Flashback:

– Inflation, Hyperinflation and Real Estate (Price Collaps)

– Phoenix Housing Market Hit By Unprecedented Plunge In Demand (ZeroHedge, July 14, 2014):

The Phoenix housing market has a special place in the heart of housing bubble watchers: together with Las Vegas and various California MSAs, this is the place where the last housing bubble was born and subsequently died a gruesome death which nearly brought down the entire financial system. Which is why the monthly WP Carey report on the Greater Phoenix Housing Market is of peculiar interest for those who want to catch a leading glimpse into the overall state of the bubble US housing market. As hoped, this month’s letter does not disappoint. What we find is that while equilibrium prices have been largely flat month over month, and are up 6% on an average square foot basis from a year ago, something very bad is happening with a key component of the pricing calculation: demand has fallen off a cliff.

Some of the disturbing findings from the report:

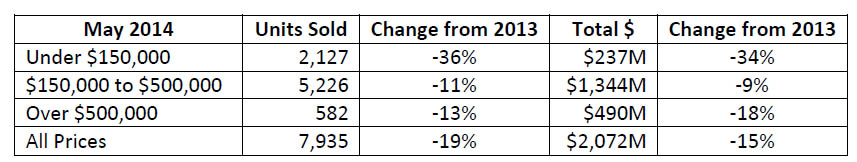

Demand has been much weaker since July 2013. The slight recovery in demand that had been developing over the last two months dissipated again in May. While move-up owner occupiers and second home buyers are starting to compensate for the departure of investors, activity by first time home buyers is unusually low.

At the top end of the market sales of single family homes over $500,000 grew 1% over May 2013. Sales of single family homes below $150,000 fell 37%. This fall was partly caused by the lack of distressed supply, but mostly by the reduction in demand from investors.

The market over $500,000 was much weaker in May than it was in April, with a 15% drop in dollar volume compared with a year earlier. However it is the market below $150,000 that has contracted the most dramatically. The relatively low volume of low-priced home sales is causing the monthly median sales price to rise.

Luxury homes over $500,000 went back to a 24% market share, the same as in May 2013. The lowest-priced homes under $150,000 fell from 15% to 11%. The mid range has increased its share of spending from 61% to 65%, despite a 9% decline in dollars spent. Contrary to what is often stated in the national media, demand is nowhere inhibited by supply shortages, unlike in April 2013 when supply was severely constrained.

So how is it that prices aren’t crashing to keep up with (lack of) demand? For now the sellers are simply staying put, and not rushing to lower their prices even as supply remains largely stable despite slumping demand for housing. As the Carey report summarizes “Although buyers now have more homes to choose from and much less competition from other buyers than in 2013, supply has not become excessive.” At least not yet.

Here one could be philosophical and note that just like the S&P 500, the leading bubble housing market is merely suffering from a case of the CYNK (henceforth halted until perpetuity just so the SEC can stick its head in the sand and pretend it never heard of that particular fraud): with a plunging number of transactions, price discovery is becoming a farce.

And plunging they are:

- The percentage of residential properties purchased by investors continued to decline from 16.3% in April to 16.1% in May.

- Single family home sales decreased year over year across every sector:

- Normal re-sales (down 2%)

- New homes (down 4%)

- Investor flips (down 53%)

- Short sales and pre-foreclosures (down 73%)

- Bank owned homes (down 20%)

- GSE (Fannie Mae, Freddie Mac, etc.) owned homes (down 44%)

- HUD sales (down 76%)

- Third party purchases at trustee sale (down 59%)

- Foreclosure starts on single family and condo homes fell 8% between April and May, which confirms a continued declining trend. They were down 47% from May 2013.

- Recorded trustee deeds (completed foreclosures) on single family and condo homes were up 9% between April and May but down 50% from May 2013.

What is just as interesting is the ongoing decline in out of state purchasers, cash buyers and investors:

Out of State Purchasers

The percentage of residences in Maricopa County sold to owners from outside Arizona was 20.1% in May, down from 20.8% in April but still the second highest percentage since June 2013, though lower than the 22.0% we saw in May 2013. Californians have reduced their market share from 4.7% to 4.1% over the last year but retained their normal position as the largest group of out of state buyers. Canadian demand has plummeted from 2.6% to 1.5% over the last 12 months, which about the same as buyers from Colorado which was the source of an unusually large number of buyers in May. Washington, Illinois, Minnesota, Texas, Michigan and New York provided the next most numerous home locations for home buyers in Greater Phoenix during May.

Cash Buyers

For some considerable time, cash purchases have been running at an unusually high level but this has been on a declining trend over the past year. In Maricopa County the percentage of properties recording an Affidavit of Value and purchased without financing was 25.0% in May 2014, significantly down from 32.3% in May 2013. We consider 7% to 12% the normal range for cash buyers, so mortgage lending still has a long way to go to get back its normal share of the market.

Investor Purchases

The percentage of individual single family and townhouse/condo parcels acquired by investors in May 2013 and May 2014 are as follows:

These percentages are the lowest we have seen for many years and are now close to the historical norm. The steep decline over the last 12 months confirms that investors are no longer driving the market the way they did between early 2009 and mid 2013.

