– The United States Of Debt: Total Debt In America Hits A New Record High Of Nearly 60 Trillion Dollars (Economic Collapse, June 15, 2014):

What would you say if I told you that Americans are nearly 60 TRILLION dollars in debt? Well, it is true. When you total up all forms of debt including government debt, business debt, mortgage debt and consumer debt, we are 59.4 trillion dollars in debt. That is an amount of money so large that it is difficult to describe it with words. For example, if you were alive when Jesus Christ was born and you had spent 80 million dollars every single day since then, you still would not have spent 59.4 trillion dollars by now. And most of this debt has been accumulated in recent decades. If you go back 40 years ago, total debt in America was sitting at about 2.2 trillion dollars. Somehow over the past four decades we have allowed the total amount of debt in the United States to get approximately 27 times larger. This is utter insanity, and anyone that thinks this is sustainable is completely deluded. We are living in the greatest debt bubble of all time, and there is no way that this is going to end well.

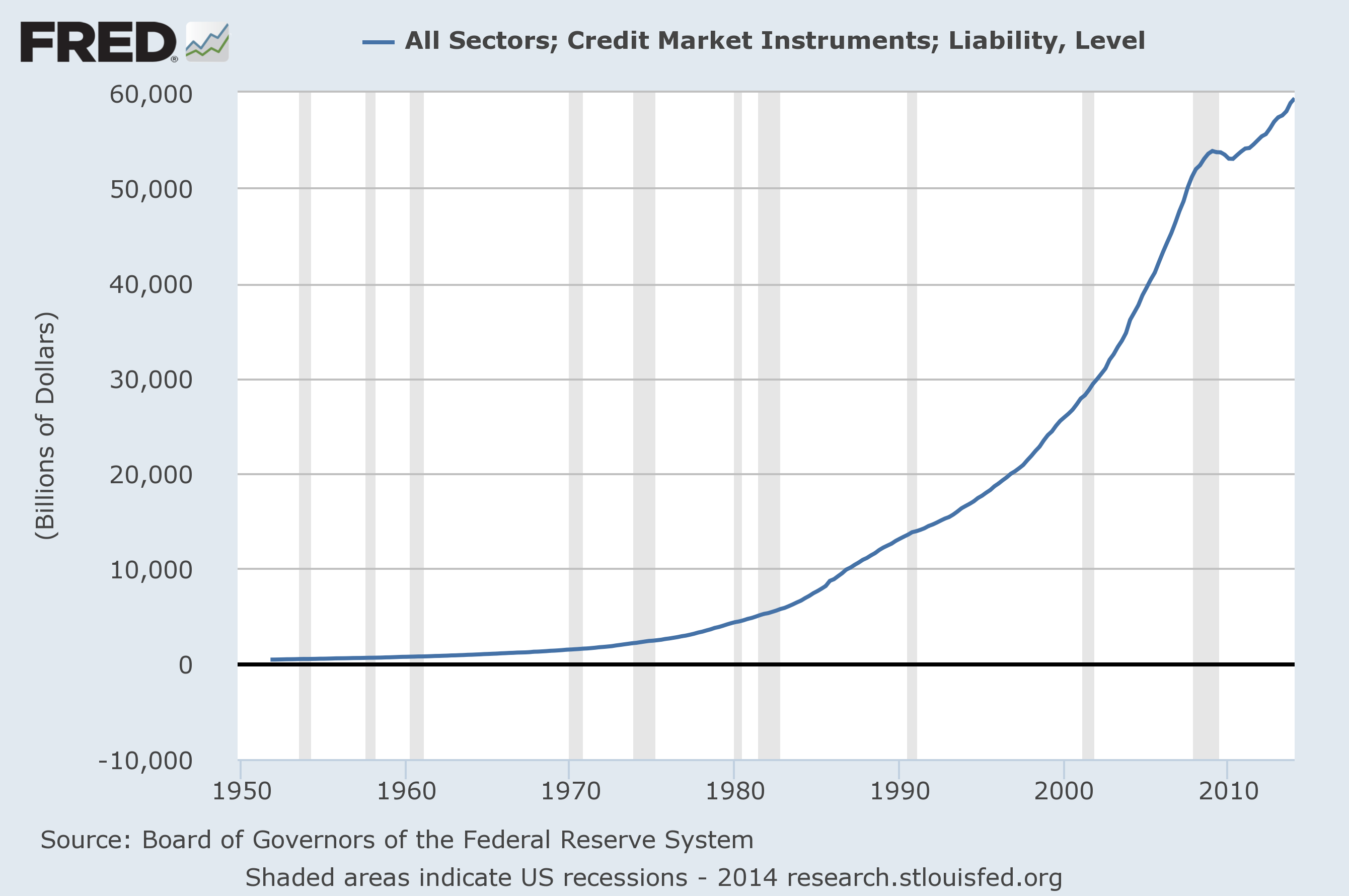

Just check out the chart…

When the last recession hit, total debt in America actually started going down for a short period of time.

But then the Federal Reserve and our politicians in Washington worked feverishly to reinflate the bubble and they assured everyone that everything was going to be just fine. So Americans once again resorted to their free spending ways, and now total debt in the United States is rising at almost the same trajectory as before and has hit a new all-time record high.

