FYI.

– Forget Russia Dumping U.S. Treasuries … Here’s the REAL Economic Threat (ZeroHedge, March 21, 2014):

Russia threatened to dump its U.S. treasuries if America imposed sanctions regarding Russia’s action in the Crimea.

Zero Hedge argues that Russia has already done so.

But veteran investor Jim Sinclair argues that Russia has a much scarier financial attack which Russia can use against the U.S.

Specifically, Sinclair says that if Russia accepts payment for oil and gas in any currency other than the dollar – whether it’s gold, the Euro, the Ruble, the Rupee, or anything else – then the U.S. petrodollar system will collapse:

Indeed, one of the main pillars for U.S. power is the petrodollar, and the U.S. is desperate for the dollar to maintain reserve status. Some wise commentators have argued that recent U.S. wars have really been about keeping the rest of the world on the petrodollar standard.

The theory is that – after Nixon took the U.S. off the gold standard, which had made the dollar the world’s reserve currency – America salvaged that role by adopting the petrodollar. Specifically, the U.S. and Saudi Arabia agreed that all oil and gas would be priced in dollars, so the rest of the world had to use dollars for most transactions.

But Reuters notes that Russia may be mere months away from signing a bilateral trade deal with China, where China would buy huge quantities of Russian oil and gas.

Zero Hedge argues:

Add bilateral trade denominated in either Rubles or Renminbi (or gold), add Iran, Iraq, India, and soon the Saudis (China’s largest foreign source of crude, whose crown prince also happened to meet president Xi Jinping last week to expand trade further) and wave goodbye to the petrodollar.

As we noted last year:

The average life expectancy for a fiat currency is less than 40 years.

But what about “reserve currencies”, like the U.S. dollar?

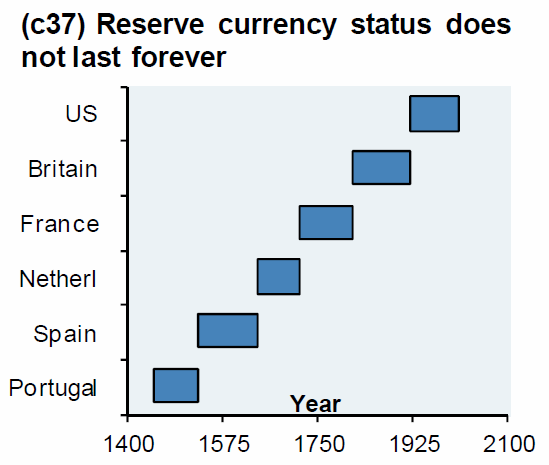

JP Morgan noted last year that “reserve currencies” have a limited shelf-life:

As the table shows, U.S. reserve status has already lasted as long as Portugal and the Netherland’s reigns. It won’t happen tomorrow, or next week … but the end of the dollar’s rein is coming nonetheless, and China and many other countries are calling for a new reserve currency.

Remember, China is entering into more and more major deals with other countries to settle trades in Yuans, instead of dollars. This includes the European Union (the world’s largest economy) [and also Russia].

And China is quietly becoming a gold superpower…

Given that China has surpassed the U.S. as the world’s largest importer of oil, Saudi Arabia is moving away from the U.S. … and towards China. (Some even argue that the world will switch from the petrodollar to the petroYUAN. We’re not convinced that will happen.)

In any event, a switch to pricing petroleum in anything other than dollars exclusively – whether a single alternative currency, gold, or even a mix of currencies or commodities – would spell the end of the dollar as the world’s reserve currency.

For that reason, Sinclair – no fan of either Russia or Putin – urges American leaders to back away from an economic confrontation with Russia, arguing that the U.S. would be the loser.

Russia has been accepting other currencies than the dollar since November of 2010. This author needs to update his information. The petrodollar is an illusion, very few nations use it any longer, the only ones who don’t seem to realize it are our deluded leaders, and writers like this one.