course, who with every passing day continue to tempt not only fate but the guillotines as well. Reference? See the French Revolution, because it is never different this time.

Deflation has reared its ugly head in the Euro zone, one more reason to look to the east and BRICS as an alternative to get out.

Except for essentials, such as food, water, shelter, ETC in the US, the same thing is happening here. The online shopping centers have replaced the shopping malls I used to spend my spare time in shopping during the 1980s. Now, I can go shopping at 3AM, and get better prices than the brick and mortar shops of retail outlets.

The quality of shopping malls are dropping. Gone are the wonderful book stores, replaced by junk food outlets or cheap Chinese clothing stores for the young…….nobody else could wear those clothes…..Target stores now replace department stores, and I find that incredibly depressing. As Americans grow poorer with each political administration, down go the shopping malls.

Stanford Shopping Center in Palo Alto, Ca used to be as beautiful and rich as Pentagon City shopping mall in the DC area. Today, it is just awful in comparison. All the nice shops are vanishing. Bloomingdales is still empty, Macys is now full of junk, Nieman Marcus is still there…….but otherwise, the quality of shopping choices have fallen. Same with Nordstrom, a store I frequented for years…..this reflects the economy of the shopper, and I don’t like what I see.

I did some shopping online this last holiday season, and the drop in prices for so many things is shocking. I mean it is great that the dollar can go farther, but I remember the stories my parents told me about the 1930s…….and the similarities scare me.

What really disturbs me is the fact our leaders don’t give a damn what happens to the people. We had enough voice in the 1930s to get some decent people into power to work to remedy the problems. Today, we don’t have that option……the scum is eating whats left of us alive. There isn’t one decent person left in DC, and any politician is sold out before he or she takes the oath of office.

An empire in decline…….and there is no coming back.