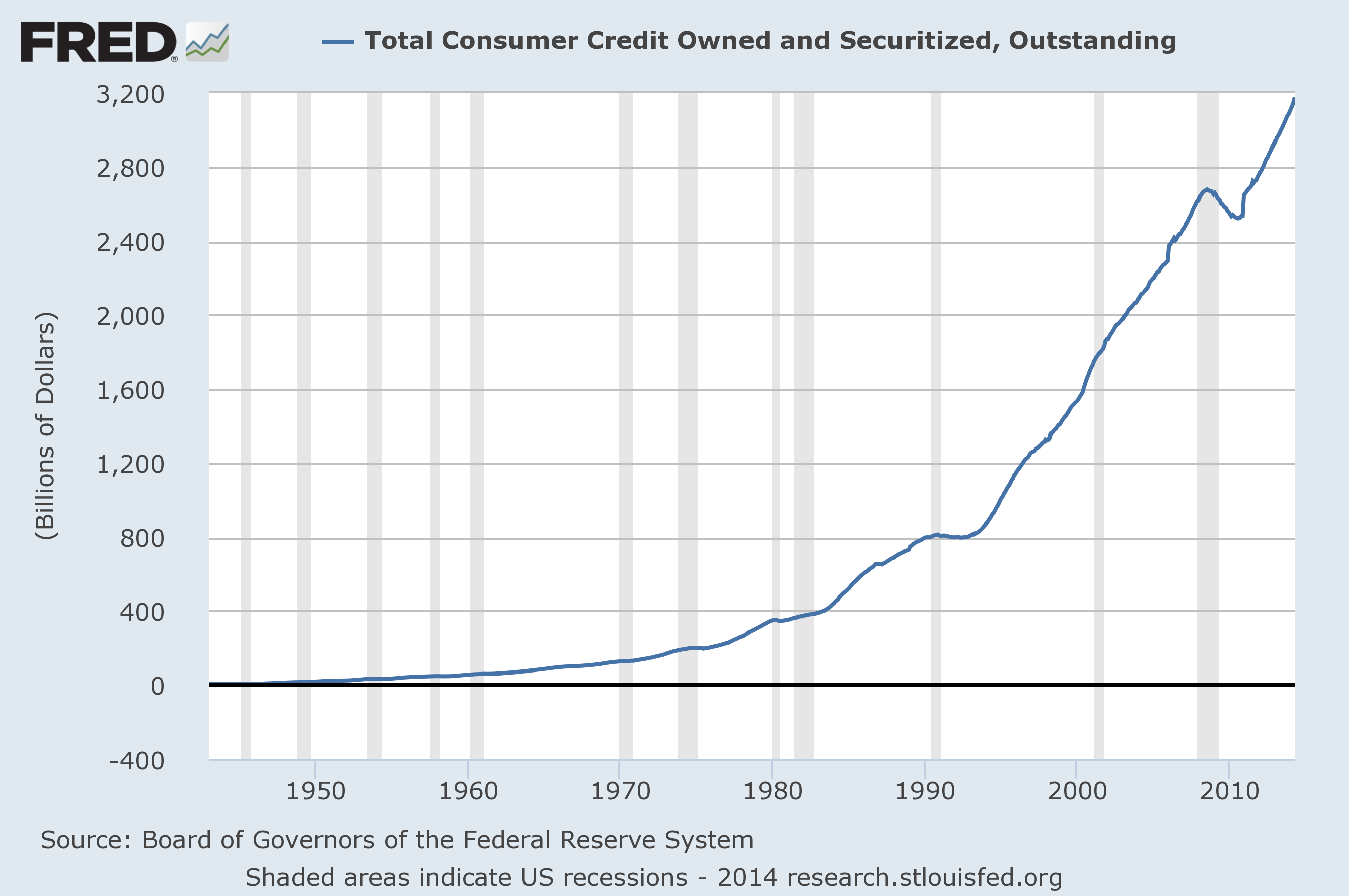

We see a similar thing when we look at a chart for consumer debt in America…

For a while after the recession it was trendy to cut up your credit cards and get out of debt.

But that fad wore off rather quickly, didn’t it?

It is almost as if 2008 never happened. We are making the same mistakes with debt that we did before.

As I noted recently, total consumer credit in the U.S. has risen by 22 percent over the past three years alone, and at this point 56 percent of all Americans have a subprime credit rating.

And have you noticed that a lot of people are not afraid to extend themselves in order to buy shiny new vehicles these days?

During the first quarter 0f this year, the size of the average vehicle loan soared to a new all-time record high of $27,612.

Five years ago, that number was just $24,174.

And as I noted in one recent article, the size of the average monthly car payment in this country is now up to $474.

That is practically a mortgage payment.

Speaking of mortgage payments, even though home sales have been falling and the rate of homeownership in the United States is the lowest that it has been in 19 years, a very large percentage of those who own homes are still overextended.

In fact, one recent survey discovered that a whopping 52 percent of Americans cannot even afford the house that they are living in right now.

At the same time, an increasing number of Americans are acting as if the last financial crisis never happened and are treating their homes like piggy banks. Home equity loans are soaring again, and when the next great crisis strikes a lot of those people are going to end up getting into a lot of financial trouble.

There has been much written about what is wrong with the housing industry, but the truth is that home prices are still way too high and young adults cannot afford to purchase homes because they are already loaded down by huge amounts of debt even before they get to the point where they are ready to buy.

In fact, a newly released survey found that 47 percent of millennials are spending at least half of their paychecks on paying off debt…

Four in 10 millennials say they are “overwhelmed” by their debt — nearly double the number of baby boomers who feel that way, according to a Wells Fargo survey of more than 1,600 millennials between 22 and 33 years old, and 1,500 baby boomers between 49 and 59 years old.