Finally, the Outlook:

The resale market is currently delivering a fairly low number of new listings to market compared with historic norms over the last 15 years. Some home sellers appear to be cancelling their listings and waiting for another time when buyers have a greater sense of urgency. Many families are choosing to stay in their homes longer than they used to 10 to 15 years ago. Some owners still have either negative equity or only a small equity position which discourages both buying and selling. Others have low interest rates that they don’t want to lose, and as they cannot apply their mortgage to a new home, it is cheaper to stay put. These trends are likely to stay in place for a while now that house prices have stabilized.

In May 2014 the Greater Phoenix housing market had sellers outnumbering buyers but the numbers of both were well below normal. For the prime spring selling season things were remarkably quiet. Supply has stabilized at a level which is about 10% below normal and is starting to weaken, an encouraging sign for sellers. However, except at the lowest price ranges, we still have more supply than necessary to meet the weak demand which is about 20% below normal. In May 2014 every category of single family sales had lower volume than in May 2013, even normal re-sales which were down 2%.

Currently there is little movement on home prices in either direction. However the mix of homes that are selling has changed a lot in the past 12 months. There are fewer distressed homes and far fewer homes priced under $150,000. This tends to push the averages and medians upward even if prices are stable.

Compared with April, sales of luxury homes were weaker in May, but we think this is mostly normal month to month variation and expect them to recover somewhat in June. However it is likely that this will fade during the hottest months of July through September when the luxury, snowbird and active adult markets tend to go relatively quiet.

…

Single family new home construction and sales are well down from last year, contrary to everyone’s expectations in Q4 2013, and they remain about 65% below what would be considered normal for Central Arizona. Population and job growth are not back to their peak levels but have recovered much further than home construction has. People have been sharing homes and renting instead of moving out and buying. All trends in housing tend to be cyclical and this one is probably no exception.

With investors pulling back from the low end, the weak demand from first time home buyers has come into sharp focus. But as lenders start to ease up on underwriting restrictions this market is likely to expand from its current extreme lows. Once this happens we shall probably be talking about the low supply again. Between 2012 and 2013 we experienced a chronic housing shortage in Greater Phoenix. This shortage has not gone away. It has just been masked by the unusually low demand between July 2013 and now, and this state of affairs is likely to be temporary.

Here one could be an optimist and agree with the following: “There is plenty of pent-up demand which could emerge at any time… But for the time being, the market remains unbalanced in favor of buyers and if demand does not pick up soon then the next likely alternative will be a fall in the supply as more sellers decide to wait for better times. Unlike 2006 there is very little likelihood of a massive increase in supply creating strong downward pressure on prices.”

That is, unless all those who are locked in their houses max out their credit cards and run out of ways to fund their lifestyle and, contrary to traditionally wrong expectations, are forced to sell. Considering the collapse in demand, what would happen then would be nothing short of an avalanche.

Regardless of what a plunge in demand translates into on the pricing front, it is becoming evident that little by little not only fraudulent microcaps (which succeed in ballooning their market cap to over $5 billion before being halted), but also the S&P 500 and the US housing market itself, are becoming “Level 3” assets: with virtually no transactions to determine the equilibrium price, the value of ever more assets is now in the eyes of the central-planner.

Full WPCarey report here

Interest rates are climbing, that is one point not covered in your article. For every point interest rates go up, the payment goes up 13%. Over the past year, interest rates have gone up from 2% to well over 5% for lower priced homes, and have touched 6% for jumbos……loans over $600K.

This would explain why out of state investments would fall. It is also hotter than hell in AZ by now, and I cannot see how people would rush to AZ to buy real estate.

Radiation from Japan is also hitting AZ, I would think people with that in mind might look farther east and north…..I don’t know. I wouldn’t buy a house in AZ if you paid me. They are going to be suffering severe water problems very soon.

When I left the Bay Area some years ago, the memories of people I had lost were too profound, I looked at Monterey, but they had to truck in all their water. As much as I love that area, I didn’t want to be that vulnerable to water shortages. I looked at Napa County, but they have not widened the roads since I was a girl, the roads are a parking lot, and wineries have taken over everything. So, I chose Sonoma County, it had the four seasons, and is lush and beautiful. Then, the drought came, the four seasons vanished, now it is endless Summer, and I despise it. I hope the drought breaks soon, it is just awful.

The drought has taken over all of CA, and from what I understand, AZ also suffers from it…..another reason housing purchases might have gone down.

Higher interest rates and drought conditions are both factors in this story not mentioned.

9 EU nations blocking sanctions against Russia.

I don’t know why we have such fools in power…..Russia stopped using the dollar in much of their international trading in 2010………do US leaders want to make that widely known?

Putting sanctions on a nation that no longer uses the dollar is absurd and shows an ignorance of current economic conditions that ought to be embarrassing.

This is beyond belief. The Euro gets E120,000 a year from Russian trade, does the US think they will threaten that to satisfy yet another petulant demand for sanctions from the obnoxious US?

http://rt.com/business/172888-9-eu-block-sanctions-russia/