To try to get out from underneath it, 47%said they spend at least half of their monthly paychecks on paying off their debts.

When I read that I was absolutely astounded.

Of course the biggest debt that many young adults are facing is student loan debt. According to the Federal Reserve, there is now more than 1.2 trillion dollars of student loan debt in this country, and about 124 billion dollars of that total is more than 90 days delinquent.

What we have done to our young people is shameful. We have encouraged them to sign up for a lifetime of debt slavery before they even understand what life is all about. The following is an excerpt from my previous article entitled “Is College A Waste Of Time And Money?“…

In America today, approximately two-thirds of all college students graduate with student loan debt, and the average debt level has been steadily rising. In fact, one study found that “70 percent of the class of 2013 is graduating with college-related debt – averaging $35,200 – including federal, state and private loans, as well as debt owed to family and accumulated through credit cards.”

That would be bad enough if most of these students were getting decent jobs that enabled them to service that debt.

But unfortunately, that is often not the case. It has been estimated that about half of all recent college graduates are working jobs that do not even require a college degree.

Considering what you just read, is it a surprise that half of all college graduates in America are still financially dependent on their parents when they are two years out of college?

According to the U.S. Census Bureau, only 36 percent of all Americans under the age of 35 own a home at this point. That is the lowest level that has ever been recorded.

And we are passing on to our young people the largest single debt in all of human history. Weighing in at 17.5 trillion dollars, the U.S. national debt is a colossal behemoth. And almost all of that debt has been accumulated over the past 40 years. In fact, 40 years ago the U.S. national debt was less than half a trillion dollars.

But this is just the beginning. As the Baby Boomer “demographic tsunami” washes through our economy, we are going to be facing a wave of red ink unlike anything we have ever contemplated before.

Meanwhile, the rest of the planet is drowning in debt as well.

As I wrote about the other day, the total amount of debt in the world has risen to a new all-time record high of $223,300,000,000,000.

Our “leaders” keep acting as if these debt levels can keep growing much faster than the overall level of economic growth indefinitely.

But anyone with even a shred of common sense knows that you can’t spend more money that you bring in forever.

At some point, a day of reckoning arrives.

2008 should have been a major wake up call that resulted in massive changes. But instead, our leaders just patched up the old system and reinflated the old bubbles so that they are now even larger than they were before.

They assure us that they know exactly what they are doing and that everything will be just fine.

Unfortunately, they are dead wrong.

$60 trillion in debt. The US generates about $15 trillion a year GDP……

In 1995, the US GDP was fairly balanced, the financial parts equaled 16% of our GDP. In 2005, after all the regulations were removed, Financials made up 67%. I am sure today’s numbers are even higher for financials, because the entire economy is made up of paper shuffling and moving non-existent money around.

They now leverage all monies. If they have $100 million, they leverage it into $100 billion…….Now, they are leveraging the leveraged funds at equally high numbers. I bet the real number in the debt column is even higher……with all the other games they play with the money people so trustingly put into their banks.

About three years ago, the IMF put up the idea banks have on deposit 5 cents on every dollar they claim as assets on their spread sheets. The banks would all have had to borrow the 5 cents, so the idea died.

We have crooks in power that are totally destroying our world while people watch US media that lulls them into mindless security.

What will they do when the walls come down?

Perhaps this is why they are militarizing the police and preparing for upheaval…….when people go to their ATMs, and cannot draw out any money, Hell will break out. I have a terrible feeling we are days away, perhaps weeks, but not long.

This is very disturbing. The crooks have taken everything, our wealth is gone. Those of us who realize it are once again voices in the wilderness…..perhaps more will listen, but don’t hold your breath.

Thanks for a great article that most journalists would not dare publish. US media keeps insisting how great our “recovery” is doing. Dow is up 6 points……isn’t that great……. it is unbelievable……Medtronic is set to renounce US tax Citizenship……this is a growing trend in the US, we are now losing all tax revenue from these greedy corporations. This particular corporation has made a fortune here in the US, it has an outlet here where I live, and it does very well……so, now, it is not going to pay taxes in the US any longer?

What has happened to this country that corporations can do stuff like this? Someone has to have some balls!

This nation is being totally gutted. In the meantime, lets have another middle east war……..we don’t need to spend anything more, we need to retrench and change our laws to benefit our people, not the greedy corporations. If not, there will be nothing left.

Accountancy = Bullshit

Honest!

To my friend, Squodgy: Accountancy in the US = BS

Not in all nations, I hope.

Accountancy in the US has become Enron accounting.

Enron’s accounting methods destroyed the US economy in 2001.

They would take a debt of say…$100 million, and move the debt off their balance sheets into a shell corporation. In the shell corporation, they would list the $100 million as an asset. Then, the false shell would give Enron an equally large contract for electricity…….this is why their stock could not go down. They did this with all their debts, moved them into lots of shell corporations and turning the shells into customers. They could not stop the profits from pouring in until the market started correcting itself. It did not take long for the Enron scam to show itself for what it was, the spinning of straw into gold ended, along with millions of jobs, pension funds, promised bonus’……….hundreds of thousands of people lost their homes, jobs and futures, and as the virus spread all over America, the plague was harsh indeed.

The greedy guts who created this financial monster, grabbed their stolen millions and billions and ran to safer shores. Nothing was done to any of them, being a crook isn’t a crime in America.

They destroyed us with a few cheap accounting tricks.

Then, in 2008, the greedy guts destroyed the rest of us with their real estate bubbles and false mortgages.

Since that time, most of the loans given have been adjustable rate mortgages, and the fools have been lulled into thinking ARMs are a good idea. Fact is that they cannot get fixed rate loans.

Now, interest rates are going up, and many folks who thought they have survived the 2001 and the 2008 scams haven’t a clue of what they are now facing. Interest rates are going up because they have to. Putin is offering 7.5% to park money, and equal rates are being offered around the world. The US has to follow suit in order to keep people investing here. Right now, if they did not have the mortgage markets, they would have no possibility of growth at all because no new money is coming into America…….

Good luck, it will be a hell of a ride.